- Polygon’s income elevated, however TVL continued to fall

- MVRV Ratio and social dominance down

Polygon [MATIC] once more grew to become a sizzling subject in the neighborhood because it ranked third on the checklist of high DeFi initiatives by way of income within the final 24 hours, solely behind Uniswap [UNI] and QuickSwap [QUICK].

High DeFi Tasks by Charges and Income on @0xPolygon Ecosystem Final 24H $UNI @Uniswap$QUICK @QuickswapDEX$MATIC @0xPolygon$AAVE @AaveAave$DODO @BreederDodo$MVX @MetavaultTRADE$SUSHI @SushiSwap$CRV @CurveFinance$WOO @WOOnetwork$FSX @fraxfinance#POLYGON $MATIC pic.twitter.com/45yIlkvTkZ

— Polygon Every day 💜 (@PolygonDaily) November 16, 2022

Regardless of the expansion in income, Polygon’s DeFi area didn’t look fairly optimistic as its whole worth locked (TVL) was declining constantly. DeFiLlama’s data revealed that over the past day, Polygon’s TVL decreased by 1.22%; on the time of writing, the worth was $1.52 billion.

Learn Polygon’s [MATIC] value prediction 2023-24

Regardless of the adverse development within the DeFi ecosystem, a number of optimistic updates did occur that gave buyers hope. For example, Polygon Applied sciences lately bagged funding of $450 million, and with this new capital, the community needs to make a spot for itself within the web3 business.

Not solely this, however Polygon has additionally grow to be one of many high blockchain service suppliers across the globe that has partnered with extra top-tier manufacturers. A couple of notable manufacturers embrace Nike, Starbucks, Coca-Cola, Meta, and Adidas, amongst others.

A number of the largest manufacturers on the earth are adopting Polygon.@0xPolygon has grow to be one of many high blockchain service suppliers across the globe that has partnered with greater than top-tier manufacturers.

— Ethereum Every day (@ETH_Daily) November 16, 2022

Although these developments appeared fairly bold, nothing appeared to mirror on MATIC’s chart, which was painted purple. As per CoinMarketCap, Polygon’s value was down by practically 7% within the final 24 hours, and at press time, it was trading at $0.8886 with a market capitalization of greater than $7.7 billion.

Is a revival attainable?

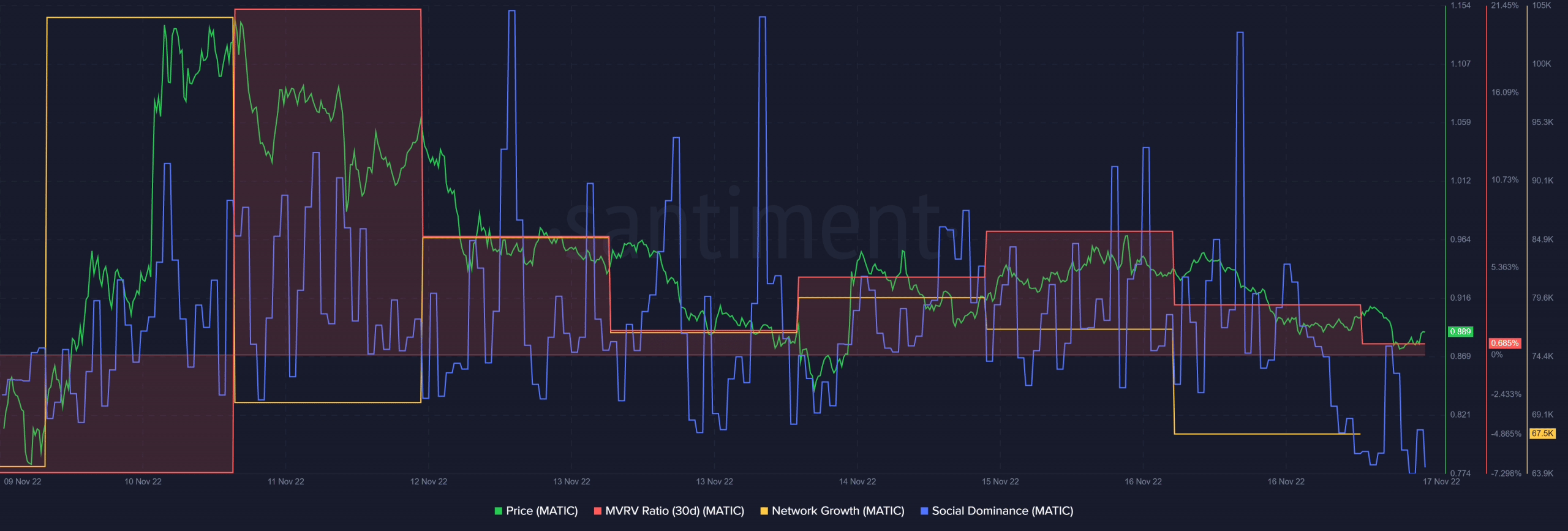

Curiously, MATIC’s metrics weren’t fully supportive of a value hike or a decline. MATIC’s MVRV Ratio registered a downtick, which was a bearish sign.

Furthermore, after a spike, MATIC’s social dominance additionally began to lower. Thus, indicating much less reputation of the token within the crypto group. The community development additionally adopted an identical route and went down in the previous few days.

Supply: Santiment

Nevertheless, CryptoQuant’s data gave some reduction because it revealed that issues would possibly get higher within the coming days. MATIC’s alternate reserve continued to fall, indicating decrease promoting stress. Moreover, the variety of lively addresses and transactions was additionally growing, which by and enormous is a optimistic sign for any community.

The bulls’ benefit would possibly finish quickly

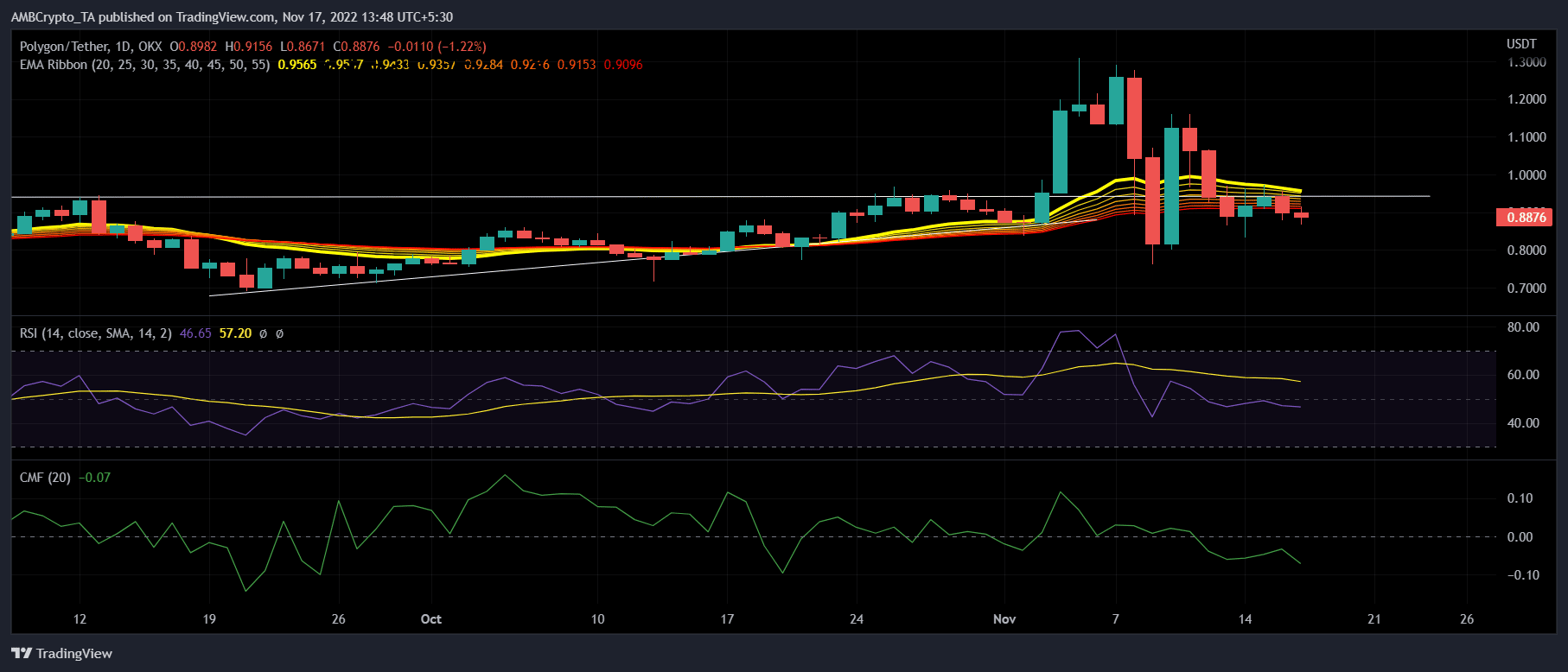

A have a look at MATIC’s each day chart made it clear that although the bulls appeared to have a bonus available in the market, the bears would possibly take over the throne quickly.

In response to the Exponential Shifting Common (EMA) Ribbon, the space between the 20-day EMA and the 55-day EMA was lowering, growing the probabilities of a bearish crossover.

Moreover, the Relative Energy Index (RSI) and Chaikin Cash Circulation (CMF) each registered downticks and have been headed additional beneath the impartial mark, which could be troublesome for MATIC within the coming days.

Supply: TradingView

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-350x250.jpg)