- As a result of fall in costs of some native cash, Lido’s TVL declined within the final week.

- The shopping for stress for LDO has declined considerably, and a worth disadvantage is perhaps on the horizon.

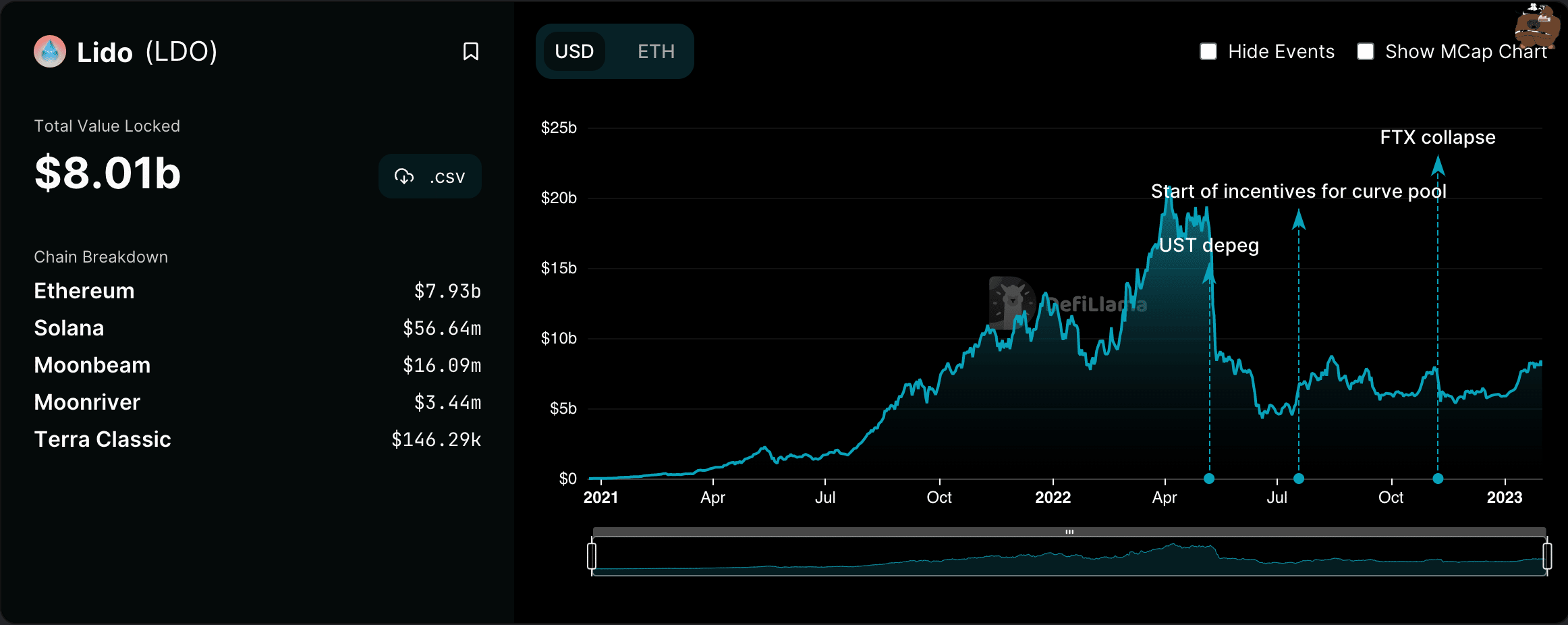

Lido Finance [LDO], a distinguished liquid staking protocol, skilled a drop in its Complete Worth Locked (TVL) up to now week because of a lower within the values of the native cash inside its working networks, together with Ethereum [ETH], Polygon [MATIC], Solana [SOL], Polkadot [DOT], and Kusama [KSM].

⚡️Lido TVL

Lido staking deposits grew throughout all Lido chains besides Kusama. Nevertheless, decreases in native token costs (incl ETH worth 7d: -2.7%) contributed to a TVL lower.

— Lido (@LidoFinance) January 30, 2023

Learn Lido’s [LDO] Value Prediction 2023-24

Based on information from cryptocurrency worth tracker CoinMarketCap, ETH’s worth fell 4% within the final seven days. Likewise, the costs of SOL, DOT, and KSM fell by 3%, 6%, and 5%, respectively.

At press time, Lido’s TVL was $8.01 billion, having declined by 3% within the final week.

Supply: DefiLlama

The decline in TVL on Lido occurred regardless of the launch of a brand new ETH/LDO manufacturing unit pool, which gained over $16 million within the final week.

LDO/ETH @LidoFinance pool simply received added. It has a vote for gauge [https://t.co/WazdZtth2F] (so please vote!) however within the meantime exhibiting some wholesome APY in LDO for depositorshttps://t.co/NMVLmRI4mH pic.twitter.com/rkT0oLgLlM

— Curve Finance (@CurveFinance) January 25, 2023

Bother in Lido’s paradise?

It’s now not information that Lido’s dominance of the liquid staking market has come below risk due to the rise in exercise on centralized crypto change Coinbase.

Based on Delphi Digital, Lido’s market share, which was 85% at first of 2022, has decreased to 73% following Coinbase’s entry into the liquid staking market in June 2022.

Presently, the dominant participant right here is @LidoFinance.

Nevertheless, its market share has persistently declined since Coinbase’s entry into the liquid staking market in June 2022.

Whereas Lido’s market share stood at 85% at first of 2022, it has since come all the way down to 73%. pic.twitter.com/5gVKXq36cx

— Delphi Digital (@Delphi_Digital) January 28, 2023

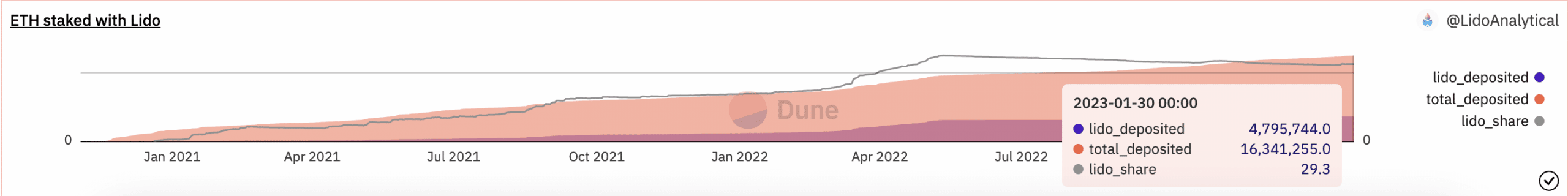

Narrowing it all the way down to the ETH staking market, information from Dune Analytics revealed a persistent drop in Lido’s share of that vertical. As of this writing, Lido solely managed 29% of the market. On Could 22, this stood at 32%.

Supply: Dune Analytics

Your LDO positive aspects is perhaps in bother

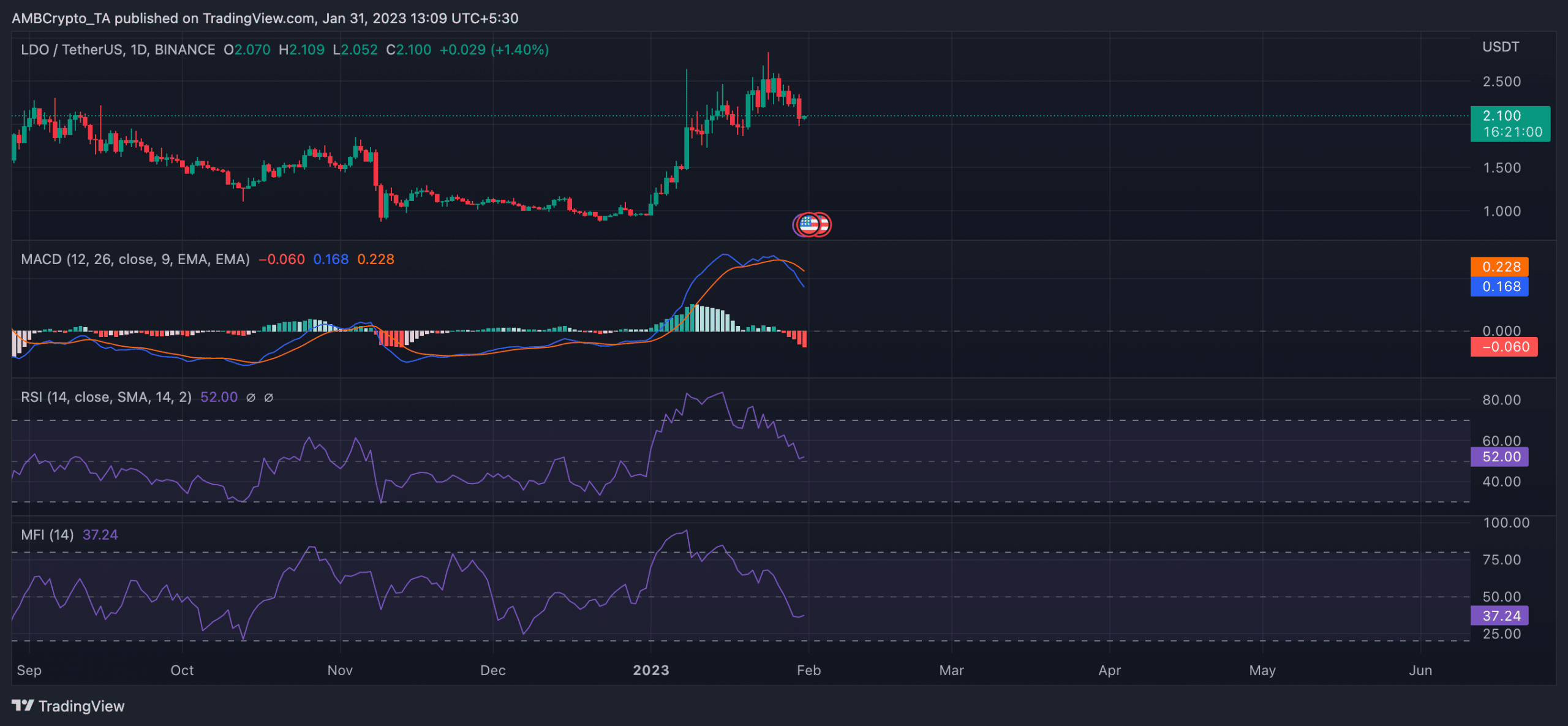

LDO’s worth, which has risen 109% up to now month, may expertise a downturn as evaluation of its every day chart suggests the beginning of a bear market cycle.

An evaluation of the alt’s shifting common convergence/divergence (MACD) revealed an intersection of the MACD line with the pattern line in a downtrend on 27 January. The indicator has since been marked by pink histogram bars. In reality, LDO’s worth has since dropped by 9%, per CoinMarketCap.

When an asset’s MACD line crosses the pattern line in a downtrend, it typically indicators a possible pattern reversal or a change in momentum. Because of this, it’s thought of a bearish crossover, and merchants typically interpret it as a promote sign.

Is your portfolio inexperienced? Take a look at the Lido Revenue Calculator

Additionally, key momentum indicators such because the Relative Energy Index (RSI) and the Cash Circulation Index (MFI) had been in downtrends. For instance, at press time, LDO’s RSI was 52, whereas its MFI had fallen beneath the impartial line to be pegged at 37.24.

These confirmed a persistent drop in LDO accumulation, normally adopted by a worth reversal.

Supply: LDO/USDT on TradingView

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)