- Ethereum whales lit up curiosity in LDO because the token value elevated

- The on-chain efficiency of Lido confirmed some shortfall. Therefore, there is likely to be a necessity for warning

Lido Finance [LDO] garnered a 7.88% value enhance within the final 24 hours following Ethereum [ETH] whales’ curiosity within the token. Based on WhaleStats, LDO was one of many good contract tokens largely utilized by the highest 5000 buyers on this group inside the similar interval.

This motion implied elevated shopping for exercise and motion for the liquid-staking answer utility token.

JUST IN: $LDO @lidofinance one of many MOST USED good contracts amongst prime 5000 #ETH whales within the final 24hrs🐳

We have additionally obtained $BOBA & $LINK on the listing 👀

Whale leaderboard: https://t.co/kOhHps9vr9#LDO #whalestats #babywhale #BBW pic.twitter.com/yXESQe3a3i

— WhaleStats (monitoring crypto whales) (@WhaleStats) November 29, 2022

Learn Lido DAO’s [LDO] value prediction 2023-2024

Nonetheless, the rise in worth won’t be sufficient to conclude that LDO reacted positively to the event. For brief-term revenue fanatics, that is likely to be sufficient. But, the on-chain situation of LDO revealed contrasting views.

Pleasure mustn’t eradicate oversight

There have been causes to stay vigilant as a result of Santiment confirmed that the worth rise not often impacted the positive aspects recorded. This was the case, particularly for long-term holders of the token, set free by the Market Worth to Realized Worth (MVRV) ratio.

Based on the on-chain portal, the seven-day to 365-day MVRV ratio maintained negative values all spherical. At press time, the seven-day MVRV ratio was -9.859% and the 365-day ratio was -37.80%.

![Lido Finance [LDO] price and MVRV ratio](https://ambcrypto.com/wp-content/uploads/2022/11/Bitcoin-BTC-07.00.20-29-Nov-2022.png)

Supply: Santiment

Thus, the common buying worth of LDO was value greater than the present value. Due to this fact, buyers had hardly made earnings, and so they weren’t prepared to promote but. As well as, it was unlikely that there could be a market correction since LDO could possibly be thought of undervalued.

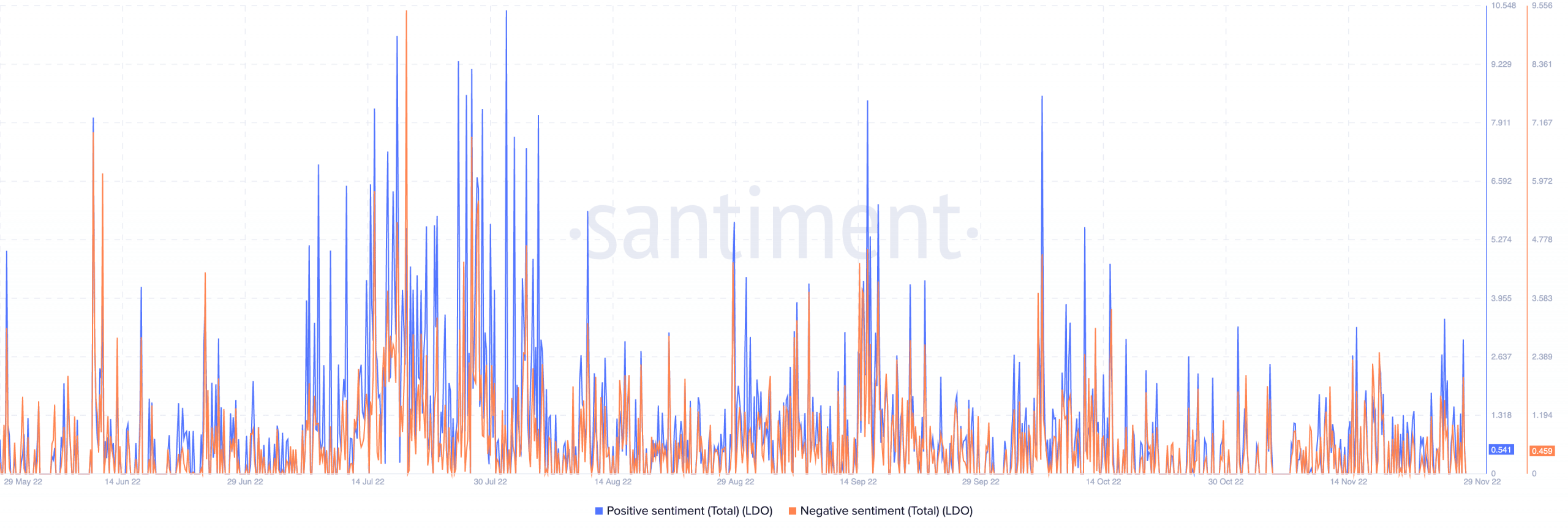

Despite the inconsistency proven by LDO, the common investor remained zealous. This was as a result of the optimistic sentiment attributed to LDO was 0.541, on the time of writing. Based mostly on Santiment’s information, the unfavourable sentiment was 0.459.

Nonetheless, because the values had been shut, and the optimistic sentiment couldn’t dominate with a 0.75 worth, it meant that a big a part of LDO buyers nonetheless exercised warning.

Supply: Santiment

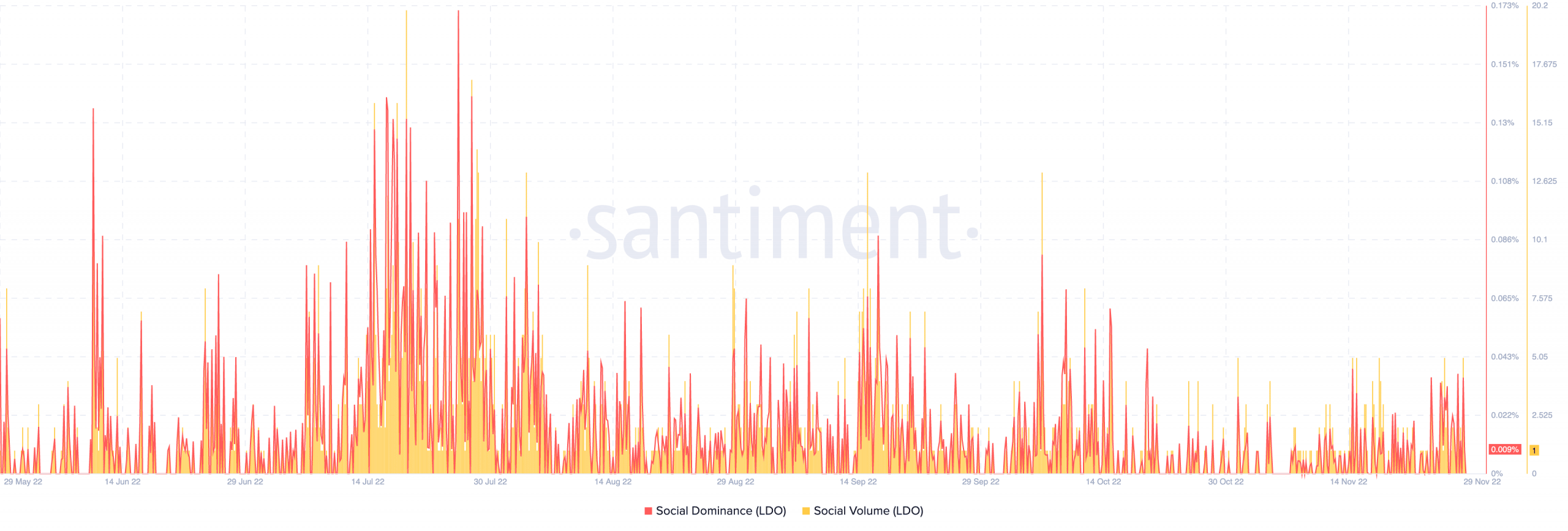

Lido Finance: On the social entrance

Lido’s social metrics remained “bland and unhealthy” at 0.009%, in keeping with Santiment. This meant that arbitrary search and discussions for LDO had been at an especially low level. Moreover, this situation meant that LDO hardly obtained any hype even after the worth hike and will probably ship the uptrend in the other way.

Its social quantity was additionally stuffed with blemish as Santiment confirmed that it was at a worth of 1. This implied that group dialogue about LDO was not important to set off the worth to the highest. Therefore, LDO had the prospect of shedding the upturn lately registered.

Supply: Santiment

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)