A quant has prompt that Bitcoin will once more develop into the driving pressure within the crypto market as soon as the Ethereum merge hype dies down.

Bitcoin Share Of Crypto Buying and selling Quantity Already Appears To Be Overtaking Ethereum’s

As defined by an analyst in a CryptoQuant post, there are some indicators that time to BTC surpassing ETH as soon as extra to be the dominant energy available in the market.

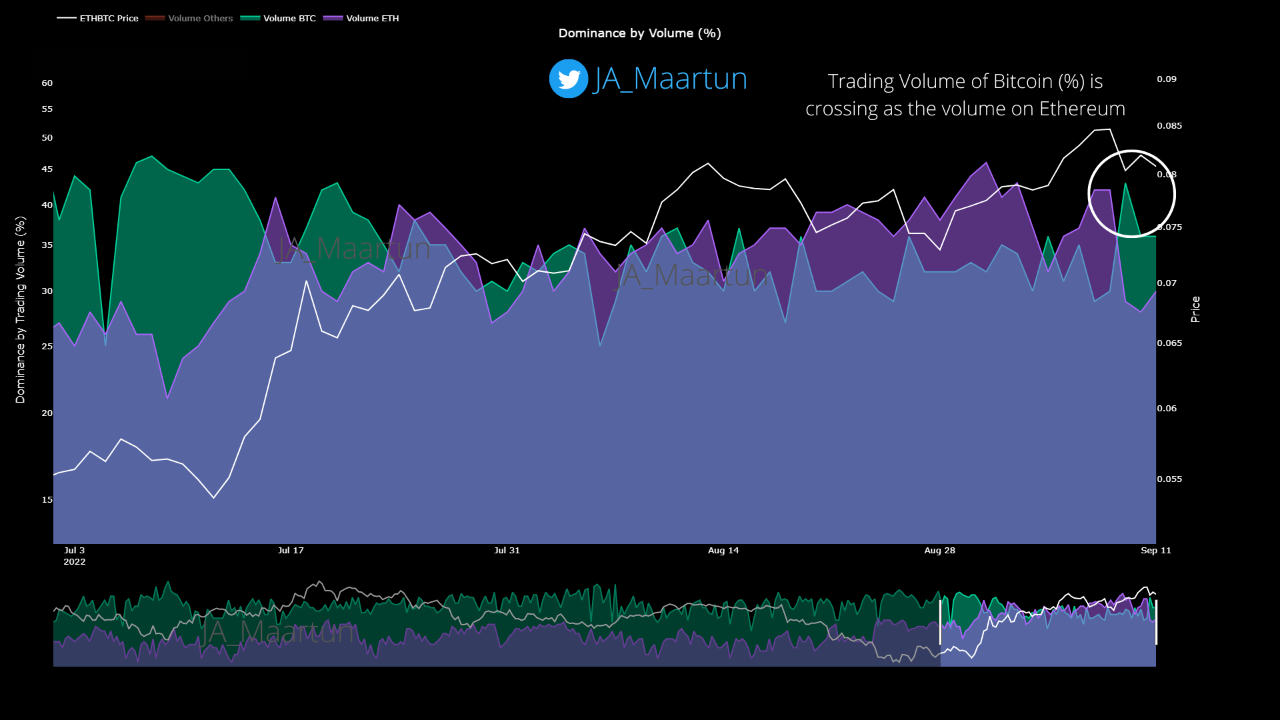

The related indicator right here is the “dominance by quantity,” which measures what a part of the entire crypto buying and selling quantity is contributed by every coin within the sector.

The “buying and selling quantity” is a metric that measures the entire quantity of crypto being concerned in transactions in spot markets.

Now, here’s a chart that exhibits the pattern within the dominance by quantity for each Bitcoin and Ethereum:

The worth of the metric for BTC appears to have crossed over that of ETH in current days | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin share share of the buying and selling quantity was considerably increased than Ethereum’s throughout the begin of July.

Nonetheless, as the center of that month approached, ETH slowly began surging up and passing above the BTC volumes.

Associated Studying: Bitcoin Taker Purchase Promote Ratio Hits Highest Worth in 636 days

In August, the ETH dominance by quantity remained increased than BTC’s for your complete month, save for a pair temporary spikes for the latter.

This continued into September, till just some days in the past. The explanation behind Ethereum main the bear marketplace for virtually two months was the hype created by the upcoming PoS merge.

The quant believes that when the merge is completed in roughly two days, this narrative that stored the crypto’s volumes up can be gone.

Associated Studying: Chiliz and Massive Eyes Coin: Two Ethereum-based Cryptos that May Overthrow the Binance Crypto Undertaking

Round three days in the past, BTC’s share of the buying and selling quantity crossed over that of Ethereum’s and has since stayed up. The analyst factors out that this is without doubt one of the early indicators for a shift within the investor conduct across the merge launch.

BTC overtaking the volumes on exchanges now means quickly after the merge, Bitcoin can be again to being the primary driving pressure within the crypto market.

BTC Value

On the time of writing, Bitcoin’s value floats round $22.2k, up 13% within the final seven days. Over the previous month, the crypto has misplaced 7% in worth.

The under chart exhibits the pattern within the value of the coin over the past 5 days.

Seems like the worth of the crypto has been observing some upwards momentum throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Peio Bty on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)