Bitcoin managed to interrupt above the resistance degree above $21,000 and appears poised for additional beneficial properties. The cryptocurrency information its first week within the inexperienced after relentless promoting stress pushed it to a multi-year low of round $17,000.

Associated Studying | Why Weakening Bearish Bitcoin Momentum May Give Bulls The Higher Hand

On the time of writing, Bitcoin (BTC) trades at $21,700 with a 5% and 12% revenue within the final 24 hours and seven days respectively.

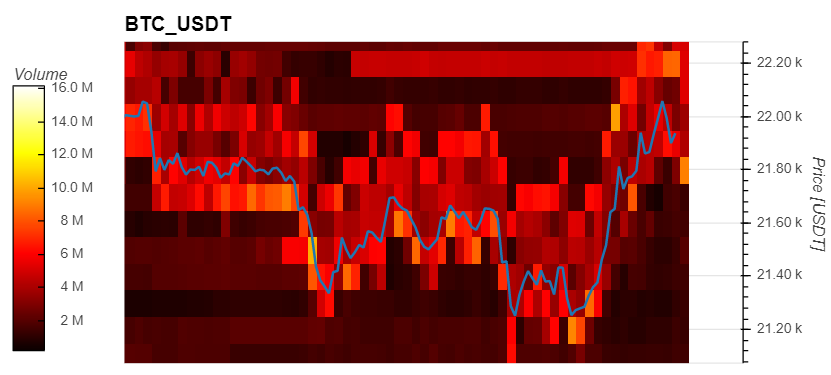

Information from Materials Indicators (MI) reveals a rise in bid orders for BTC’s value because it strikes to $22,000. The cryptocurrency information round $10 million in bid orders at $21,800 and $21,500 alone.

As seen beneath, these ranges had been beforehand unprotected and had been prone to additional draw back. In decrease timeframes, it appears as if buyers have been forming a liquidity defend for BTC’s value at its present ranges.

The present bullish value motion was preceded by a rise in shopping for stress from BTC whales. MI information reveals these massive entities have been shopping for extra Bitcoin because the begin of July and influenced BTC’s value to the upside.

The information reveals a slight lower within the shopping for stress, which may point out BTC’s value will return to a consolidation part. As a way to maintain the bullish momentum, analysts from Materials Indicators claimed BTC’s value should keep above $20,000 for the subsequent two days.

As a way to lengthen the bullish momentum, the cryptocurrency should reclaim the 200 Weekly Transferring Common (WMA) which stands at $22,560. Analyst Michaël Van de Poppe concurs on potential value consolidation earlier than any try and reclaim greater ranges:

The essential resistance for #Bitcoin as we converse. (Quantity has to do with the truth that Binance has added the zero buying and selling charges) Trying good general however wouldn’t be stunned with some slight consolidation earlier than a giant breakout happens.

What May Get In The Means Of A Contemporary Bitcoin Rally

In accordance with economist Alex Krüger, the U.S. Federal Reserve (Fed) remains to be a very powerful headwind for BTC’s value. The monetary establishment has been making an attempt to decelerate inflation by mountaineering rates of interest.

Nonetheless, the Fed believes any potential adverse affect from an rate of interest hike or reducing its stability sheet, Quantitative Tightening (QT), is already priced in. Thus, why the potential for future draw back has been doubtlessly decreased, Krüger said:

Until inflation surprises significantly to the upside, the Fed is okay with issues as they’re, and financial coverage tightening is generally within the value. QT received’t destroy markets. Main strikes require an data shock, which then results in a shift in equilibrium.

Associated Studying | Solana Glints With 14% 3-Day Rally – Will SOL Maintain On Beaming?

The following main impediment to BTC’s value may very well be the normal firms’ earnings season. If shares commerce to the draw back because of an financial slowdown, the already extremely correlated crypto market may observe.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)