intermediate

Bear traps in buying and selling are simply as disagreeable to be caught in as those in actual life — though they’re quite a bit much less more likely to price you one in every of your limbs. They will, nonetheless, bleed your funds dry.

What Is a Bear Entice?

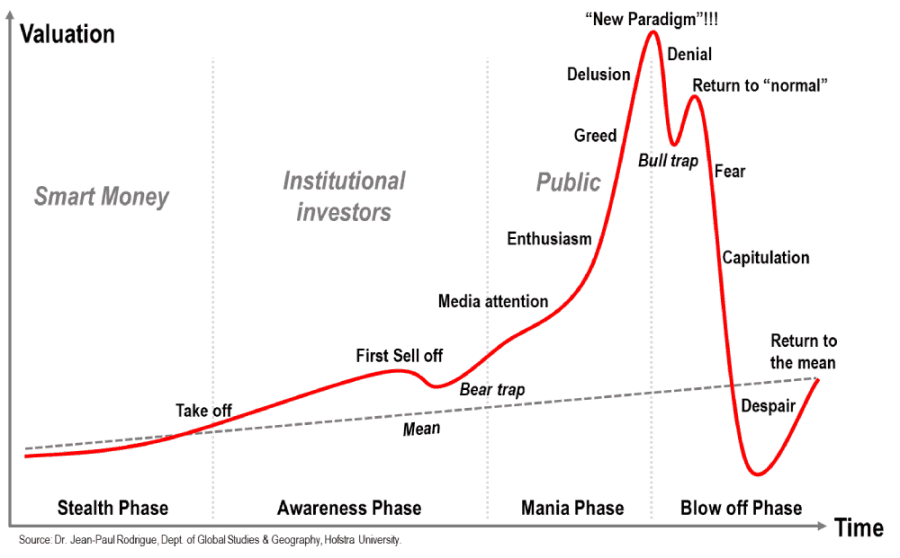

A bear entice in buying and selling is a false technical sample that may be noticed when the worth of an asset on the crypto or inventory market incorrectly reveals a reversal of an upward pattern to a downward pattern. Bear traps are much like quick squeezes, however the value rallies they trigger are sometimes smaller and take longer to start.

To place it merely, a bear entice is a faux value drop, typically orchestrated by a couple of or extra merchants to trick different market individuals, primarily novice traders, into promoting a specific asset. It’s referred to as this manner as a result of it traps bears — merchants who wish to profit from a value drop/downward pattern.

How Does Bear Entice Buying and selling Work?

Bear traps falsely sign a bearish pattern, tricking some merchants into considering that there is perhaps a protracted value decline coming. Whereas they might happen naturally, most of the time, bear traps occur available on the market attributable to coordinated actions of institutional traders or different large gamers, like crypto whales.

An orchestrated bear entice happens when there are a whole lot of institutional and/or skilled merchants available on the market who need the worth of an asset to rise. To do this, they promote a considerable amount of the stated asset, aiming to extend the shopping for stress and reduce the potential promoting stress. This pushes the costs to say no, which might scare novice merchants off. So, they might find yourself promoting their shares, fiat, or crypto to reduce losses out of worry of additional value drops.

Nonetheless, because the shopping for stress will increase, there can be a whole lot of merchants seeking to purchase in, which is able to create a sudden value reversal. Moreover, the identical novice merchants will now be compelled to purchase again the inventory they’ve simply bought out of FOMO. Because the concerned asset begins to see extra demand, the costs will rise, permitting skilled merchants to reap earnings.

Some seasoned merchants can get caught in bear traps, too, though in a distinct method. This sort of entice is especially harmful and devastating for unaware, inattentive, or just non-institutional short-sellers, who might even see the downward pattern as a chance to open quick positions solely to obtain a margin name when the costs go up. Sometimes, solely the short-sellers who know the bear entice is about to happen or uncover it simply because it begins and commerce accordingly can revenue from it.

Crypto markets are notoriously straightforward to control. Many merchants concerned in cryptocurrency buying and selling are novices — in spite of everything, crypto has a a lot decrease entry barrier and better potential earnings than shares or Foreign exchange. Moreover, the shortage of regulation within the crypto business additionally contributes to bear (and bull) traps being fairly straightforward to execute as whales can talk and set up bear traps with out worry of repercussions.

Methods to Establish a Bear Entice

The one dependable technique to establish a bear entice is to make use of technical evaluation. Skilled merchants could make use of the RSI indicator and Fibonacci retracements as a way to test whether or not the worth drop is questionable and is more likely to proceed or not.

Nonetheless, technical evaluation is just not for everybody, and whereas it’s one of the best ways of figuring out bear traps, it’s not the one one. For instance, although value volumes are a technical indicator, they’re straightforward to know and displayed clearly in just about all buying and selling terminals. If the buying and selling volumes for the present value drop are decrease than regular when the worth is in decline, then there might be a bear entice.

Testing public opinion and information is one other great way of figuring out a bear entice. If nothing has occurred that might trigger the worth of an asset to say no (dangerous information, damaging opinions from fashionable influencers, and so on.), and the group appears to have a somewhat optimistic angle, then it might be a bear entice.

Bear Entice Instance

A typical bear entice works like this: think about we’re in the course of a bull market, and also you’re one of many inexperienced merchants seeking to money in in your funding. The crypto/inventory costs that you simply’re following solely carry on rising, so that you haven’t bought any of your belongings but within the hope of getting an even bigger revenue. Then, all of the sudden, there’s a pattern reversal, and costs begin happening. What would you do in a state of affairs like this?

Nicely, because it occurs, many merchants rush to promote their belongings in worry of a complete crash. Nonetheless, as the costs drop, different merchants, particularly skilled ones who perceive that the market is okay and the asset nonetheless has room to develop, determine to purchase the asset, which drives its worth up. The “weak palms” that bought their belongings earlier determine to purchase again in. This typically leads them to be caught in shedding trades.

Bear Entice vs. Bull Entice

Similar to a bear entice, a bull entice can be a false buying and selling sign, however in reverse: it tips folks into considering {that a} bullish pattern is about to return, inflicting them to open lengthy positions and purchase belongings. Nonetheless, as it’s a entice, after the quick spike, the costs proceed declining, leaving many market individuals caught in a foul commerce.

Methods to Keep away from Bear Traps

As we’ve got already talked about, bear traps are straightforward to execute within the crypto market, so it’s essential to discover ways to keep away from getting caught in them.

- Keep away from opening quick positions, particularly in case you are not that skilled.

- If you happen to do open a brief place, be sure to perceive the danger and use a stop-loss order if potential.

- Don’t commerce shitcoins and different cryptocurrencies that don’t have that many energetic merchants: these belongings are illiquid and, thus, further susceptible to bear traps.

- Do as a lot analysis as potential and observe buying and selling with smaller sums. As you change into extra aware of the market and acquire expertise as a dealer, you’re going to get higher at figuring out bear traps. Good luck!

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)