The minting of non-fungible tokens (NFTs) is turning into more and more aggressive, with extra new initiatives created and the fee to mint new NFTs being reduce. Nevertheless, quite a lot of NFTs minted nonetheless find yourself as a part of a “useless assortment” with no buying and selling exercise — although, notably, the proportion of such NFTs is reducing, a report from blockchain analytics platform Nansen has mentioned.

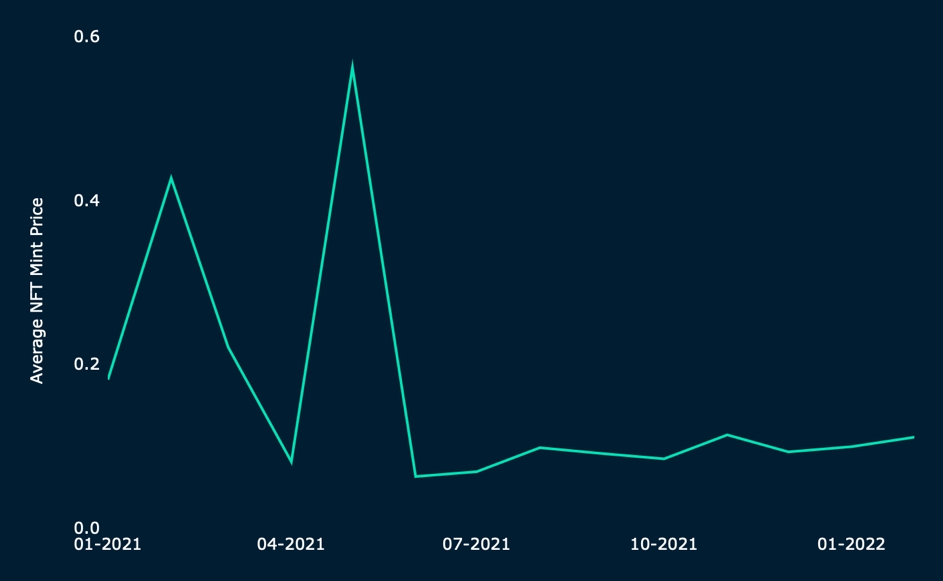

The typical price to mint an NFT peaked in Might of 2021 at ETH 0.56 (USD 1,741), earlier than it dropped to a low of ETH 0.06 (USD 186) in June 2021. Since July 2021, the typical price to mint NFTs has been between ETH 0.07 (USD 217) and ETH 0.1 (USD 311), based on Nansen’s report.

A potential motive for this, the agency mentioned, is that NFT minting is turning into extra aggressive as extra new initiatives are delivered to the market.

Between January 2021 and February 2022, the variety of minted collections elevated by a whopping 4,800%, from 39,802 to 1.97m, the report mentioned.

The outcome seems to have been a pointy drop in minting prices within the first half of 2021, with prices after that stabilizing at a a lot decrease degree.

In the meantime, Nansen additionally mentioned in its report that as prices to mint new NFTs have come down, the variety of initiatives that find yourself “useless” has risen.

“When analyzing the profitability of minted NFTs, it reveals that, on common, one in three NFTs minted go on to grow to be a useless assortment with little or no commerce exercise,” the agency mentioned.

Nonetheless, it added that it’s not all unhealthy and that the proportion of latest NFTs which are in revenue relative to their minting price is growing.

Consequently, the proportion of latest NFTs that find yourself as useless collections is regularly reducing, Nansen mentioned.

In conclusion, Nansen mentioned that collaborating in NFT mints is one thing buyers ought to solely do after “cautious consideration,” whereas noting that this additionally consists of having an understanding of the macro outlook for the NFT market.

Moreover, it’s essential to conduct due diligence on the venture an investor is contemplating to take part in, and this consists of researching “the neighborhood, their roadmaps and the founding workforce’s historical past,” the report warned.

____

Study extra:

– 6 NFT Use Instances That Will (Most likely) Stay After the Hype Dies Down

– NFT Market Continues to Outperform Crypto Regardless of Correction – Nansen

– NFTs Coming to Instagram in ‘A number of Months’ as Metaverse is ‘Subsequent Chapter of the Web’ – Zuckerberg

– NFT Rental Has Main Progress Potential as ‘Airbnb of the Metaverse’ – Analysts

– Ethereum Scaling Platform Loopring Soars on New GameStop NFT Partnership

– ApeCoin Soars After Launch, BAYC NFT Costs Pump and Dump

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)