- The overall annualized issuance fee of ETH diminished considerably

- Circulation additionally decreased, including to Ethereum’s deflationary nature

Many speculations had been made relating to what would lie forward for Ethereum [ETH] publish the Merge. One of many doubts that almost all had was round ETH’s deflationary nature. Nevertheless, there was some readability seen on that entrance as based on official sources, ETH achieved a virtually zero whole annualized issuance fee.

____________________________________________________________________________________________

Learn Ethereum’s [ETH] Worth Prediction 2023-24

____________________________________________________________________________________________

Final 12 months, Ethereum builders pushed the London improve that enabled the Ethereum burning. The diminished issuance fee, when coupled with the Ethereum burn, added to its deflationary nature and painted a constructive image for Ethereum’s future.

Deflationary traits amplified

As per Messari’s knowledge, ETH’s provide additionally diminished significantly over the previous couple of days. This additional supported its deflationary traits.

#ETH reached a declining provide this week.

Is the “ultra-sound” narrative not a meme? 🦇 🔊 pic.twitter.com/Tez25ZjEi6

— Messari (@MessariCrypto) November 13, 2022

Apparently, whereas the availability continued to lower, Ethereum’s variety of addresses holding 10+ cash simply reached an ATH of 326,899. This improvement was constructive, because it confirmed the boldness of buyers in ETH.

📈 #Ethereum $ETH Variety of Addresses Holding 10+ Cash simply reached an ATH of 326,899

Earlier ATH of 326,856 was noticed on 12 November 2022

View metric:https://t.co/6ggy1nLJIb pic.twitter.com/7T3DSrg6fO

— glassnode alerts (@glassnodealerts) November 13, 2022

In principle, every thing seemed to be working in favor of ETH. Nevertheless, these new updates didn’t appear to influence ETH’s worth, because it was down by over 21% within the final week. At press time, ETH was trading at $1,259.72, with a market capitalization of over $153.5 billion.

Maintain on! This may be regarding for ETH

The king of altcoins’ metrics advised that issues would possibly get even worse for ETH. This was as a result of there was a chance of an additional worth decline within the days to return. In response to CryptoQuant, the web deposits on exchanges had been excessive in comparison with the seven-day common, which was a detrimental signal because it indicated greater promoting strain.

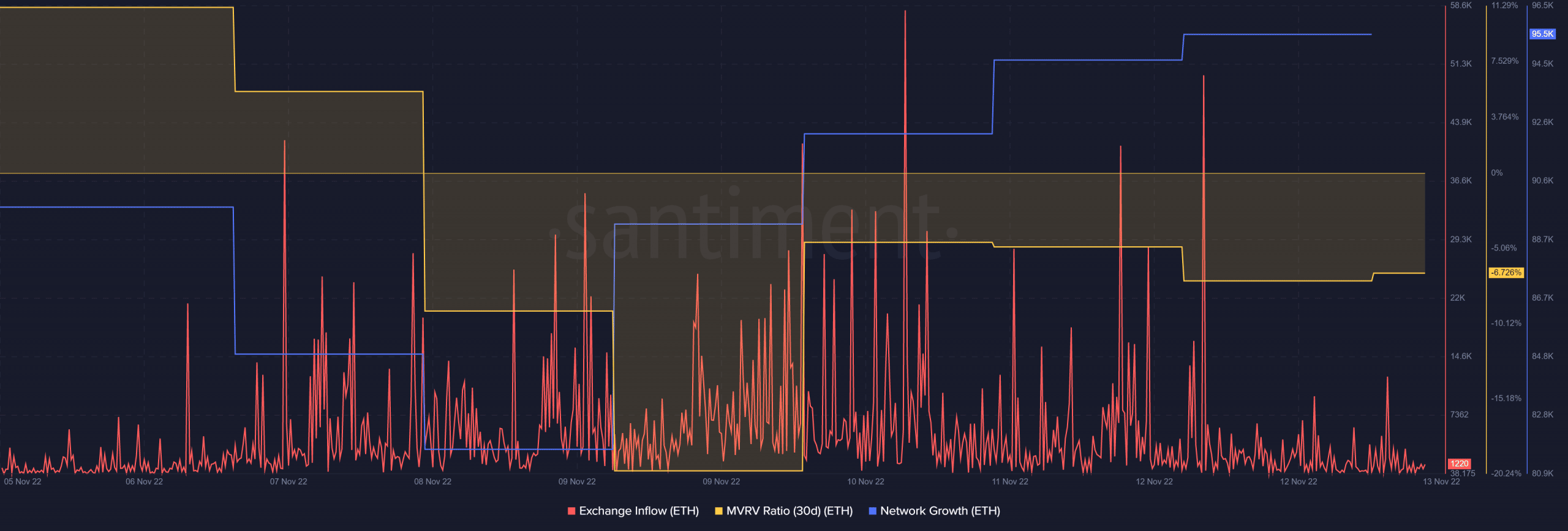

Ethereum’s variety of energetic addresses went down. This advised a decrease variety of customers on the community. The overall variety of transactions additionally adopted the same route, which was one more bearish sign. Santiment’s chart additionally supplemented the aforementioned metrics. Although ETH’s Market Worth to Realized Worth (MVRV) went up during the last week, it was nonetheless not ample. ETH’s change outflow additionally registered a spike, which was a bearish signal too.

Supply: Santiment

Regardless, not every thing was towards Ethereum, as a number of metrics indicated in the direction of a pattern reversal. As an illustration, ETH’s change reserve was declining. This was a constructive signal indicating decrease promoting strain.

Furthermore, ETH’s community progress registered a substantial uptick in the previous couple of days, suggesting the potential for higher days within the close to future.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)