intermediate

There are a number of various kinds of orders in buying and selling, however the primary two each investor ought to know are the market order and the stop-loss order.

The previous permits merchants to purchase or promote shares or crypto on the present market value. Cease-loss orders are somewhat bit extra difficult than that; due to them, skilled merchants can comply with a extra refined buying and selling technique.

Get the most recent crypto necessities first

Subscribe to our newsletters to remain conscious of crypto traits

What Is a Cease-Loss Order?

A stop-loss order permits customers to purchase or promote shares at a cease value. Basically, it lets merchants set a sure value at which an asset will probably be purchased or offered as soon as this stage turns into the present market value. It may be thought to be a delayed market order that can come into impact solely as soon as the set off value is reached.

Please notice {that a} stop-loss order may be very unlikely to be executed on the cease value. Your order will probably be carried out on the subsequent accessible market value, which might be decrease (or larger) than the cease value you’ve entered.

Cease-Loss Order Instance

Think about you need to purchase one Bitcoin; nonetheless, its value is at present risky (nicely, when is it not risky), so you employ a stop-loss order to reduce your danger of paying greater than you had been planning to. Bitcoin’s present market value is $60K, however you assume that’s too excessive and anticipate it to say no someday later that day. So, you set a stop-loss order at $59.9K.

BTC does certainly come right down to that specified value stage later within the day, and at that time, your order turns into a market order. It instantly will get executed on the market value of $59.85K.

Nonetheless, it may additionally occur that the market value instantly rises after reaching the desired cease value. In that case, it’s attainable that your order will probably be executed at $59.95K, and even probably $60K. Nonetheless, that occurs fairly not often, and the deviation in value is normally fairly minimal.

Understanding Cease-Loss Orders

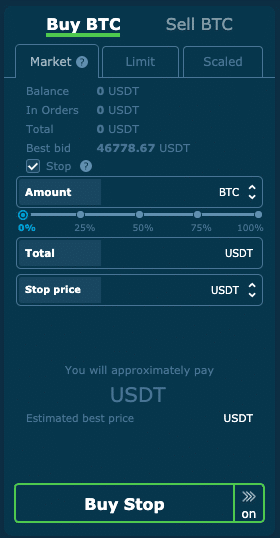

Right here’s an instance of how the buying and selling terminal appears while you attempt to arrange a stop-loss order.

Right here, the cease value is the set off value at which the alternate will buy your chosen quantity of BTC on the prevailing market value.

As you’ll be able to see, a stop-loss order is actually a market order with an extra step. Nonetheless, you can even place a restrict order with a cease value.

Cease-Restrict Order

In case you Google “stop-loss order,” then likelihood is, you’ll come throughout the time period “stop-limit order.” Regardless of seemingly being very comparable, these two have one key distinction.

Along with a cease value, a stop-limit order additionally has a restrict value. Subsequently, as soon as crypto or inventory value reaches the set off, your order gained’t be executed on the market value — as an alternative, a standard restrict order will probably be positioned.

Though it could appear safer, it comes with an enormous downside: stop-limit orders don’t all the time get executed. If the asset’s value strikes too sharply, it might probably go beneath/above the desired restrict value, primarily blocking the order from going by means of. It may be both a profit or an obstacle relying in your buying and selling technique and the market you’re buying and selling in.

Benefits of a Cease-Loss Order

Cease-loss orders have two major benefits:

- They are going to be executed instantly and are extremely unlikely to not undergo, permitting you to reap earnings whereas minimizing losses with out having to maintain a detailed eye in the marketplace. Cease-loss orders will solely fail to undergo at a value just like your cease value if they’re triggered proper earlier than the market closes or there’s too little liquidity.

- They gained’t be executed till the asset reaches the cease value, guaranteeing that your commerce will undergo in crucial market situations.

Cease-loss orders act as a type of insurance coverage for merchants, ensuring their losses by no means go above a specified level.

Functions of Cease-Loss Orders

The principle goal of stop-loss orders is, nicely, to cease you from incurring any losses. They’re particularly helpful in a fast-moving market the place it may be fairly troublesome to catch the fitting second to execute your trades.

Cease-loss orders are additionally typically used to determine new positions at value ranges that the dealer believes the asset goes to be at sooner or later. For instance, in case you assume that Bitcoin may attain $50K by the top of the week, you’ll be able to set a stop-loss order at that particular value stage. Then, if it certainly does rise, you’ll get a revenue, and if it doesn’t, you’ll simply cancel your order with out dropping something.

Disclaimer: Please notice that the contents of this text will not be monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native rules earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)