Bitcoin trades north of the $40,000 value mark with bullish momentum within the final 24 hours. As we speak, the U.S. Federal Reserve (FED) is anticipated to start its financial tightening coverage.

Associated Studying | TA: Bitcoin Breaks $40K, Key Upside Break Suggests Development Change

The monetary establishment might elevate rates of interest hikes, and slowly pull liquidity from international markets. Bitcoin and risk-on property, reminiscent of equities, are anticipated to show bearish. Thus far, BTC’s value has failed to satisfy expectations.

On the time of writing, Bitcoin trades at $40,416 with a 4% revenue on the final day.

Bitcoin has been behaving by itself with resilience to a possible shift within the U.S. greenback financial coverage. In step of buying and selling as a inventory, BTC’s value appears extra akin to Gold’s (XAU) value motion.

The valuable metallic lately broke above the $2,000 however has backtracked on a few of its good points. This downtrend could possibly be short-lived and will predict what’s coming for Gold and Bitcoin. Two completely different property are generally traded beneath the inflation hedge narrative.

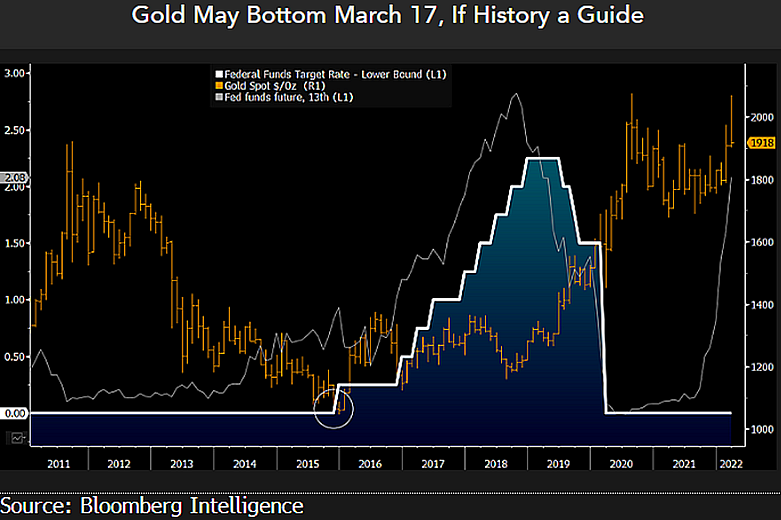

Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone indicated that the FED final elevated rates of interest to 25 bps or 0.25% in 2015. Gold was coming from a multi-year downtrend that started in 2011.

The valuable metallic noticed appreciation posts the 2008 international financial disaster, however as markets started to get better, traders start decreasing their gold positions. As seen under, 2015 was the final time in the course of the previous decade that Gold’s value noticed a low at round $1,000.

Gold started an upward motion, as McGlone famous, the “subsequent day” after the FED introduced the start of a brand new tightening cycle. The present inflationary surroundings, with the danger of an prolonged warfare in Europe, might gas a recent Gold rally and Bitcoin might comply with.

Bitcoin On A Tightening Cycle

At the very least, Bitcoin might proceed to disappoint merchants ready for the low $20,000. The cryptocurrency, based on the pessimistic merchants, has been appreciating a positive surroundings since 2020.

Nevertheless, the XAU/BTC chart exhibits Bitcoin has been appreciating for the previous decade regardless of the FED’s financial coverage, or due to it.

The short-term response to the FED announcement might trace at what BTC’s value will do within the coming months. As NewsBTC has been reporting, cryptocurrencies might recognize if the monetary establishment hints at a much less aggressive financial coverage.

Associated Studying | Bitcoin Worth Takes A Hit As U.S Inflation Rises

In response to the analyst TedTalksMacro through Twitter:

Fed hikes by 25bps at the moment, threat property (BTC, equities) greater on the information. Powell signifies on the press convention that extra hikes to come back (4-5 by EOY) – how the market strikes throughout/after the press convention to be determined by whether or not it’s a dovish or hawkish hike Dovish hike might be signaled by any point out of warning in the course of the press convention. A hawkish hike might be signaled by any intention to proceed mountain climbing charges/tightening regardless of destructive impacts on financial progress!

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)