- ETH was in a bullish market construction however in a value correction section

- The worth decline might settle on the 78.6% ($1260.23) Fibonacci retracement stage

Ethereum (ETH) was buying and selling at $1283.82 at press time. This stage was a drop after ETH misplaced the psychological $1300 mark it reached after a latest rally final week.

On the time of publication, ETH was nonetheless therapeutic from the latest rally.

ETH value pullback targets 78.6% Fib stage: can it maintain?

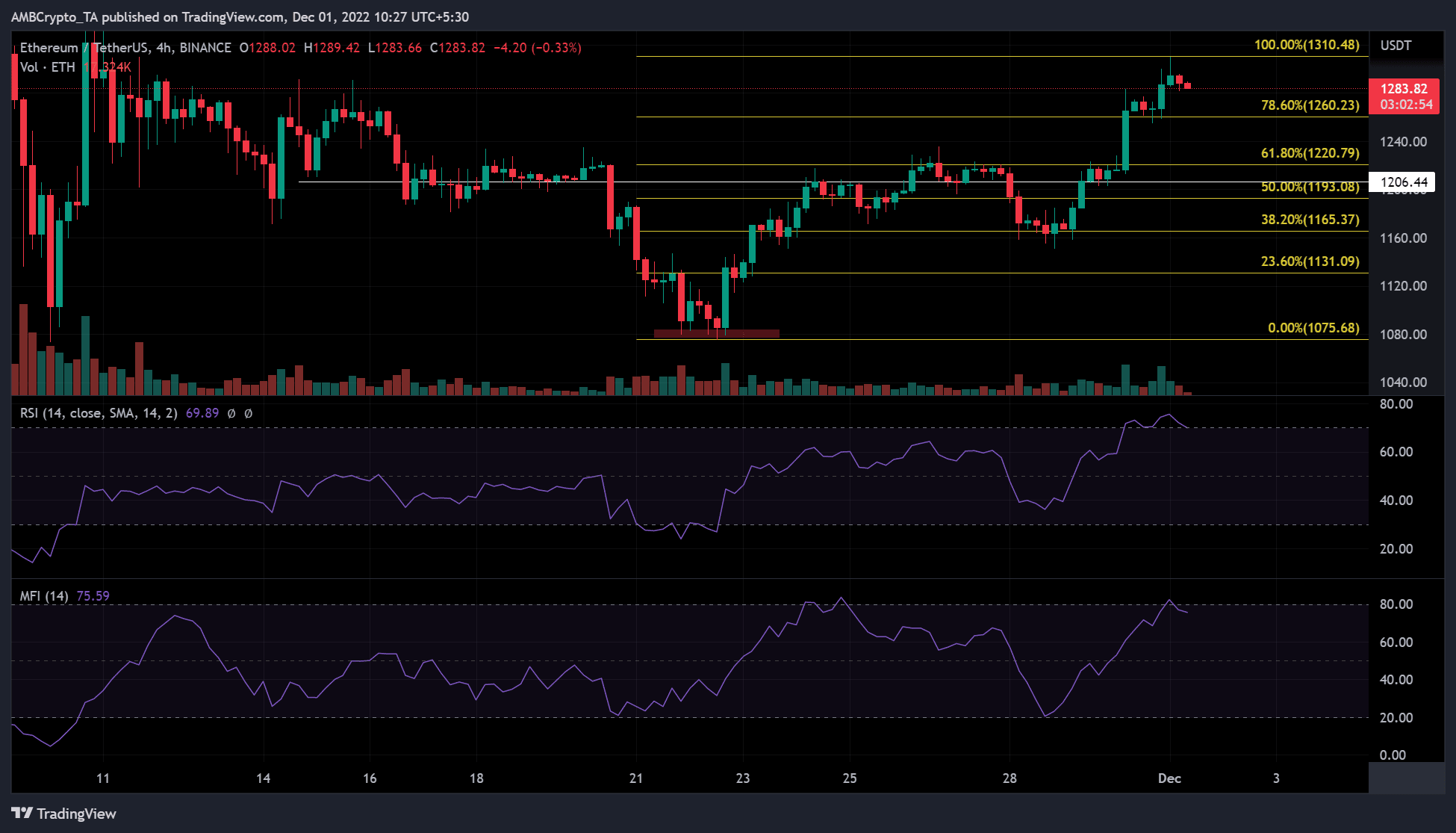

Supply: TradingView, ETH/USDT

ETH reached $1310 after BTC reclaimed $17K on Thursday (1 December). The 4-hour chart confirmed ETH had risen since Tuesday (29 November) with negligible value corrections. There was one value correction at press time, nevertheless it was not negligible.

Technical indicators on the short-term time-frame charts urged an prolonged value correction the place ETH might settle on the 78.6% Fib stage ($1260.23).

The Relative Energy Index (RSI), which is used to gauge shopping for and promoting stress, was tilted towards shopping for stress. Particularly, the RSI retreated from the overbought territory and sloped downward. Thus, shopping for stress was reducing, and sellers could acquire a bonus within the close to future.

The Cash Move Index (MFI) additionally pulled again from overbought territory. This strengthened the suggestion that the buildup section is coming to an finish, and a downward transfer (promoting) is probably going. Thus, promoting stress might drive ETH to maneuver decrease and discover new assist at $1260.23.

If BTC loses the psychological $17K stage, the value correction of ETH might prolong to $1220.8 or $1193.08.

Nonetheless, a detailed above the present resistance goal at $1310.5 would negate this bearish bias.

Brief-term ETH reserving income however…

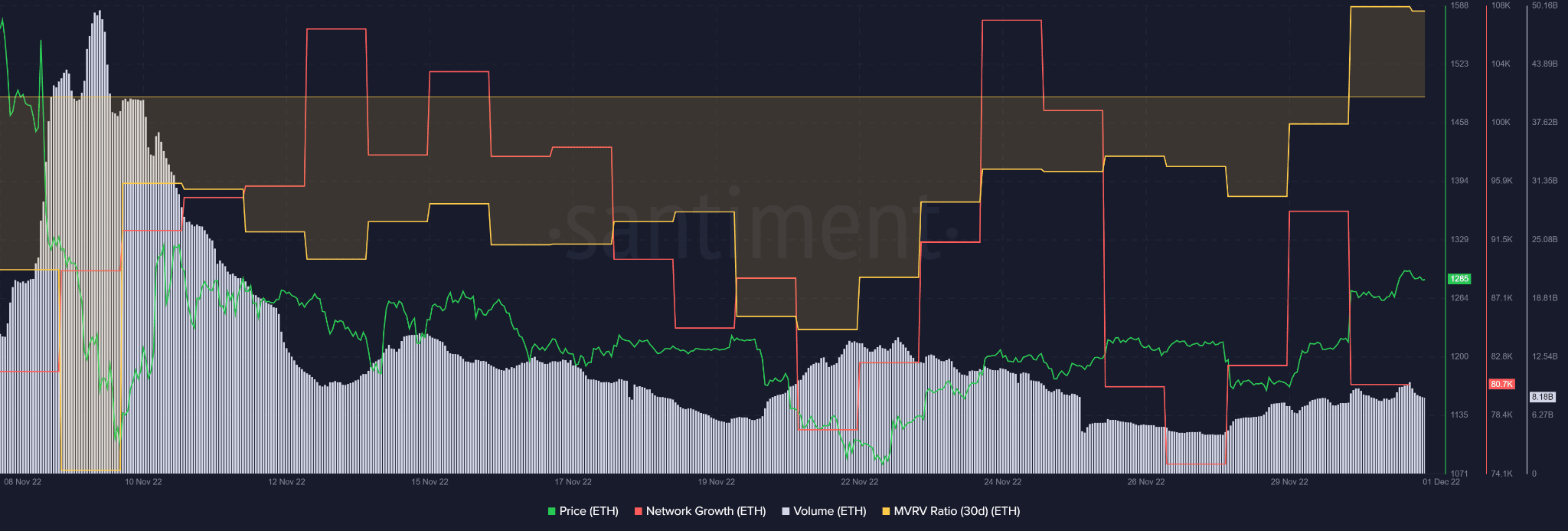

Supply: Santiment

Santiment knowledge confirmed that the 30-day MVRV has climbed to the constructive facet, suggesting that short-term ETH holders have booked income following the latest value rally. Moreover, the value rally could have been fueled by a gradual improve within the development of the Ethereum community.

Sadly, community development, buying and selling quantity, and 30-day MVRV have been all down barely at press time. Given the constructive correlation between ETH’s value and these metrics, an extra value decline can’t be dominated out.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![What Ethereum [ETH] holders should expect in the near-term](https://cryptonoiz.com/wp-content/uploads/2022/12/zoltan-tasi-uNXmhzcQjxg-unsplash-4-1000x600-750x375.jpg)