- Lido skilled a drop in TVL in earlier days partly resulting from a fall within the worth of LDO.

- LDO rallied by over 9% in latest days to assist Lido turn into the highest DeFi platform.

Lido just lately disclosed a lower in its Whole Worth Locked (TVL), the potential contributing issue was a decline within the worth of its native token LDO.

Earlier than a modest decline, the staking platform had been the main Decentralized Finance (DeFi) platform. Nonetheless, DefiLlama’s latest information hinted at a shift within the staking protocol’s TVL’s fortune. Now, the query is- What could have induced this most up-to-date improvement?

The ups and downs of Lido’s TVL

There had been a change within the quantity of Whole Worth Locked of Lido Finance, as per statistics collected from DefiLlama.

Within the final 24 hours, the staking platform’s TVL climbed by greater than 3%, and over the previous 30 days, it elevated by about 8%. With a TVL of $6.45 billion as of this writing, it was successfully the highest DeFi platform.

A second have a look at Lido’s TVL revealed that two vital occasions that shook the crypto world had a detrimental impact on the platform. The platform’s TVL was over $18 billion earlier than Terra’s collapse.

Nonetheless, this worth fell massively on account of the collapse. The newest hostile impact was the FTX collapse, which additionally induced the TVL worth to say no from nearly $8 billion to $6.45 billion, at press time.

Supply: DefiLlama

LDO’s value causes TVL rally

The decline within the worth of LIDO’s native token, LDO, was one of many elements Lido recognized for the preliminary decline in TVL.

A each day timeframe evaluation of the value of LDO revealed that the asset had elevated. It rose by roughly 10% over the earlier 72 hours. Moreover, it was evident from the buying and selling interval underneath statement, on the time of this writing, that it was buying and selling at a revenue of greater than 1%.

Supply: TradingView

The quick Shifting Common’s (yellow line) location indicated that the value was not in a powerful development. The placement of the Relative Energy Index (RSI) line indicated that LDO had entered a bullish development as a result of latest spike.

However when the RSI and yellow line have been mixed, it was clear that, whereas bullish, the development might have been stronger. The yellow line additionally functioned as a area of resistance for the token at about $1.2. An additional upward development is feasible if it breaks via this resistance stage.

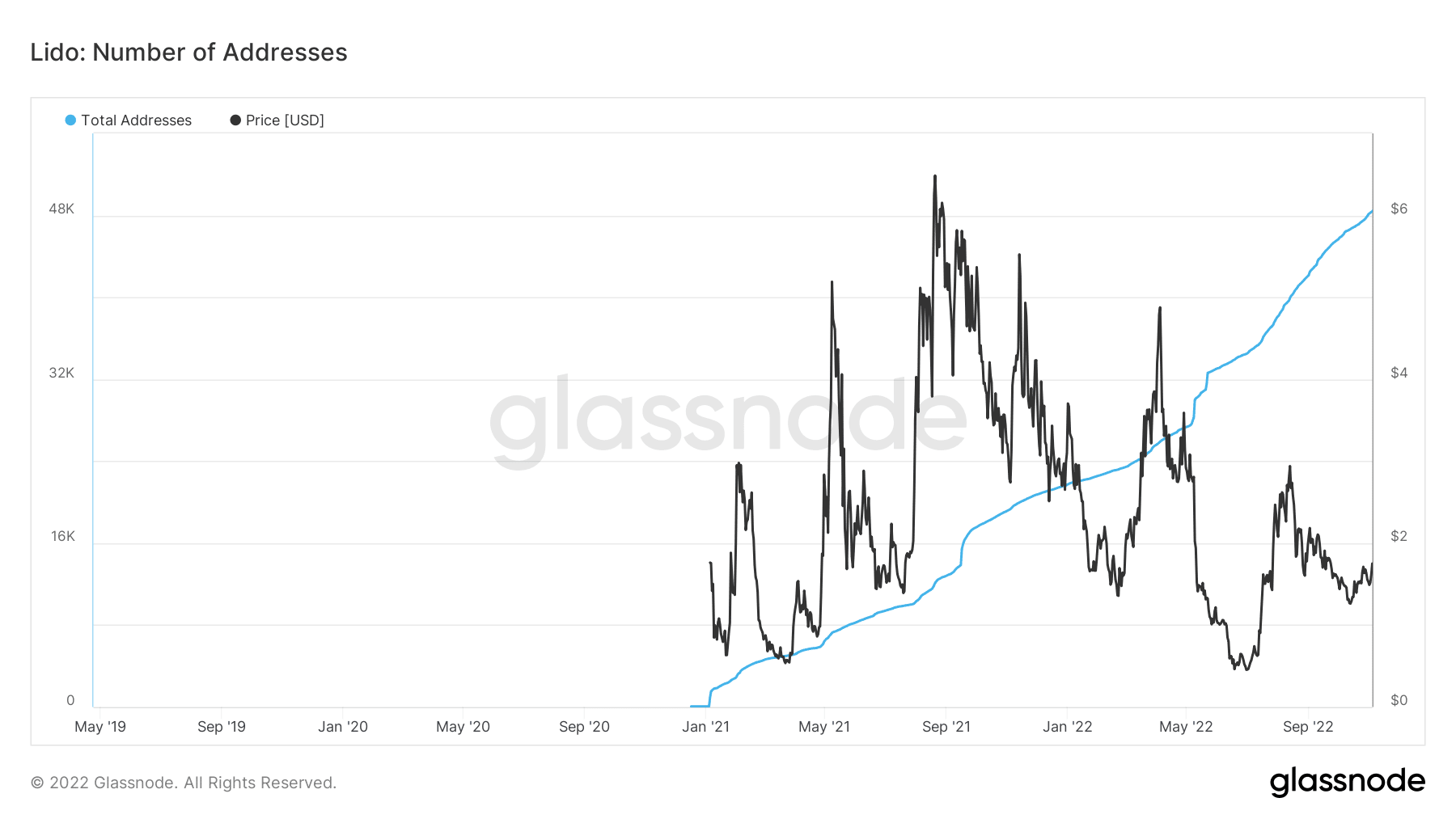

Whole tackle metrics on the rise

The trajectory of Glassnode’s Whole Deal with metric can be utilized to deduce details about how Lido has developed. The general variety of addresses registered on the community was greater than earlier than, in keeping with the full tackle rely. As of the time of writing, greater than 49,000 addresses may very well be seen.

Supply: Glassnode

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-350x250.jpg)