On-chain knowledge reveals Bitcoin long-term holders are dumping their cash as BTC plummets beneath the $17,000 stage.

Bitcoin Lengthy-Time period Holder SOPR Spikes Right this moment

As identified by an analyst in a CryptoQuant post, some BTC long-term holders appear to have taken earnings up to now day. The related indicator right here is the “Spent Output Revenue Ratio,” which tells us whether or not Bitcoin buyers as a complete are promoting their cash at a revenue or at a loss proper now.

When this metric has a worth larger than 1, it means the typical holder has been shifting their cash at some revenue just lately. Alternatively, values beneath the brink recommend the general market has been realizing some loss. Naturally, SOPR precisely equal to 1 implies that the buyers are simply breaking-even with their promoting.

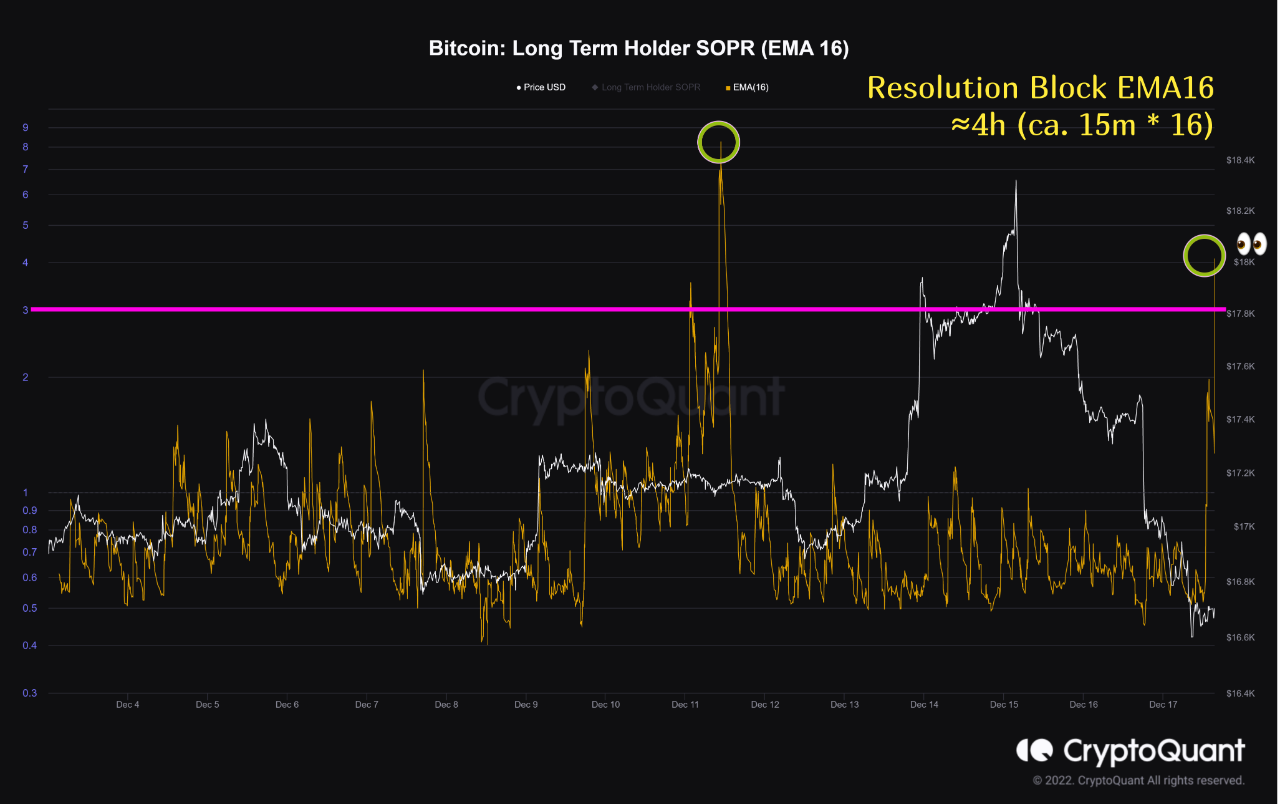

The “long-term holder” (LTH) group is a Bitcoin cohort that features all buyers who’ve been holding onto their cash since a minimum of 155 days in the past, with out having moved or offered them from a single tackle. Here’s a chart that reveals the development within the Bitcoin SOPR particularly for these LTHs over the past 15 days:

Appears to be like just like the EMA16 worth of the metric has shot up in the previous few hours | Supply: CryptoQuant

Because the above graph reveals, the Bitcoin LTH SOPR (EMA16) has noticed a pointy spike above 1 in the course of the previous day. Which means these holders have harvested some earnings immediately. Statistically, LTHs are the buyers least more likely to promote at any level, so any dumping from them can have noticeable penalties on the BTC market.

From the chart, it’s obvious that when the indicator final noticed such a big spike in its worth, the worth of the crypto had plunged down shortly after. Curiously, the most recent spike has solely come after BTC has plunged down beneath $17k. Normally, such holders promote for earnings throughout rallies, however right here the dumping has come after the bullish momentum has already handed over.

This might be an indication that with all of the FUD going round available in the market proper now, these supposed diamond arms have additionally damaged down and really feel bearish in regards to the prospects of Bitcoin in the meanwhile. Such a development is more likely to be unfavorable for the worth, and may take the crypto even additional decrease.

BTC Worth

The value of the coin appears to have slid down over the previous few days | Supply: BTCUSD on TradingView

On the time of writing, Bitcoin’s value floats round $16.7k, down 2% within the final week. The above chart shows the development within the worth of the crypto during the last 5 days.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)