On-chain information reveals miners have despatched a considerable amount of Bitcoin to identify exchanges just lately, one thing that may be bearish for the worth of the crypto.

Bitcoin Miners To Spot Exchanges Movement Has Surged Up Over The Previous Day

As identified by an analyst in a CryptoQuant post, the most recent spike within the miner trade deposits is bigger than another current peaks.

The related indicator right here is the “miners to identify exchanges move imply,” which measures the full quantity of Bitcoin being transferred by miners to identify exchanges.

When the worth of this metric shoots up, it means miners have simply despatched numerous cash to exchanges. Since these chain validators normally deposit to identify markets for promoting functions, this type of development can show to be bearish for the worth of BTC.

Then again, the worth of the indicator being low suggests there aren’t many transactions taking place from miner wallets to centralized trade wallets. Such a development will be both impartial or bullish for the worth of the coin because it implies there isn’t a lot promoting strain coming from this cohort proper now.

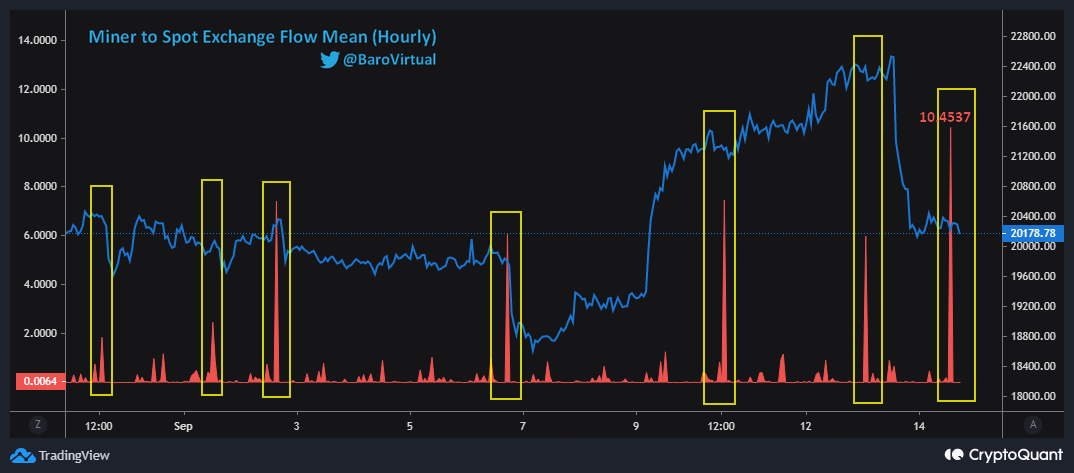

Now, here’s a chart that reveals the development within the Bitcoin miners to identify exchanges move imply over the past couple of weeks:

The hourly worth of the metric appears to have been fairly excessive in current days | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin miners to identify exchanges move imply has noticed an enormous spike throughout the previous day.

The final two weeks noticed a number of trade inflows coming from miners, after every of which the worth typically suffered a short-term decline.

This newest improve within the miner spot deposits is considerably bigger than another seen on this interval, and has come whereas the worth has already plunged down. That is not like the earlier ones, which got here as the worth was round a peak.

If the identical development because the earlier miner trade inflows follows this time as effectively, then these contemporary deposits are additionally more likely to have a bearish impression on Bitcoin.

BTC Value

On the time of writing, Bitcoin’s value floats round $20.1k, up 4% within the final seven days. Over the previous month, the crypto has misplaced 17% in worth.

Beneath is a chart that reveals the development within the value of the coin over the past 5 days.

Appears like the worth of the crypto plummeted down just a few days again and has since moved sideways | Supply: BTCUSD on TradingView

Featured picture from Brent Jones on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)