- Ethereum improvement exercise declines in comparison with different cryptocurrencies comparable to Polkadot and Cardano

- The variety of Ethereum holders continues to develop. Moreover, community progress and every day energetic addresses lower

In line with latest knowledge, Ethereum‘s improvement exercise decreased compared to different cryptocurrencies comparable to Polkadot [DOT] and Cardano [ADA]. This decline may have adverse impacts on the long-term prospects of Ethereum.

GitHub Weekly Growth Exercise:

#1: 383 Polkadot / Kusama

#2: 351 Decentraland

#3: 273 Standing

#4: 264 Cosmos

#5: 247 Cardano

#6: 232 Ethereum

#7: 218 Web Pc

#8: 189 Filecoin

#9: 183 Vega Protocol

#10: 173 ChainLink pic.twitter.com/RuFsqr2E4s— ProofofGitHub (@ProofofGitHub) January 8, 2023

A brand new proposal

Nonetheless, there may be hope on the horizon as the event exercise may improve attributable to Ethereum builders’ new proposal. The brand new Poseidon proposal entails introducing a brand new kind of contract that makes use of the Poseidon cryptographic hashing algorithm.

The brand new contract will enable completely different programs to work collectively and also will add extra choices for cryptographic hashing to the Ethereum Digital Machine. These embody Ethereum Digital Machine and zero-knowledge and Validity rollups.

Moreover, this new contract may make it simpler and cheaper to make use of zero-knowledge proofs and proof-of-reserves. These can be Merkle-based proofs on the Ethereum community.

Are your ETH holdings flashing inexperienced? Test the revenue calculator

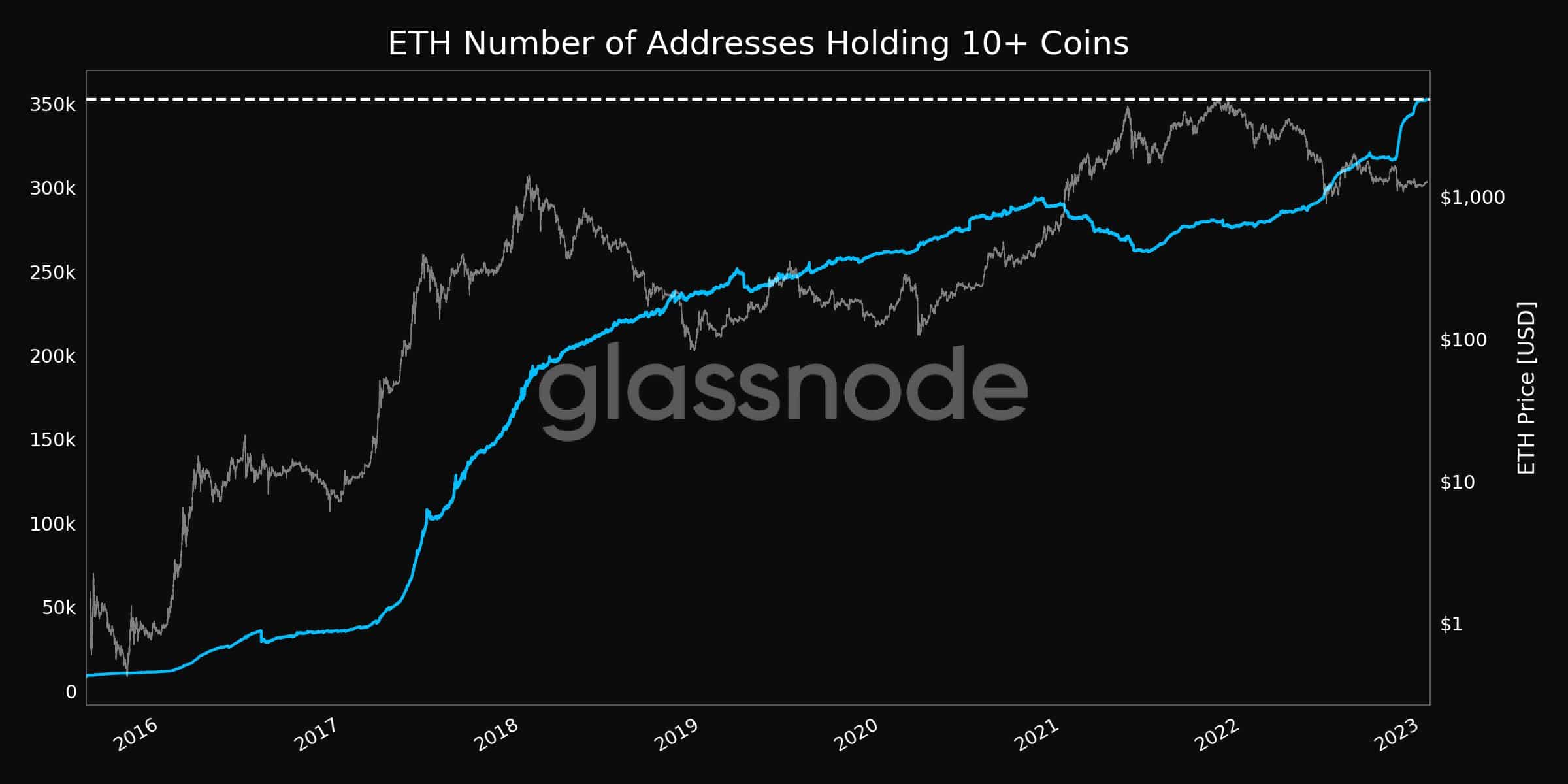

Moreover, the variety of Ethereum holders continued to develop. This was indicated by the truth that the variety of addresses holding 10 or extra cash has reached an all-time excessive of 352,501 in accordance with knowledge from Glassnode.

Supply: glassnode

Holding the metrics in thoughts

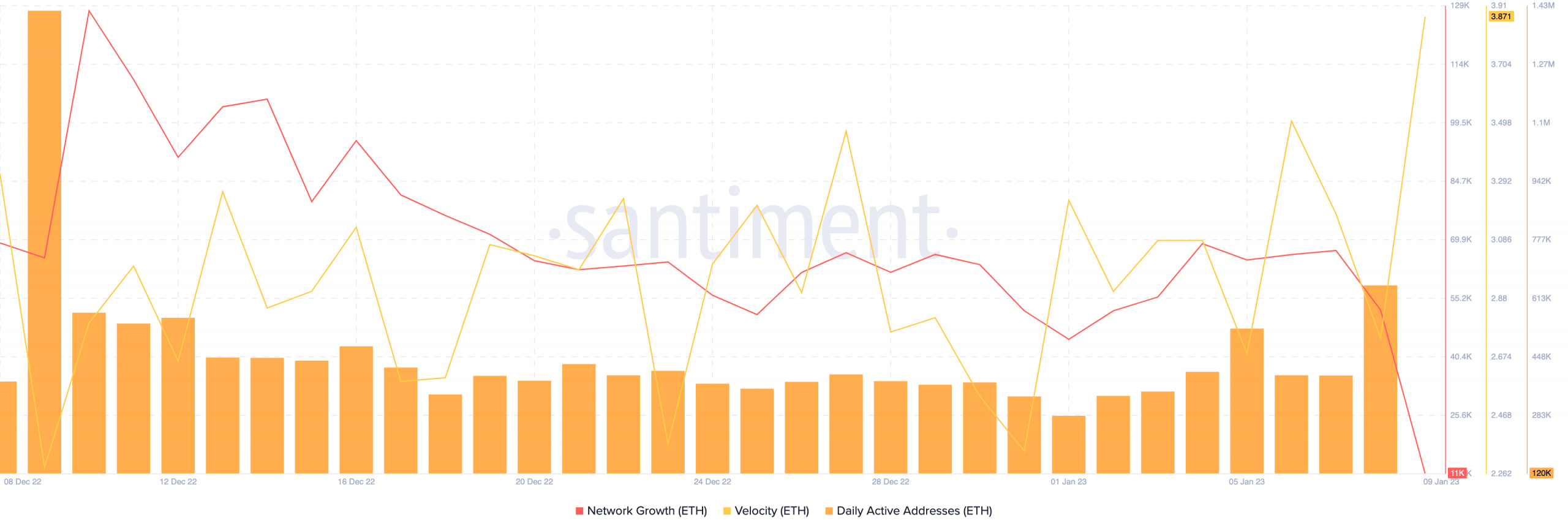

Regardless that the variety of holders continued to develop, Ethereum’s general on-chain exercise continued to say no.

As an illustration, Ethereum’s community progress decreased materially over the previous month. This indicated that there was a lower within the variety of new addresses transferring ETH for the primary time. Moreover, every day energetic addresses additionally decreased.

Nonetheless, regardless of these components, Ethereum’s velocity witnessed an enormous spike. This indicated that the frequency at which ETH was being traded amongst addresses elevated.

Supply: Santiment

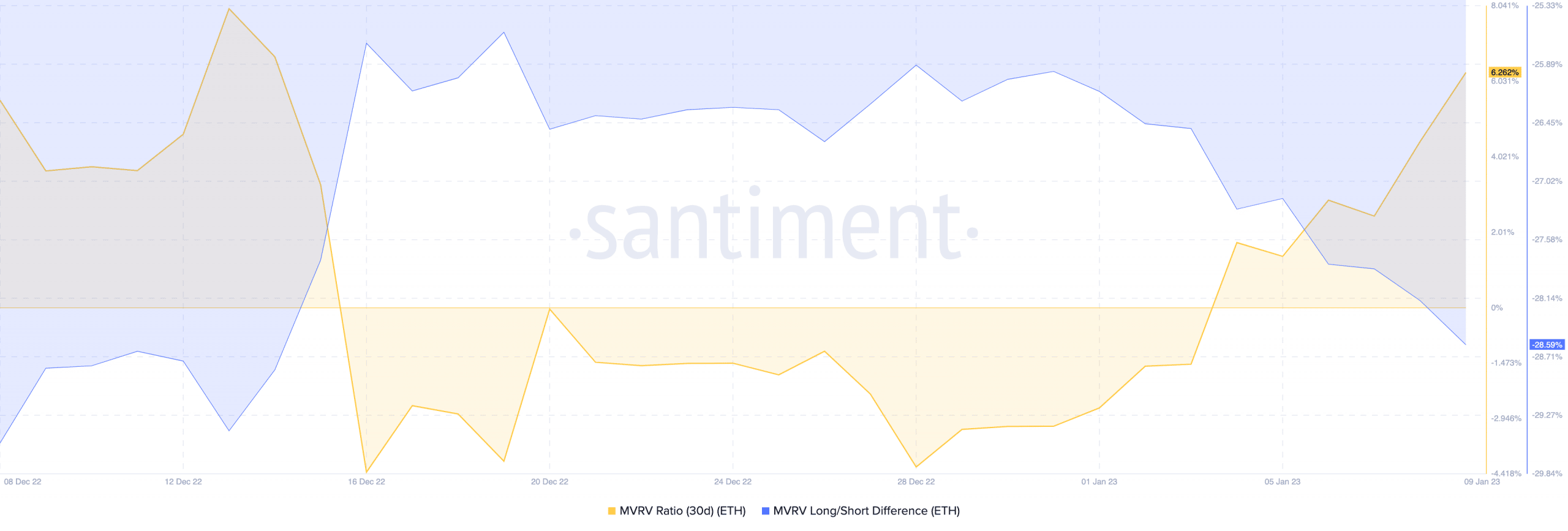

Together with the rising velocity, Ethereum’s Market Worth to Realized Worth (MVRV) ratio improved as nicely. The MVRV ratio, which measures the revenue or lack of most holders, elevated over the previous week.

This meant that if most holders determined to promote, they’d be taking earnings. Nonetheless, the long-short distinction was adverse suggesting that many short-term holders had been worthwhile. These short-term holders had been extra prone to promote their ETH positions within the close to future.

What number of ETHs are you able to get for $1?

Supply: Santiment

It stays to be seen whether or not the decline in improvement exercise and different components can have a long-lasting influence on the worth of Ethereum. On the time of writing, Ethereum was buying and selling at $1,308.26 with a worth improve of three.61%.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)