After a tough couple of months, this week began with a robust upward motion from Bitcoin because the coin broke out above the $45,000 stage on Monday to $48,215 earlier than fluctuation, thus erasing yearly losses and anticipating a $50,000 goal.

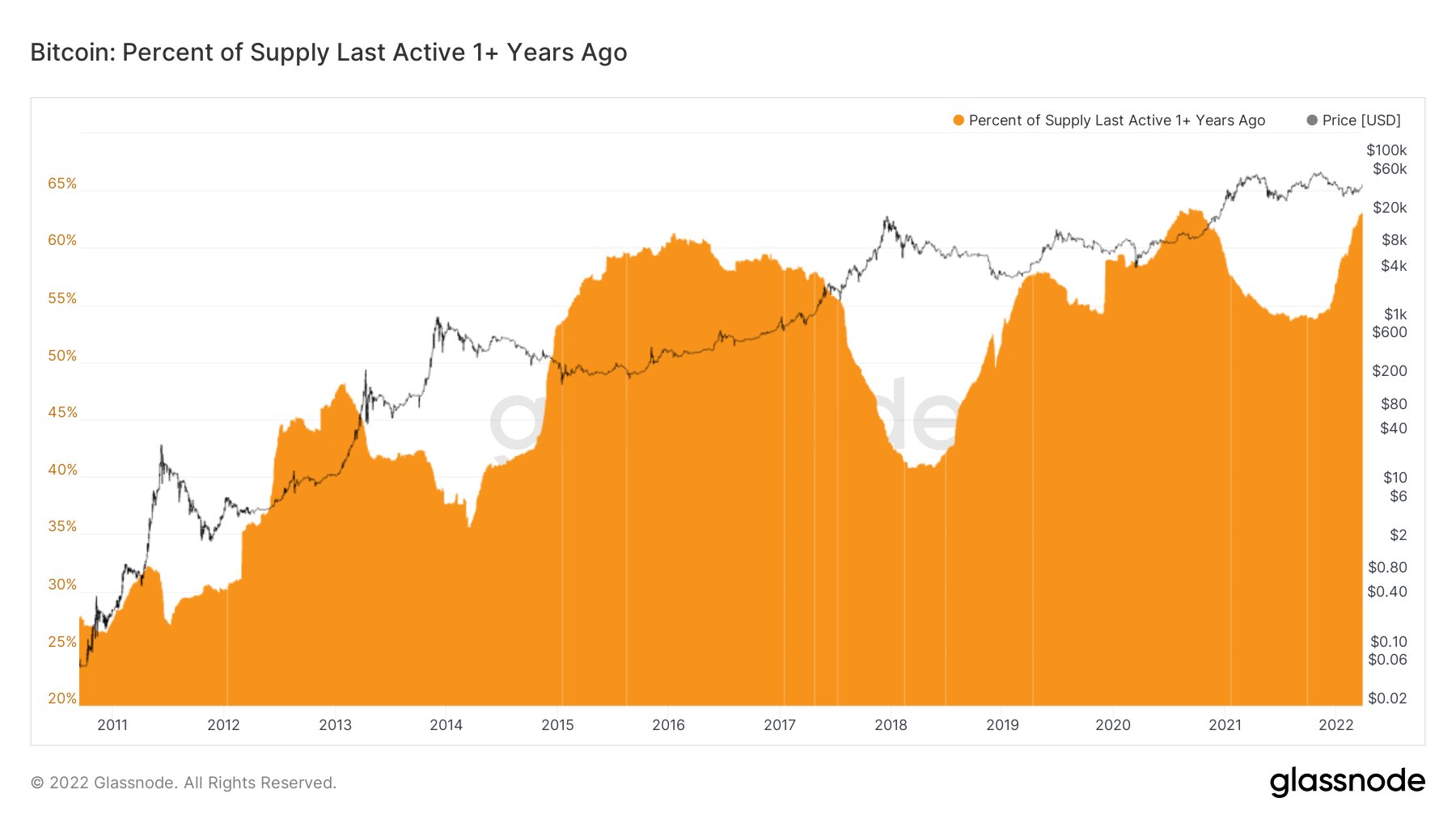

Regardless of the decline over the 12 months, a considerable amount of the coin was by no means bought. A situation that exhibits how holders strongly imagine within the long-term recreation and stay surprisingly calm over a interval of turmoil.

Constructing Up To A Rally

Senior Analyst Dylan LeClair noted that, as Bitcoin is buying and selling at round $48,000, “there has solely been one different time that the proportion of provide that hadn’t moved in over a 12 months was at this stage,” which was throughout September 2020.

On the talked about date Bitcoin recovered from the dramatic crash of march 2020. The robust bounceback noticed a 185% hike within the costs, taking to coin to over $10,000. A excessive variety of dedicated ‘hodlers’ had additionally saved their BTC dormant regardless of the acute swings in costs through the 12 months.

This was adopted by a efficiency that catapulted Bitcoin’s status amongst buyers as “digital gold”. It closed the 12 months buying and selling at document highs of near $30,000, outperforming gold with a rise of 416% over the 12 months.

Brett Munster at Blockforce Capital had additionally noted final week a near-record highs share of the entire Bitcoin provide that hasn’t moved in over a 12 months, additional declaring that it’s rising at a a lot quicker tempo than the final time Bitcoin was at these ranges.

“I anticipate this quantity to set new all-time highs in coming weeks and months as a result of it’s precisely this cohort that stepped in and aggressively purchased in April and Could of final 12 months when Bitcoin’s worth fell.”

Associated Studying | Bitcoin Probably To Proceed Upward Trajectory, Is $50K Its Subsequent Goal?

Bitcoin Derivatives Paint A New Image

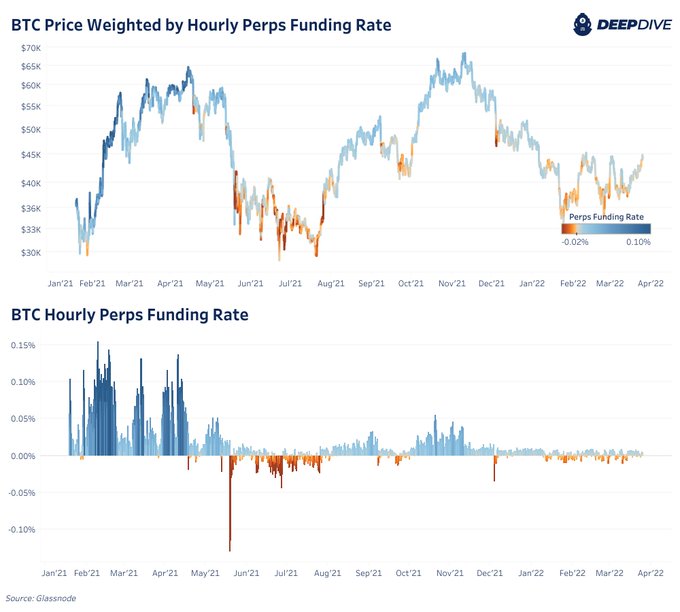

Moreover, Dylan LeClair additionally famous that BTC derivatives “are nonetheless considerably defensive & nowhere close to as risk-on as 2021 regardless of identical worth ranges.”

Illustrated by the next chart, the analyst confirmed the motion of BTC derivatives all through 2021 “when the value was buying and selling at this present stage.”

Be aware that funding charges “signify merchants’ sentiments within the perpetual swaps market,” with constructive funding charges (over 0) indicating that lengthy place merchants are dominant and unfavourable funding charges (beneath 0) indicating the alternative, CryptoQuant explains.

In comparison with earlier years, the BTC hourly perpetual funding charges are considerably nearer to zero. “Extreme long-biased by-product market hypothesis is close to non-existent at the moment,” says LeClair.

What the analyst is declaring signifies that extreme hypothesis and leverage drove the market to those worth ranges in 2021, and “now its principally nowhere to be seen and bitcoin is rallying.” This might suggest that the value is now rising due to demand, not market hypothesis.

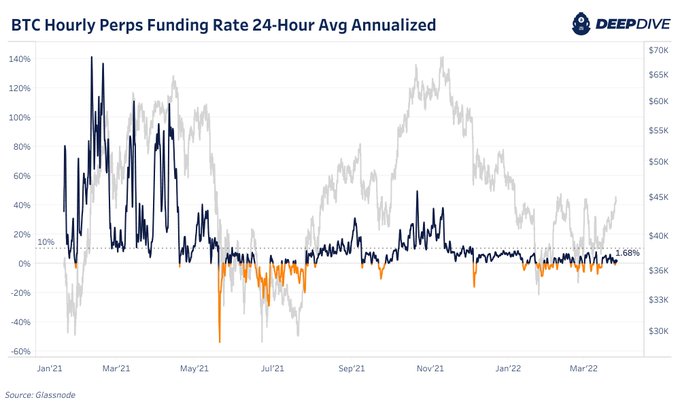

Equally, within the following chart, LeClair shows annualized perpetual future funding charges on a 24-hour Shifting Common, whereas including that “Merchants have been paying ~100% annualized to go lengthy BTC early in 2021. An identical however much less extreme speculative market arose within the fall. At this time? Funding has been flat/unfavourable for many all of 2022.”

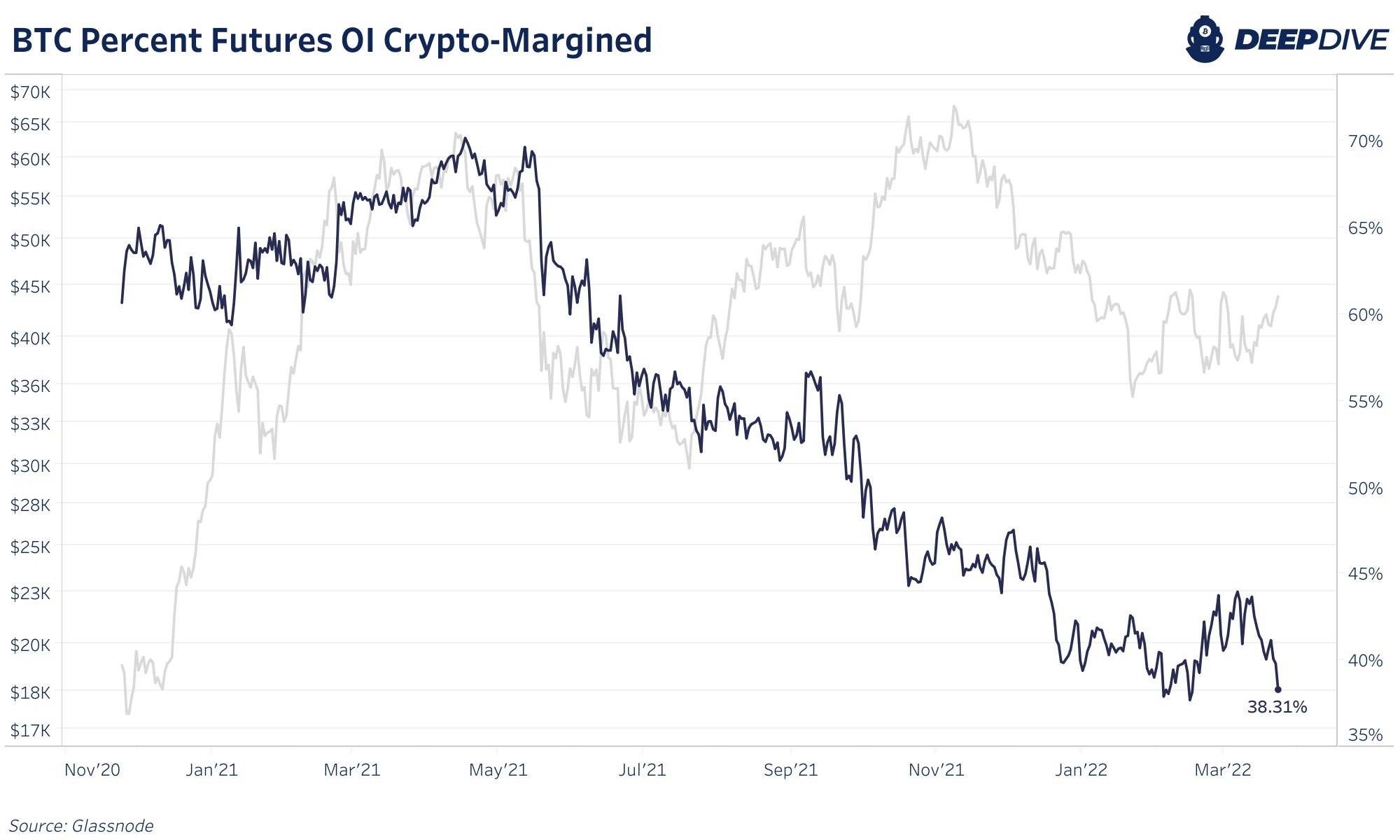

“Lastly, have a look at the collateral make-up of BTC by-product open curiosity,” LeClaire provides.

“In 2021 as much as 70% of OI was collateralized with BTC. Merchants have been paying outrageous charges to lengthy with BTC collateral, resulting in large liquidations. Now a majority of OI is collateralized with stables.”

Associated Studying | TA: Bitcoin Noticed Key Technical Breakout: Huge Response From Bulls Imminent

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)