In 2022, ethereum has been in a bearish pattern. It has dropped 40% 12 months so far, way over the typical cryptocurrency. ETH has a protracted historical past of being one of many best-performing cryptocurrencies.

Since its introduction in 2016, it has largely outperformed Bitcoin, leading to a narrowing of the market capitalization hole between the 2 cash. Nevertheless, this 12 months has deviated considerably from the long-term tendency. A key incentive to purchase Ether has been faraway from the market as a result of waning of the NFT craze. ETH is now principally utilized by merchants, and demand for the cryptocurrency is way decrease than it was late final 12 months.

Ethereum Worth Swings

The market has seen no obvious course within the final 24 hours, as a consolidation between $2,500 assist and $2,600 resistance continues. In consequence, we will count on a follow-up push to both facet after ETH/USD breaks to both facet.

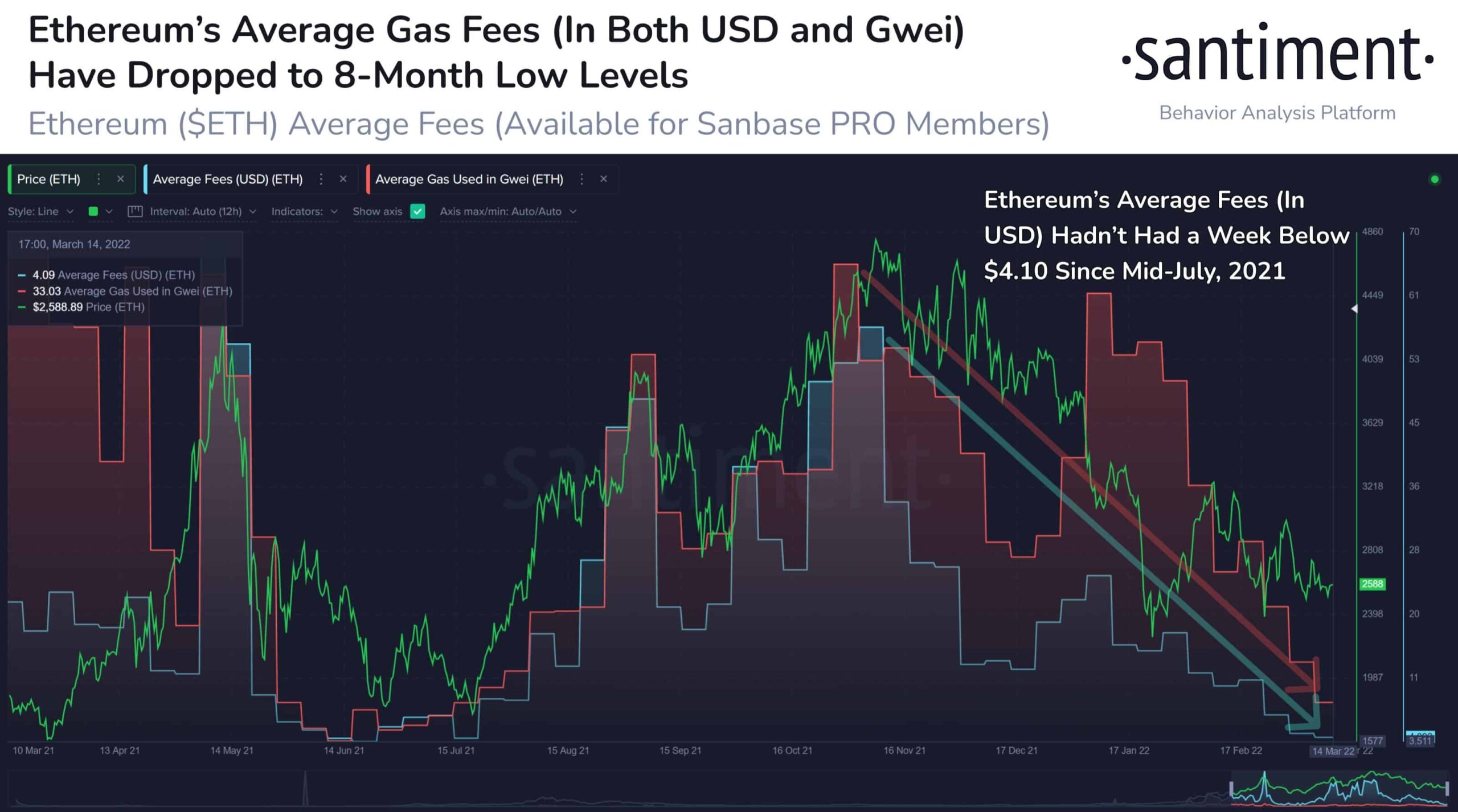

In consequence, the Ethereum (ETH) blockchain continues to bear vital adjustments. Santiment, an on-chain information supply, revealed that the Ethereum (ETH) worth has dropped to an eight-month low, which is welcome information for ETH traders. In keeping with Santiment:

Ethereum is bouncing quickly across the $2,560 degree presently. Along with the extraordinarily tight #SP500 correlation it has proper now (much more than Bitcoin), it’s additionally seeing 8-month low charges proper now. $ETH final had charges under $4.10 in mid-July.

Supply: Santiment

During the last 24 hours, the market has risen considerably. As they each proceeded to consolidate, Bitcoin gained 0.38 and Ethereum gained 0.34. Worth exercise within the the rest of the market has been comparable.

Associated Studying | The place Ethereum and Bitcoin Headed After Musk’s Tweet

Buyers See Upside

On Monday, March 14, Invoice Barhydt, CEO of crypto alternate Arba, instructed CNBC that Ethereum has the potential to succeed in $30,000-$40,000.

Invoice is turning into extra enthusiastic on account of the assorted use instances and advances within the Ethereum ecosystem. He said.

“Ethereum’s community impact is predicated on this concept that it may grow to be the world’s computer systems. It’s getting used for stablecoins, NFTs (non-fungible tokens), defi (decentralized finance) … and gaming now.”

By the center of 2022, the Ethereum 2.0 replace is projected to be operational. He believes that after the preliminary rush to stake, there could also be a “sell-the-news impact.” Nevertheless, he’s optimistic that if the general gasoline payment is decreased, ETH traders will profit. Invoice said,

“If the gasoline charges and the transaction charges come down, which is the promise of the proof-of-stake, look out, as a result of now all the impediments of these community results are taken out of the best way. I believe, you might be speaking probably $30,000-$40,000 Ethereum”.

ETH/USD trades near $2,500. Supply: TradingView

Regardless of the rationale for Ethereum’s worth remaining within the $2,500 vary, there aren’t any technical causes for it to indicate any power. ETH is under the 2022 Quantity Level Of Management, continues under the bearish pennant, and is now under the 61.8 % Fibonacci retracement of the all-time excessive to the trough of the robust bar on the weekly chart at $2,570, along with the Very best Bearish Ichimoku Breakout affirmation.

The Ethereum worth’s draw back dangers are most probably restricted to the $1,800 worth degree in June 2021 and July 2022.

Associated Studying | Abra CEO Predicts Ethereum May Attain $40,000 – However Some Fintech Analysts Don’t Agree

Featured picture from Pixabay, chart from TradingView.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)