newbie

With Bitcoin hovering in recognition and worth because the 2010s, many buyers are asking themselves whether or not they have missed their probability to get a bit of this digital pie or not but. Now could be undoubtedly an thrilling time for these fascinated with shopping for Bitcoin as its value continues to shed on a month-to-month foundation. And right here’s the excellent news: no, it’s not too late to put money into Bitcoin! However this loud assertion must be clarified.

To determine whether or not or not it’s a good suggestion for you personally to put money into Bitcoin proper now, we propose you learn this text, the place we’ll take note of the historical past of Bitcoin’s efficiency, analyze its present market situation and assess its future potential.

Bitcoin Rationalization in Brief

Bitcoin is a revolutionary and progressive cryptocurrency that makes use of blockchain know-how.

It was created in 2009 by an nameless particular person or a gaggle. Bitcoin represents a decentralized digital forex that doesn’t require the oversight of any authorities or monetary establishment. Safe and nameless transactions are executed through peer-to-peer networks, offering new alternatives for people to regulate their funds and to speculate their cash with out conventional banking buildings.

The Bitcoin community is enticing as a result of it may be used wherever throughout the globe, has low transaction charges, and offers near-instant transactions. All in all, Bitcoin provides customers a singular type of monetary independence.

Bitcoin Worth Historical past

Individuals ceaselessly surprise: Is Bitcoin nonetheless price investing in? However they ignore the coin’s value historical past, which might present perception into potential value actions sooner or later.

Bitcoin Worth – 2009 to 2017

The one locations the place Bitcoin noticed widespread use in its early years have been shady on-line marketplaces like Silk Street.

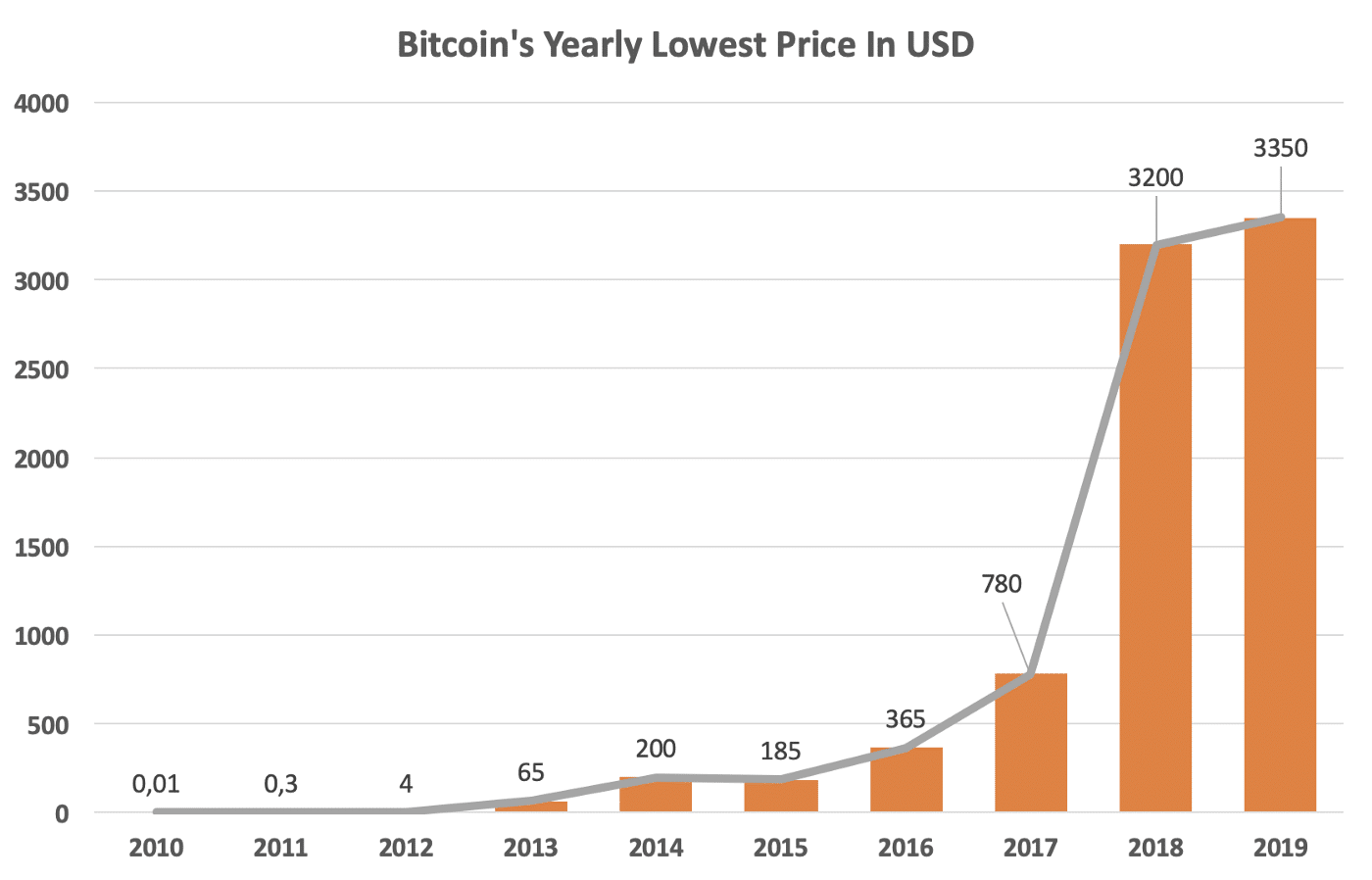

The value of BTC began to rise within the early 2010s, and between 2013 and 2014, it elevated by greater than 5,600%. The event of most of the high cryptocurrency exchanges we see immediately was prompted by the investing group starting to take discover at that time.

The value of the cryptocurrency was across the $1,000 mark initially of 2017. Bitcoin noticed a surprising rise from $975.70 on March 25 to $20,000 on December 17 after a small drop within the first two months.

Bitcoin Worth – 2018 to 2021

The BTC value ceased its rise in 2018. As a substitute, Bitcoin had returned to the $4,000 mark by the beginning of 2019. Within the first half of 2019, the worth of the cryptocurrency elevated by round 200%, reaching $12,000 by August. The value of Bitcoin stayed between $8,000 and $12,000 for the next six months.

Halfway via March 2020, the Covid-19 pandemic struck, sending the complete crypto market right into a tailspin. Bitcoin skilled a comparatively fast bear market, similar to different monetary property, shedding over 50% of its worth in lower than 48 hours to commerce under $5,000.

This decline, nonetheless, proved to be a quick setback. Bitcoin skilled explosive development after March 2020, reaching about $30,000 by yr’s finish — and this was solely the start. In January 2021, Bitcoin reached $40,000, and by March of that very same yr, its worth had risen to $60,000.

After a number of tumultuous months, Bitcoin ultimately reached an all-time excessive of just about $69,000 in November 2021.

Having fun with this text? Subscribe to our weekly publication to remain up to date on the newest crypto information!

Bitcoin Highs and Lows

The highs and lows of BTC from its conception to the current are summarized under:

- 2009 noticed the primary Bitcoin transaction, with the worth per coin being $0.0009 again then.

- The value of Bitcoin first started to rise in 2013, when it went from about $100 to $1,150 in a single yr.

- The BTC value fell in 2014 and fluctuated in 2015 and 2016.

- December 2017 had a excessive of $19,735, representing a 933% rise in 5 months.

- December 2018 had a low of $3,270.

- June 2019 noticed a excessive of $13,910.

- March 2020 set a low of $3,881.

- The all-time excessive of $68,789 happened in November 2021, surpassing the lows of March 2020 by 1,644%.

- November 2022 noticed a low of $15,757.

Bitcoin Efficiency in 2022

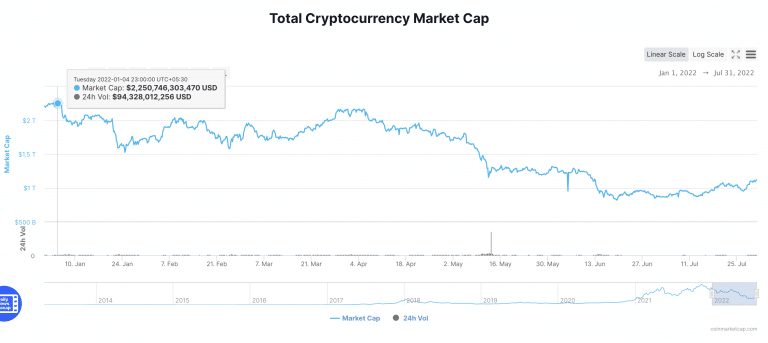

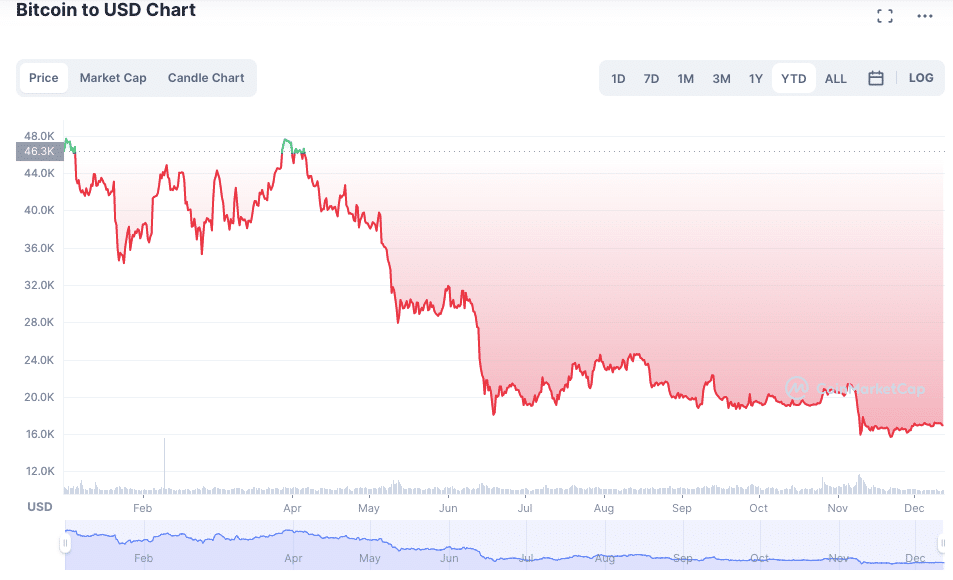

The yr 2022 has confirmed to be troublesome for the world markets: excessive ranges of inflation are at the moment affecting the worldwide economic system, and buyers are anxious a few potential recession.

Moreover, rising rates of interest have introduced a basic decline in investments. These elements have brought on the crypto market, together with Bitcoin, to enter the bearish stage.

Bitcoin’s bearish momentum gained power as these looking for the cryptocurrency with the best potential for development began concentrating on different initiatives. Massive institutional buyers like Tesla selected to dump sizable chunks of their Bitcoin holdings. All this stuff mixed created an unfavorable ambiance for Bitcoin and its proponents.

The FTX scandal served because the icing on the cake for BTC. Though this disaster had nothing to do with Bitcoin particularly, it impacted the complete cryptocurrency market. This sparked a widespread sell-off, which drove the worth of BTC down.

Even when it has dropped by virtually 75% from its peak, Bitcoin stays one of many best investments of the last decade. Bitcoin proponents are hopeful that this “crypto winter” is only a transient drop and that, as historical past has typically demonstrated, the worth of BTC will rise as soon as extra.

Bitcoin Worth Prediction 2023 – 2030

Based on some analysts, Bitcoin’s days of exponential development are lengthy gone, so buyers looking for fast earnings may be higher off elsewhere.

We expect that Bitcoin will nonetheless be capable to generate earnings sooner or later, simply not on the identical fee because it did between 2020 and 2021. So, the subsequent part offers BTC value forecasts for the upcoming years, primarily based on each technical and elementary evaluation.

We estimate that BTC can have been price $23,000 by the top of 2023. The crypto market ought to recuperate within the coming years, creating a greater atmosphere for Bitcoin’s value to rise. If this occurs, we assume Bitcoin can have been price $35,000 by the top of 2024. If monetary establishments undertake Bitcoin extra extensively and there are extra use circumstances, Bitcoin will possible be the very best long-term cryptocurrency. If that is so, BTC can have been price $60,000 by the top of 2025 and 90,000 by the top of 2030.

There are at the moment 18.5 million Bitcoins in existence, and this quantity contains misplaced Bitcoins. There are actually lower than three million BTC left for distribution. Though you may nonetheless mine Bitcoin, solely 21 million cash will be mined. In durations of rising prices and diminished buying energy, shortage can help in sustaining worth.

For a extra detailed BTC value prediction, we propose you learn this text.

How Might Bitcoin Be Used within the Future?

Bitcoin has undoubtedly taken the world by storm since its launch in 2009. In consequence, quite a few buyers have scrambled to get their fingers on this digital forex because of its potential to skyrocket in worth. Whereas Bitcoin continues to be risky and lacks authorities laws, consultants have recognized a number of catalysts that would drive the worth of Bitcoin within the coming years. All these key catalysts not solely excite buyers but additionally signify that Bitcoin may nonetheless attain unimaginable heights within the close to future.

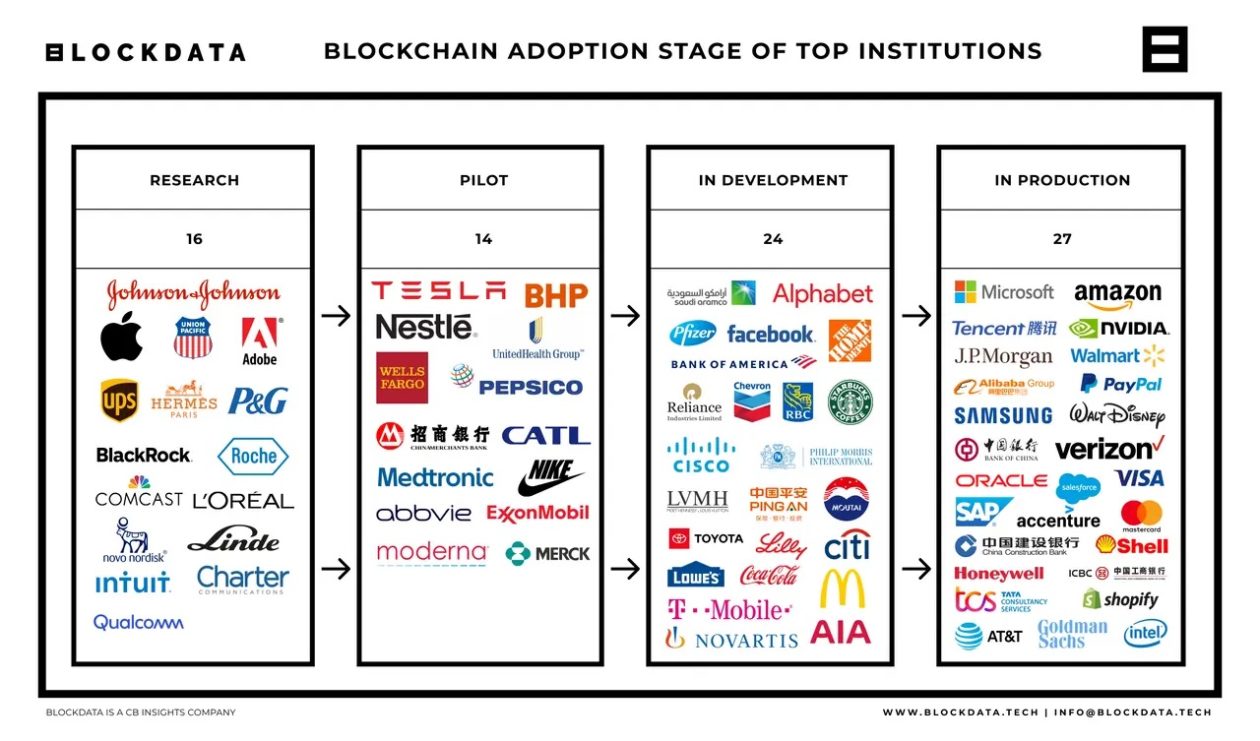

Rising Institutional Adoption

Bitcoin’s low correlation to different monetary property is one in every of its most alluring options.

With regard to market diversification, this unbiased stance provides Bitcoin a bonus. As an example, a whole lot of buyers select to buy Bitcoin aiming to guard their portfolio from a potential market droop. Monetary establishments have created quite a few Bitcoin-focused securities in response to the demand for this digital forex. As an illustration, a variety of cryptocurrency ETFs present derivatives like futures along with direct and oblique publicity to Bitcoin.

You might also like: Can Bitcoin Develop into a Reserve Forex?

Actual World Transactions

Traders anticipate that cryptocurrencies will develop into extra extensively accepted as a medium of change each on nationwide and world ranges. Moreover, given the present monetary atmosphere, organizations acknowledge the potential of blockchain know-how increasingly, which may also help deliver much-needed effectivity, transparency, and belief into many industries, from finance to healthcare.

Rising Crypto Infrastructure

One other results of Bitcoin’s recognition is the rise of a totally new business of infrastructure companies. A brand new crypto-based economic system is rising, and it’s led by Bitcoin. As an example, companies like Block, Robinhood, and PayPal have developed instruments to make buying and promoting Bitcoin easy. The information signifies that there’s nonetheless a whole lot of alternative for Bitcoin to develop, which is sweet information for buyers trying to find real-world purposes.

Professional Opinions: Is It Too Late to Purchase Bitcoin?

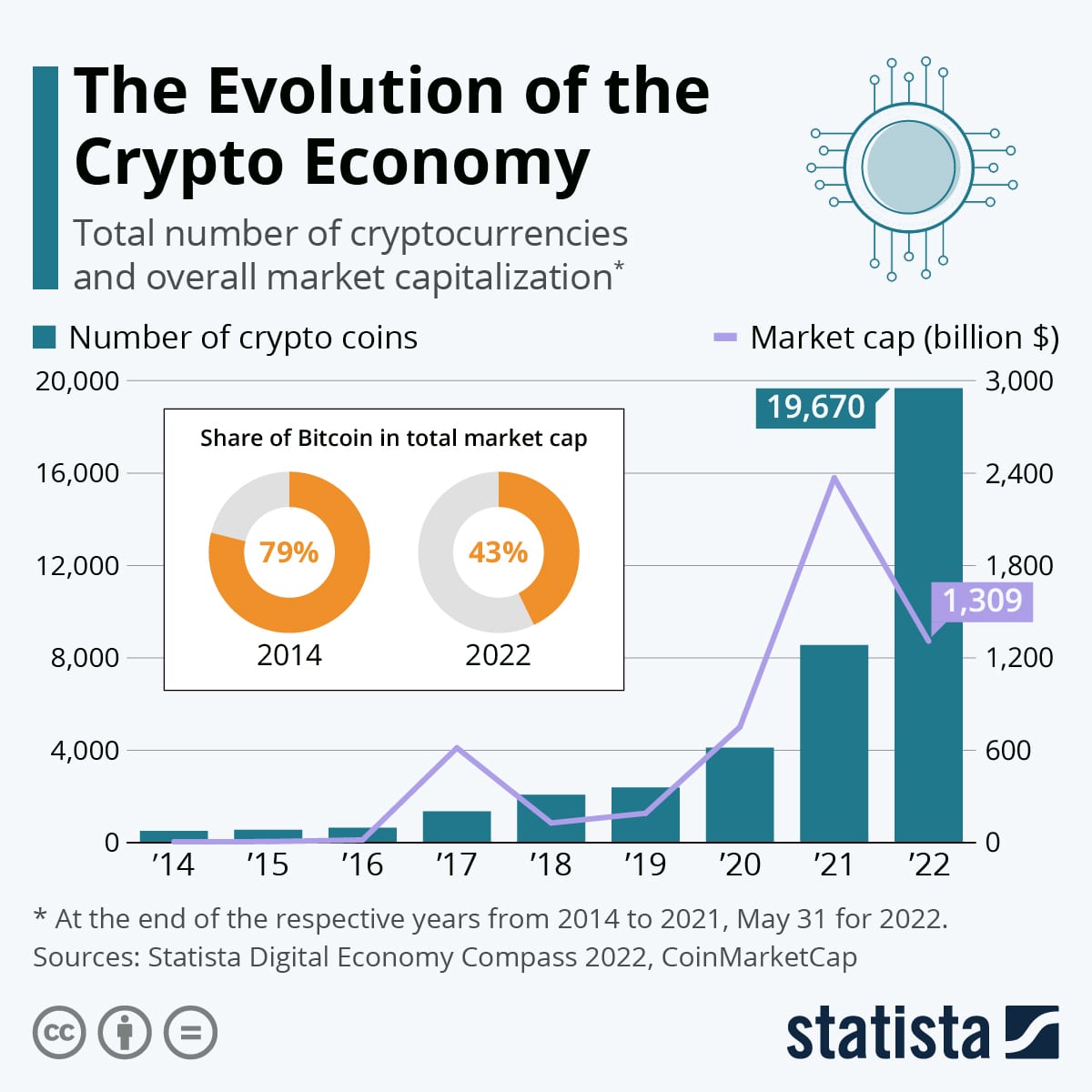

The talk on whether or not it’s too late to purchase Bitcoin continues to spark sturdy opinions amongst monetary and cryptocurrency consultants. The vast majority of analysts agree that given its immense beneficial properties in recent times, shopping for Bitcoin now may not be the very best funding resolution: the highlight is on new cryptocurrencies, and Bitcoin is progressively dropping market share. Nonetheless, many consultants are nonetheless intrigued by the potential of this forex.

Michael Novogratz

One of many largest buyers within the area, Novogratz, acknowledged that it’s “uncertain” that Bitcoin will attain a value of $30,000 any time quickly in his current Bloomberg interview. Moreover, Novogratz identified that Bitcoin’s growth is being hampered by an absence of institutional capital coming into the market.

Cathie Wooden

Cathie Wooden, one of many well-known fund managers at Ark Make investments, continues to imagine that Bitcoin will attain the $500,000 mark. Wooden has publicly acknowledged shopping for $100,000 price of Bitcoin, underscoring her upbeat outlook. Earlier this yr, an analyst at Ark Make investments acknowledged their opinion that BTC may be price greater than $1 million by 2030.

Jack Dorsey

Jack Dorsey, the co-founder of Twitter and Block, Inc., is a fervent proponent of cryptocurrencies and has ceaselessly expressed his religion in Bitcoin.

Based on Dorsey, “Bitcoin modifications the whole lot,” and “The world will ultimately have a single forex, and I imagine it is going to be Bitcoin.” Block, Inc. additionally permits for BTC commerce, underscoring Dorsey’s help for cryptocurrencies.

You might also like: Who Owns the Most Bitcoin within the World?

The place to Purchase Bitcoin

On the lookout for a platform to purchase Bitcoin on-line? Changelly is the very best place to purchase and promote Bitcoin! We’re glad to give you the very best change charges within the business, low charges, 24/7 buyer help, the best safety requirements, and extra!

Is It Too Late to Purchase Bitcoin? Our Conclusion

So, is it too late to purchase Bitcoin? Sure and no. There are stable arguments on either side. So, earlier than we ship a verdict, let’s take a more in-depth have a look at what folks coming from these two positions say.

Crypto Is Method Down From Its Current Highs

In case you imagine that the cryptocurrency market is simply one other type of the inventory market, there is probably not a greater time to purchase cryptos like Bitcoin as a result of they’re at the moment on sale. As Bitcoin’s historical past demonstrates, huge dips like this should not unusual in any respect, but the cryptocurrency has persistently managed to succeed in new highs.

Crypto Is Going to $500,000 and Past

As we talked about earlier, the well-known monetary planner Cathie Wooden predicts that Bitcoin will really attain $500,000. Based on Greg Cipolaro and Dr. Ross Stevens, researchers at New York Digital Funding Group, who additionally help this assertion, “Growing elementary demand mixed with a hard and fast provide and robotically declining provide development make a compelling case for Bitcoin in its place funding for institutional buyers.

Governments Are Toughening Up

One of many issues about investing within the cryptocurrency market has all the time been that governments will ban the very creation and even acceptance of the cash. The second might have already arrived. Across the finish of Could 2021, China began to crack down severely on Bitcoin mining and commerce, which brought on the worth of cryptocurrencies to spiral precipitously.

Extra currently, far-flung nations like Singapore, Estonia, and Iran have began their very own crackdowns. Demand and help for Bitcoin and different cryptocurrencies may collapse if different governments comply with go well with.

As well as, there are fixed headlines within the media about the necessity to regulate the crypto market. The XRP vs SEC case illustrates this level.

Crypto Market Is Going to Zero

Skeptics assume that cryptocurrencies are a category of property with no retailer of worth, an entry barrier, or any worth as a medium of change. Due to this, detractors see cryptocurrencies as merely speculative investments that gained’t final as reputable asset courses in the long term. Jeff Schumacher, the founding father of BCG Digital Ventures, acknowledged this about Bitcoin in 2019: “I do imagine it can go to zero. Though I feel it’s a superb know-how, I don’t assume it must be used as cash.”

Summing Up

In abstract, buyers proceed to favor Bitcoin as one in every of their high investments. Over the course of 13 years, Bitcoin has advanced from a distinct segment fad to a extensively used funding automobile and can possible stay the most important digital asset by market capitalization.

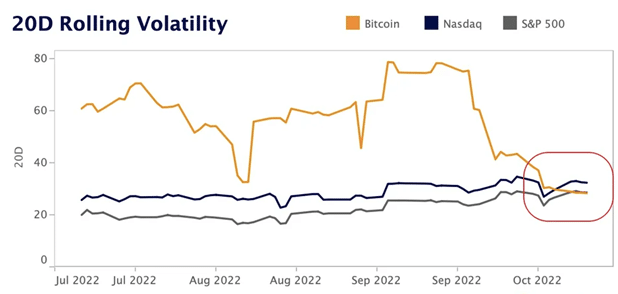

Bitcoin was much less risky than the S&P 500 and Nasdaq for the primary time since 2020. Supply: Kaiko

Definitely, Bitcoin is not a brand new cryptocurrency and is now even considered “previous” or “mature” within the context of the cryptocurrency market. This makes the coin’s value much less unpredictable on common, however this additionally makes episodes of exponential development unlikely. This is because of a wide range of elements, together with the outdated, energy-intensive mining course of, lack of practicality, and, as shocking as it could sound, recognition. Though the acceptance by monetary establishments has some benefits, it additionally raises the likelihood that Bitcoin’s four-digit development is not potential.

Given its mainstream recognition and promising future, Bitcoin could also be a sensible choice for retail buyers who want to enter the world of cryptocurrencies. Many analysts contend that Bitcoin is among the most undervalued cryptocurrencies accessible in the intervening time, with a value of round $17,000 as of this writing. Nonetheless, there are undoubtedly higher selections if buyers search cryptocurrencies with larger upside potential.

Cash to Take into account Shopping for Alongside Bitcoin

Regardless of its large success in its place asset, Bitcoin is just not with out its dangers, probably the most notable of which being its risky value and gradual processing instances. Thankfully, there are a selection of different digital or “alt” cash that supply probably increased returns and quicker transactions:

Whereas these choices could also be enticing to these fascinated with investing in digital currencies, you will need to do not forget that cryptocurrency markets can change rapidly, and buyers ought to conduct thorough analysis earlier than making any selections.

Cryptos to Take into account Shopping for As a substitute of Bitcoin

In case you’re trying to put money into cryptocurrency, Bitcoin is just not your solely possibility. Earlier than buying Bitcoin, buyers ought to contemplate different cryptocurrencies which have the potential to generate increased returns. Listed here are the very best altcoins with probably the most upside potential:

The volatility of those cash could cause crypto costs to fluctuate drastically in a single day, so it’s essential to do your analysis earlier than investing any important sum of money. With the correct strategy and data, different cryptocurrencies might be the important thing to increased returns for savvy buyers.

The data on Changelly shouldn’t be considered funding recommendation, nor are we certified to supply it.

FAQ

Is it too late now to put money into Bitcoin?

It relies on what you anticipate from this sort of funding.

Is it ever too late to get into crypto?

Because the crypto market turns into increasingly mainstream, the chance of unbelievable upsurges in value decreases. Amongst a couple of explanation why some day it may be too late to put money into crypto, that is the principle one.

Is it the correct time to purchase Bitcoin?

In case you imagine in technical evaluation — sure, it’s. BTC has been at its lows in current months.

Is it too late to put money into Bitcoin in 2022?

Some might argue that it’s by no means too late to put money into BTC. We’ve mentioned what to anticipate from BTC investments above.

Disclaimer: Please be aware that the contents of this text should not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)