newbie

Think about a world the place you may have full management over your cash, a spot the place the transactions you make aren’t tied to a government like a financial institution or authorities, and the charges for sending cash the world over are minuscule. Welcome to the world of Bitcoin.

The primary cryptocurrency has supplied folks with an alternative choice to fiat foreign money, turning into a new-age medium of alternate. Nevertheless, regardless of its recognition, many individuals nonetheless don’t actually perceive what it truly is.

On this article, I’ll discuss Bitcoin, a digital asset that has modified the best way many individuals take into consideration cash. I’ll undergo some Bitcoin fundamentals, clarify the way it works, and the place you should buy it.

Definition: What Is Bitcoin?

Bitcoin is a digital type of foreign money that operates on a decentralized community referred to as a blockchain. In contrast to conventional currencies such because the US greenback or the Euro, Bitcoin isn’t issued or regulated by any central authority like a authorities or a monetary establishment. It was created in 2009 by an nameless individual or group of individuals utilizing the pseudonym Satoshi Nakamoto.

Bitcoin known as a “cryptocurrency” as a result of it makes use of cryptographic methods to safe transactions and management the creation of latest items. It is usually identified for its potential to revolutionize the monetary trade and has gained important consideration from buyers, researchers, and common customers alike.

What does “Bitcoin” imply?

The identify Bitcoin comes from the mix of phrases “bit” and “coin”.

How Does Bitcoin Work?

At its core, Bitcoin is a peer-to-peer digital money system. It permits customers to ship and obtain funds instantly with out the necessity for intermediaries like banks. The underlying expertise that makes this doable known as the blockchain.

The Bitcoin blockchain is a public ledger that accommodates a document of each transaction ever made with Bitcoin. It’s maintained by a community of computer systems, referred to as Bitcoin nodes, which take part within the validation and verification of transactions. Every node has a duplicate of all the blockchain, guaranteeing transparency and safety.

To make use of Bitcoin, people want a digital pockets that enables them to retailer, ship, and obtain the cryptocurrency. Wallets are secured with cryptographic keys, that are basically lengthy strings of numbers and letters. These keys function distinctive identifiers for customers and allow them to entry their funds.

When somebody desires to ship Bitcoin to a different individual, they create a transaction and signal it with their personal key. The transaction is then broadcasted to the Bitcoin community, the place it awaits affirmation by miners.

How Does Bitcoin Mining Work?

Bitcoin mining is the method via which new Bitcoins are created and transactions are validated. It performs an important position in sustaining the integrity of the Bitcoin community. Miners use highly effective computer systems to resolve advanced mathematical issues that safe transactions and add them to the blockchain.

Bitcoin mining has little to do with real-world mining.

Mining entails bundling a set of pending transactions right into a block and looking for an answer to a mathematical puzzle. The primary miner to resolve the puzzle will get the chance so as to add the block to the blockchain and is rewarded with newly minted Bitcoins as an incentive. This course of is named “proof-of-work.”

To stop the blockchain from turning into congested with blocks and transactions, the Bitcoin protocol adjusts the issue of the mathematical drawback based mostly on the entire computing energy of the community. This ensures that new blocks are added roughly each 10 minutes.

Over time, as extra Bitcoins are mined, the reward for mining decreases. The whole provide of Bitcoins is restricted to 21 million, and it’s estimated that the final Bitcoin will probably be mined across the 12 months 2140. As soon as all of the Bitcoins have been mined, miners will depend on transaction charges as their most important supply of revenue.

Easy methods to Use Bitcoin

Utilizing Bitcoin begins with buying a Bitcoin pockets, a digital device that lets you handle and retailer this digital foreign money. A Bitcoin pockets creates a singular handle for receiving funds and accommodates the cryptographic keys essential to signal and confirm transactions. Blockchain expertise, which operates as a digital ledger, data each Bitcoin transaction made throughout a peer community. This ledger consists of a sequence of blocks the place every block accommodates transaction knowledge and a reference to the earlier block, ranging from the genesis block.

However how can Bitcoin be used? With its decentralized nature, Bitcoin has opened up a brand new world of alternatives. It’s primarily used for digital fee for items and providers, significantly useful for worldwide transactions the place conventional banking techniques and central banks might complicate the method. Extra companies are beginning to settle for Bitcoin as a type of fee as a result of its rising recognition and the development of Bitcoin fee expertise.

Aside from serving as an digital fee system, Bitcoin has emerged as a digital asset and a possible retailer of worth. Some people purchase and maintain Bitcoin, treating it like an funding in gold or different monetary merchandise. In some international locations, significantly these experiencing financial instability and excessive inflation, Bitcoin is used as a hedge in opposition to the native financial system.

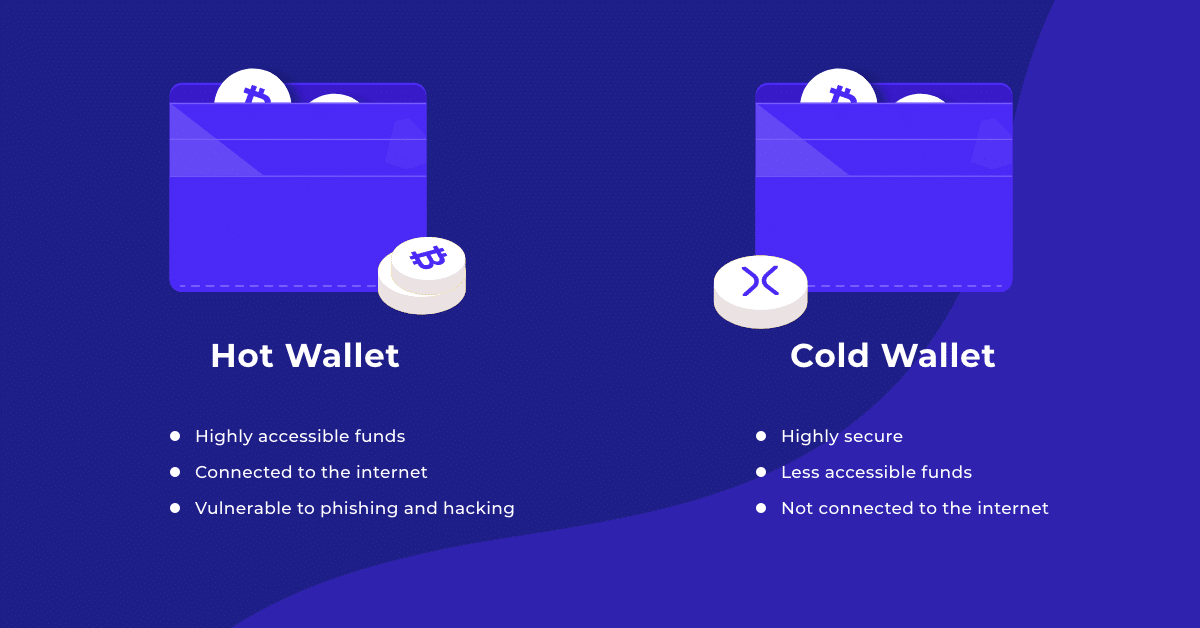

Storing Bitcoin: Scorching vs. Chilly Wallets

Storing Bitcoin securely is essential for any consumer of the digital foreign money. Similar to bodily wallets retailer your money and playing cards, Bitcoin wallets retailer your BTC cash. However as a substitute of something bodily, these wallets hold your key pair – a public key, which is like an e-mail handle different folks use to ship you Bitcoins, and a personal key, which you employ to authorize transactions.

The selection between a cold and hot pockets is dependent upon how you employ your Bitcoins. Should you carry out common cryptocurrency transactions, a scorching pockets provides extra comfort. However if you happen to’re a Bitcoin miner or an investor holding giant quantities of BTC, the safety of a chilly pockets is extra appropriate. It’s additionally price noting that you should utilize each sorts concurrently – a scorching pockets for each day transactions and a chilly pockets for long-term storage. Some wallets even supply integrations with different pockets sorts, like Ledger.

Keep in mind, the important thing to profitable crypto administration is securely managing your personal keys and selecting the best pockets on your wants.

If you wish to see extra examples or a extra thorough information on Bitcoin wallets, try this text.

Scorching Wallets

A scorching pockets is a Bitcoin software program pockets that’s all the time related to the Web. This connection makes scorching wallets handy for finishing Bitcoin transactions shortly, but in addition will increase safety dangers. Crypto exchanges like Coinbase and Binance present customers with scorching wallets after they create accounts.

Professionals:

- They’re handy and user-friendly, making them ultimate for learners.

- Immediately accessible from wherever with an Web connection.

- Appropriate for dealing with small quantities of Bitcoin and common transactions.

Cons:

- As they’re all the time on-line, they’re extra prone to cyber threats.

- If the platform your pockets belongs to is compromised, your Bitcoins may very well be stolen.

Finest for: Informal Bitcoin customers, small-scale merchants, and those that spend Bitcoin repeatedly.

Examples: Coinbase pockets, Binance pockets, and different exchange-based wallets. Standalone software program wallets like Electrum and Exodus additionally fall into this class. Please word that alternate wallets are usually much less secure than different kinds of software program wallets.

Chilly Wallets

Chilly wallets are the kind of a Bitcoin pockets that shops your personal keys offline. They normally come within the type of a small USB drive or card, and typically have little screens. These wallets are safer as a result of they’re much less prone to hacking.

Professionals:

- Offers the very best degree of safety on your Bitcoins.

- Ultimate for storing giant quantities of Bitcoin.

- Proof against on-line hacking makes an attempt.

Cons:

- Much less handy for normal transactions.

- Should you lose the machine or overlook the password, recovering your Bitcoins will be troublesome and even unattainable.

Finest for: Lengthy-term holders, large-scale buyers, and people mining Bitcoins who want safe storage for big quantities.

Examples: Trezor and Ledger ({hardware} wallets), paper wallets (a bodily copy or printout of your private and non-private keys).

Easy methods to Purchase Bitcoin

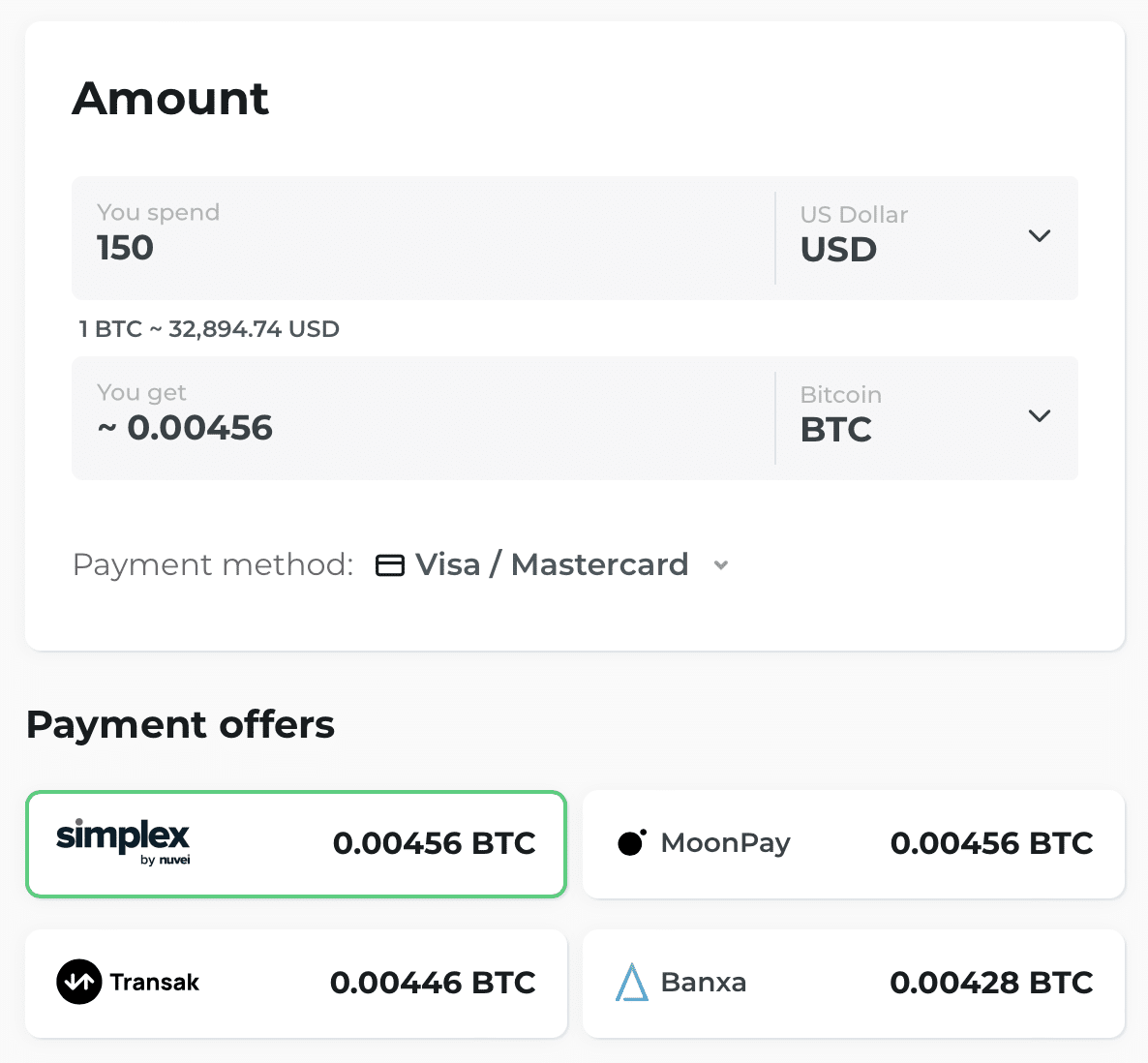

Shopping for Bitcoin entails transacting on cryptocurrency exchanges, on-line platforms the place people can alternate conventional fiat foreign money like US {dollars} or Euros for Bitcoin or different digital currencies. Most main Bitcoin exchanges additionally present a platform for buying and selling Bitcoin for different cryptocurrencies.

The method of shopping for Bitcoin usually entails the next steps: create an account on a cryptocurrency alternate, bear a verification course of, deposit fiat foreign money into the account, after which use these funds to purchase Bitcoin. Bitcoin transactions are then recorded on the blockchain ledger, and Bitcoin miners validate transactions and add them to an current chain of blocks.

As Bitcoin is the preferred cryptocurrency, there are additionally many different methods to get it. For instance, you should utilize a Bitcoin ATM, or purchase BTC on a peer-to-peer platform instantly from different customers. Moreover, nowadays, many crypto wallets supply built-in widgets that allow Bitcoin purchases.

Ought to You Purchase Bitcoin?

Deciding whether or not to purchase Bitcoin is a private resolution and relies upon largely in your monetary state of affairs, threat tolerance, and understanding of Bitcoin and blockchain expertise. It’s important to contemplate the next:

- Bitcoin’s value is thought for its volatility. Whereas important will increase in worth can lead to substantial good points for buyers, the worth also can drop shortly. Subsequently, potential buyers must be ready for this volatility and keep away from investing cash they can not afford to lose.

- Bitcoin’s decentralized nature additionally signifies that there’s no central authority guaranteeing its worth. In contrast to conventional fiat currencies issued by central banks, Bitcoin’s worth is solely decided by provide and demand dynamics out there.

- Given its relative novelty and complicated nature, it’s important for potential buyers to totally analysis and contemplate their resolution earlier than shopping for Bitcoin. Many assets can be found on-line, together with programs, boards, and articles that may assist people study extra about this digital foreign money.

Regardless of the dangers, many consider in Bitcoin’s potential to disrupt conventional monetary techniques and examine it as the way forward for cash. For these people, shopping for and holding Bitcoin isn’t just an funding however a perception in a technological revolution. Whether or not you determine to purchase Bitcoin or not, there’s little question that it has sparked a major dialog about the way forward for cash and finance.

FAQ

Is Bitcoin an precise coin?

No, Bitcoin doesn’t have a bodily kind. It’s a totally digital foreign money.

What blockchain does Bitcoin use?

Bitcoin makes use of its personal blockchain, referred to as the Bitcoin blockchain.

What are Bitcoins manufactured from?

Effectively, technically, Bitcoins are manufactured from… nothing. In any case, they solely exist in a digital kind.

How lengthy do Bitcoin transactions take?

Transactions on the Bitcoin community sometimes take wherever from 10 to twenty minutes.

Disclaimer: Please word that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)