The buying and selling quantity throughout the most important non-fungible token (NFT) market OpenSea has been in a downtrend over the previous week, presumably largely as a result of a number of incidents which led to customers shedding thousands and thousands of {dollars} price of digital property.

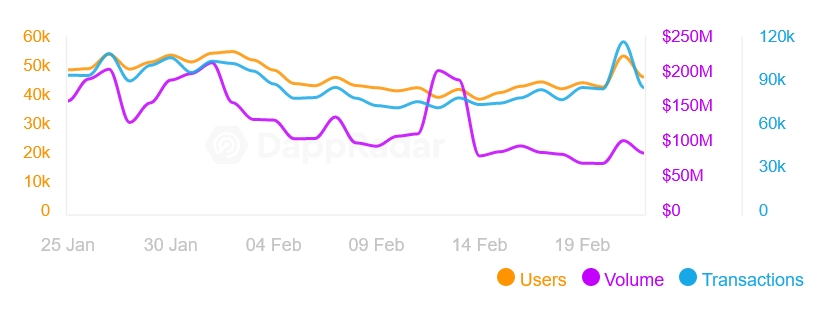

OpenSea’s buying and selling quantity is down greater than 11% over the previous day and greater than 27% over the previous week, in line with knowledge by DappRadar. Over the previous 30 days, it’s up 29%.

The platform processed round USD 87m price of transactions on Tuesday, down from USD 161.7m seen 30 days in the past, on January 25. Evaluating Tuesday’s quantity to that of January 25, it’s down by greater than 46%.

Apparently, the variety of transactions and customers interacting with the platform has largely remained flat. On Tuesday, {the marketplace} processed 86,800 transactions from 47,030 customers, in comparison with 95,300 transactions from 49,540 customers on January 25.

The lower in OpenSea’s quantity could, not less than partly, be attributed to the current incidents.

In late January, as a result of a problem with {the marketplace}’s person interface (UI) design, some opportunists have been in a position to buy NFTs beneath their precise worth. In a press release to Cryptonews.com, {the marketplace} detailed that the difficulty would come up when customers create listings for his or her NFTs after which switch the listed NFTs to a distinct pockets with out canceling the itemizing.

“OpenSea can not cancel listings on behalf of customers. As a substitute, customers should cancel their very own listings,” OpenSea mentioned on the time.

To deal with this concern, OpenSea released a wise contract replace on Friday, requiring all customers to maneuver their listings on Ethereum (ETH) to the brand new sensible contract.

Subsequently, nevertheless, it fell sufferer to a phishing assault, with some arguing that the difficulty might need been with the migration.

Nevertheless, on Tuesday, the platform mentioned that their contract migration instrument has been dominated out as a vector for the assault, including that it is “protected emigrate your listings.”

In the meantime, the day by day buying and selling quantity throughout LooksRare, a rival to OpenSea, has declined sharply. On Tuesday, the platform processed USD 90.3m price of transactions (in comparison with OpenSea’s USD 133.6m per this supply) — down by 89% in comparison with its peak of USD 842.8m recorded on January 19, in line with Dune Analytics.

As reported, NFT knowledge aggregator CryptoSlam argued in late January that wash-trades represent an enormous portion of LooksRare’s quantity.

____

Be taught extra:

– OpenSea Narrows Down Checklist of Impacted Customers, Nonetheless Searching for the Trigger

– Texas Man Sues OpenSea Over Stolen NFT, Asks for Over USD 1M in Damages

– OpenSea Boosts Valuation 9X as This NFT Big Units 4 Strategic Targets

– NFT Market Cools Down As soon as Once more as Crypto Costs Warmth Up

– ETHDenver Hackathon Finalists Goal at These Ache Factors Throughout DeFi, NFTs, DAOs, and Metaverse

– What’s Nonetheless Holding NFTs Again & The way to Repair It

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)