There are literally thousands of totally different cryptocurrencies in the marketplace, however not lots of them present customers with actual utility — or discover their footing and rise to the highest regardless of direct competitors with different prime crypto cash and tokens. Avalanche, nonetheless, is considered one of such crypto property. However what’s AVAX, and the way does it work? Let’s check out considered one of Ethereum’s most profitable opponents.

What Is AVAX Crypto?

AVAX is the native token of the Avalanche platform, a blockchain community that goals to supply excessive throughput, low latency, and unparalleled scalability. In contrast to lots of its predecessors, Avalanche distinguishes itself with a singular structure designed to unravel among the blockchain trilemma’s most important challenges: safety, scalability, and decentralization.

Avalanche positions itself as a direct competitor to Ethereum, searching for to deal with among the scalability and transaction pace points which have plagued the latter. AVAX serves a number of functions throughout the Avalanche ecosystem. It’s used to pay transaction charges, safe the community via staking, and act as a primary unit of account throughout a number of blockchains throughout the Avalanche community.

One of many key options of Avalanche is its consensus mechanism, which is a novel strategy combining the advantages of each classical consensus and Nakamoto consensus mechanisms. This facilitates fast transaction processing (reportedly hundreds per second) with out sacrificing community safety. Furthermore, the Avalanche community helps the creation of Subnets, basically permitting for the creation of customized, application-specific blockchains that may function beneath their very own guidelines whereas nonetheless benefiting from the safety and interoperability of the primary Avalanche community.

A Subnet is a sovereign community that has its personal algorithm guiding token economics and membership. This set of nodes/validators is accountable for reaching a consensus for transactions on one or a number of blockchains.

Who Created Avalanche?

Avalanche was created by a crew of researchers, pc scientists, and specialists in numerous fields, led by Emin Gün Sirer. Sirer is a well known determine within the pc science and cryptocurrency communities, with a wealthy background in peer-to-peer techniques, distributed computing, and blockchain expertise. He’s a professor at Cornell College, the place his analysis has centered extensively on the scalability and safety facets of blockchain applied sciences.

The undertaking originated from a whitepaper printed in 2018, titled “Snowflake to Avalanche: A Novel Metastable Consensus Protocol Household for Cryptocurrencies.” The paper launched a brand new household of consensus protocols that promised vital enhancements over current blockchain techniques. Following the publication, Sirer co-founded Ava Labs with Kevin Sekniqi and Maofan “Ted” Yin, Ph.D. candidates from Cornell College, to develop and implement the concepts introduced within the whitepaper into what would turn into the Avalanche platform.

How Does Avalanche Work?

Avalanche (AVAX) operates on an modern platform designed to deal with the longstanding challenges confronted by blockchain expertise: scalability, safety, and decentralization. At its core, Avalanche introduces a novel strategy to consensus that permits the community to attain exceptional throughput and near-instant finality, setting it other than conventional blockchains.

Avalanche’s distinctive consensus mechanism blends classical consensus and Nakamoto consensus fashions. In contrast to the proof-of-work (PoW) mannequin utilized by Bitcoin, which depends on a single chain of blocks, Avalanche makes use of a directed acyclic graph (DAG) construction for transactions alongside a number of chains inside its ecosystem. This setup permits for parallel processing, considerably growing the community’s capability and transaction pace.

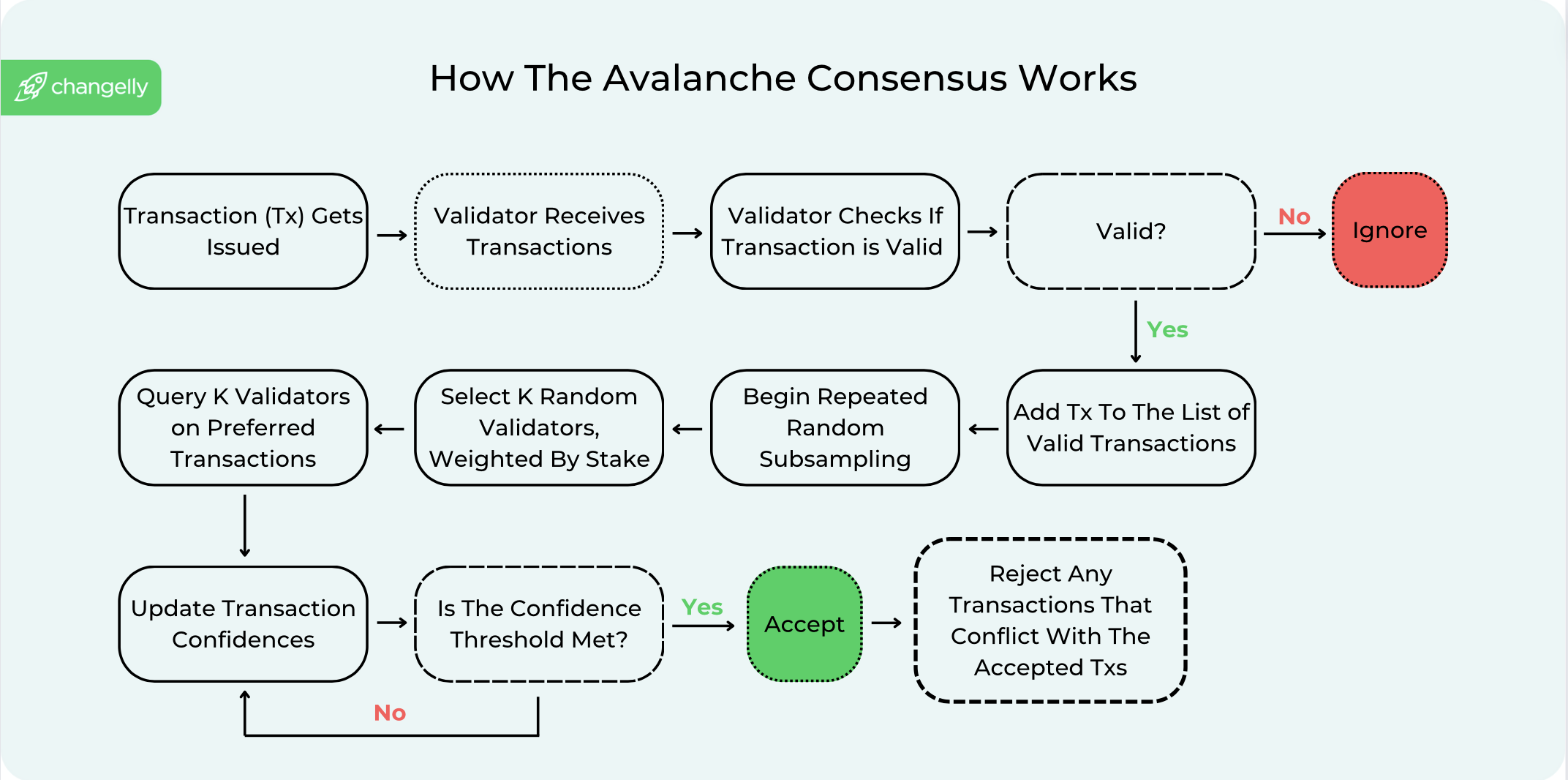

Avalanche consensus operates on the rules of sub-sampled voting. As an alternative of requiring all the community to validate a transaction, it randomly selects a subset of validators to achieve a call shortly. This course of repeats throughout a number of rounds, with every spherical attaining the next confidence degree within the transaction’s validity till it turns into virtually irreversible. This methodology permits Avalanche to course of hundreds of transactions per second (TPS), with transaction finality achieved in beneath two seconds, a major enchancment over networks like Bitcoin and Ethereum.

Community Construction

The Avalanche community consists of three particular person blockchains, every serving a definite goal:

- X-Chain (Alternate Chain): This chain is accountable for creating and buying and selling AVAX tokens and different digital property. It makes use of the Avalanche consensus mechanism.

- C-Chain (Contract Chain): The C-Chain allows the creation of good contracts and decentralized purposes (dApps). It’s appropriate with the Ethereum Digital Machine (EVM), making it simple for builders emigrate their initiatives from Ethereum to Avalanche.

- P-Chain (Platform Chain): This chain coordinates validators, tracks energetic Subnets, and permits for the creation of latest customized Subnets. It employs the Snowman consensus protocol, a variant of Avalanche consensus optimized for good contracts and easy transaction sequences.

The Position of AVAX

AVAX is a local cryptocurrency of the Avalanche community; it performs a number of crucial roles inside its ecosystem. Firstly, it’s used to pay transaction charges on the community, incentivizing validators to course of transactions. Secondly, AVAX is used for staking, the place validators lock up a certain quantity of tokens as collateral to take part within the consensus course of, thus securing the community. The staking mechanism additionally ensures a level of decentralization, as anybody with sufficient AVAX can turn into a validator. Thirdly, it’s a requirement to take part in Avalanche community governance: solely AVAX homeowners can vote for modifications within the ecosystem. Final however not least, considered one of its different main use circumstances is offering a primary unit of account between totally different Subnets on Avalanche.

The token has a most provide of 720 million, with mechanisms in place to regulate inflation and encourage shortage, influencing its worth proposition.

Avalanche vs. Ethereum

Avalanche and Ethereum are each distinguished names within the blockchain trade, every serving as a foundational blockchain platform with distinct traits but sharing some basic similarities. Ethereum, the primary blockchain ecosystem to assist decentralized purposes (dApps) and good contracts, has established itself as the first community for builders searching for a wise contracts platform. Its capability to assist ERC-20 tokens has made it a most popular medium of change and funding throughout the crypto group.

Avalanche is Ethereum’s competitor, providing a singular consensus mechanism that emphasizes scalability and near-instant transaction finality. This characteristic notably appeals to customers and builders annoyed by Ethereum’s scalability points and longer transaction occasions.

Ethereum’s long-standing place available in the market has given it an enormous catalog of dApps and ERC-20 tokens, making it a cornerstone of the blockchain trade. Avalanche, whereas newer, distinguishes itself by providing decrease transaction charges and sooner processing occasions, addressing among the scalability considerations related to Ethereum. Each networks have taken vital steps in the direction of interoperability and sustainability, aiming to scale back their environmental influence and enhance person expertise.

FAQ

How can I purchase AVAX?

You should purchase AVAX with fiat on most main crypto exchanges. If you’re searching for a dependable cryptocurrency change, you’ll be able to try our platform.

Is the Avalanche blockchain protected?

The Avalanche blockchain is thought to be protected, using superior cryptography and consensus mechanisms to guard towards assaults. Its compatibility with {hardware} wallets gives Avalanche customers an added layer of safety for his or her property, guaranteeing that even within the unstable cryptocurrency market, funds stay safe inside a person’s chosen crypto pockets.

What makes Avalanche distinctive?

What makes Avalanche distinctive is its revolutionary consensus protocol, designed for fast transaction processing and scalability with out compromising decentralization. This distinctive characteristic attracts builders searching for a strong blockchain undertaking basis, enabling a variety of purposes from decentralized finance to digital collectibles, all whereas sustaining near-instant transaction finality.

What’s AVAX used for?

AVAX is used primarily because the native token throughout the Avalanche ecosystem, facilitating numerous transactions and operations. It serves as a medium of change for paying transaction charges, a staking token for securing the community, and a primary unit of account for the a number of subnets, making it a flexible asset within the crypto pockets of Avalanche customers and members within the broader cryptocurrency market.

Is AVAX an excellent funding?

Avalanche is among the greatest tokens on the cryptocurrency market. On the time of writing, its market cap was throughout the prime 10 on CoinMarketCap. Moreover, it has a strong technical basis, a good crew behind it, and quite a lot of use circumstances. General, AVAX generally is a good funding — however it’s best to do your individual analysis earlier than shopping for Avalanche and see if it matches your portfolio.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)