Cryptocurrency buying and selling is an thrilling and dynamic world, with merchants searching for to grasp and predict market actions. One efficient manner to do that is by using technical evaluation, which incorporates learning numerous candlestick patterns. The night star candlestick is one such sample, identified for its skill to sign a possible bearish reversal.

On this article, I’ll check out the important thing traits of the night star sample, how you can commerce with it, and the dangers and advantages of utilizing it in crypto buying and selling.

What’s the Night Star Sample?

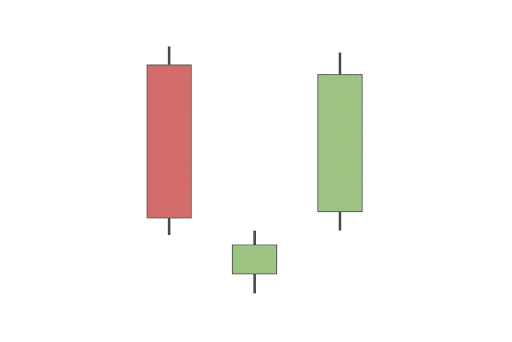

The Night Star sample consists of three candles: a big bullish candle, a small-bodied candle, and a bearish candle. It acts as a bearish indicator and alerts a possible shift from an uptrend to a downtrend when the bearish candle closes under the midpoint of the primary bullish candle.

A candle, or candlestick, is a sort of worth chart that’s used as visible illustration of worth motion throughout a given time-frame.

It’s usually used to both exit (promote) an current lengthy place or enter a brief place.

Traits of the Night Star Candlestick and How To Establish It

The night star candlestick is a bearish pattern reversal sample, which usually emerges after a bullish pattern. It consists of three Japanese candlesticks:

- A bullish candle. This inexperienced candle* represents a robust upward worth motion, indicating that consumers are in management.

- A small-bodied candle. This can be a doji candle or a small inexperienced or purple candle, which varieties when the opening and shutting costs are shut collectively, suggesting indecision available in the market.

- A bearish candle. This purple candle signifies a downward worth motion, displaying that sellers are actually dominating the market.

*Please word that on some charts, you may see a blue, black or white candle as an alternative. All of those colours can be utilized to characterize bullish candlesticks.

The sample varieties when the small-bodied candle gaps above the earlier bullish candle, adopted by a bearish candle that closes under the midpoint of the primary candle. This sample is taken into account extra dependable if the bearish candle engulfs the (bullish) earlier candle.

The other of the night star candlestick is the morning star sample. The morning star is a bullish reversal sample that alerts a possible pattern reversal from a downtrend to an uptrend. It consists of three candlesticks: a bearish candle, a small-bodied candle, and a bullish candle.

The morning star sample varieties when the small-bodied candle gaps under the earlier bearish candle, adopted by a bullish candle that closes above the midpoint of the primary candle. Just like the night star sample, the morning star sample is taken into account extra dependable if the bullish candle engulfs the bearish candle.

An Instance of the Night Star Candlestick Sample

Night star patterns are roughly widespread in each the inventory market and the crypto market. As an alternative of taking a look at any particular instance, let’s think about a hypothetical state of affairs of a dealer eager to promote their Bitcoin or alternate their BTC for one more cryptocurrency.

Let’s say the worth of Bitcoin has been experiencing a robust uptrend over the previous few days. As the worth continues to rise, a big bullish candle varieties, representing a day of serious beneficial properties for Bitcoin. This bullish candle signifies that consumers are in management and driving the worth increased, so our dealer decides to maintain holding their funds.

On the next day, a small-bodied candle (doji or a small inexperienced or purple candle) seems. This candle signifies that the market contributors are indecisive, and the worth motion is proscribed. The small-bodied candle gaps above the day past’s bullish candle, suggesting that the upward momentum could also be slowing down and there are bearish alerts.

Lastly, on the third day, a big bearish candle varieties, closing under the midpoint of the primary day’s bullish candle. This third candlestick is essential in finishing the night star sample and confirming the bearish reversal. This newly shaped sample serves as a bearish affirmation and signifies that sellers have taken management, pushing the worth downwards. Our dealer sees this as a chance to exit their BTC place.

This formation of a bullish candle, adopted by a small-bodied candle, after which a bearish candle is the night star candlestick sample. On this hypothetical instance, the looks of this sample within the Bitcoin market means that the uptrend could also be reversing, and a downtrend might be on the horizon. Merchants who acknowledge this sample may determine to take revenue or enter brief positions, anticipating a bearish market motion.

The right way to Commerce with the Night Star Candlestick Sample

To successfully commerce with the night star candlestick, comply with these steps:

- Establish the sample. Search for a bullish pattern adopted by the formation of the night star sample, which ought to sign a possible pattern reversal.

- Verify the sample. To extend the reliability of the sign, wait for extra bearish candlestick patterns or different technical indicators that counsel a bearish reversal, corresponding to resistance ranges or trendlines.

- Set a cease loss. Place a stop-loss order above the best level of the sample to attenuate potential losses if the pattern reversal fails to materialize.

- Enter a brief place. As soon as the sample is confirmed and the cease loss is in place, enter a brief place, anticipating that the worth will drop.

- Monitor the commerce. Regulate the worth motion and regulate the stop-loss and take-profit ranges as wanted.

The Dangers and Advantages of Utilizing the Night Star Sample in Crypto Buying and selling

Similar to some other technique of analyzing charts and optimizing your buying and selling, the night star candlestick sample has its dangers and advantages. Be cautious and attempt to apply multiple strategy of market evaluation when making selections.

Advantages:

- Early warning signal. The night star sample provides an early indication of a possible pattern reversal, permitting merchants to react accordingly and capitalize on the bearish motion.

- Elevated likelihood of success. Combining the night star sample with different technical evaluation instruments can increase the chance of a profitable commerce.

Dangers:

- False alerts. Like every technical evaluation device, the night star sample can often produce false alerts, resulting in potential losses.

- Excessive volatility. Crypto markets are identified for his or her excessive volatility, which may typically end result within the sample failing to foretell a pattern reversal precisely.

Conclusion

The night star candlestick is a robust bearish reversal sample that may assist merchants establish potential pattern reversals within the crypto market. By understanding its traits, utilizing it at the side of different technical evaluation instruments, and being conscious of the dangers and advantages, merchants can enhance their probabilities of success. As with every buying and selling technique, it’s important to handle threat and preserve self-discipline to attain constant outcomes.

FAQ

What’s the night star candlestick sample?

The night star candlestick is a bearish reversal sample that usually alerts a possible reversal from an uptrend to a downtrend. It consists of three candles: a protracted bullish candle, a small-bodied indecision candle, and a bearish candle.

This bearish candlestick sample signifies that bullish momentum is dropping power, and bearish sentiment is taking on, doubtlessly resulting in a downtrend within the asset worth.

What are one of the best bearish reversal patterns?

Among the greatest bearish reversal patterns in monetary markets embody the night star candles, bearish harami, capturing star, and bearish engulfing. These patterns assist merchants establish potential reversals in worth uptrends, permitting them to benefit from bearish market actions. Every sample has its distinctive traits, however all of them sign a weakening of bullish momentum and a shift in direction of bearish sentiment.

Is the night star sample dependable?

The night star candlestick is taken into account a comparatively dependable bearish reversal sign, notably when it seems after a robust uptrend and different technical indicators, corresponding to resistance ranges or worth oscillators, affirm it. Nevertheless, like all technical evaluation instruments, the night star sample might often produce false alerts. To mitigate this threat, merchants ought to mix this sample with different indicators and preserve strict threat administration practices.

What’s the morning star sample?

The morning star sample, being the alternative of the night star candlestick, is a bullish reversal sample. It alerts a possible reversal from a downtrend to an uptrend within the monetary markets. The sample consists of three candles: a bearish (purple or black) candle, a small-bodied indecision candle, and a bullish (inexperienced or white) candle. The morning star sample signifies that bearish momentum is subsiding and bullish sentiment is taking on, doubtlessly resulting in an uptrend within the asset worth.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)