newbie

In recent times, cryptocurrencies have been a subject of curiosity, pleasure, and debate, with each supporters and detractors expressing sturdy opinions on their future. The query on everybody’s thoughts is: Is crypto useless?

Lately, a billionaire tech investor Chamath Palihapitiya claimed that crypto is just about useless in the USA — primarily due to the strict rules imposed by the SEC. It stays to be seen how a lot these rules will truly do to destroy the crypto market within the States and whether or not crypto belongings will have the ability to climate this storm. Nonetheless, we will nonetheless look at issues we do know — current crypto initiatives and companies.

On this article, we’ll look at numerous points of cryptocurrency, its historical past, the present state of the market, and its potential future to find out if crypto is actually useless or if it’s merely experiencing rising pains.

Spoiler alert: Personally, I believe the reply up to now is a resolute “no.” However what do you suppose? Will crypto crash or will crypto recuperate?

What Is Cryptocurrency?

A cryptocurrency is a digital asset that depends on cryptography and blockchain expertise to allow safe, decentralized transactions. Not like conventional currencies, cryptocurrencies should not regulated by central authorities, reminiscent of governments or monetary establishments. This decentralization permits for sooner transactions, decrease charges, and elevated privateness. A few of the hottest cryptocurrencies embrace Bitcoin, Ethereum, and XRP.

Historical past of Cryptocurrency

The idea of digital currencies will be traced again to the Eighties, however the precise implementation of a decentralized cryptocurrency started with the creation of Bitcoin in 2009 by a person or a gaggle often called Satoshi Nakamoto. Bitcoin was designed to deal with the issues within the current monetary system, together with the dearth of transparency and the potential for a banking disaster and management inherent in centralized monetary establishments.

Through the years, many different cryptocurrencies have been created, every with its distinctive options and use circumstances. Whereas the market has skilled vital fluctuations and a number of other bear markets, the general trajectory has been one in every of development and elevated adoption. Essentially the most notable milestones within the crypto market have been the preliminary Bitcoin growth and the next “altseason” of 2017.

Two of the crypto market’s most vital peaks each occurred throughout the identical 12 months — 2021. That was when Bitcoin achieved its (on the time of writing) all-time excessive, and virtually each crypto trade was brimming with guests. After these highs, nonetheless, got here the lows — and the crypto business obtained caught up in an extended bear market.

How is the Crypto Market Doing Proper Now?

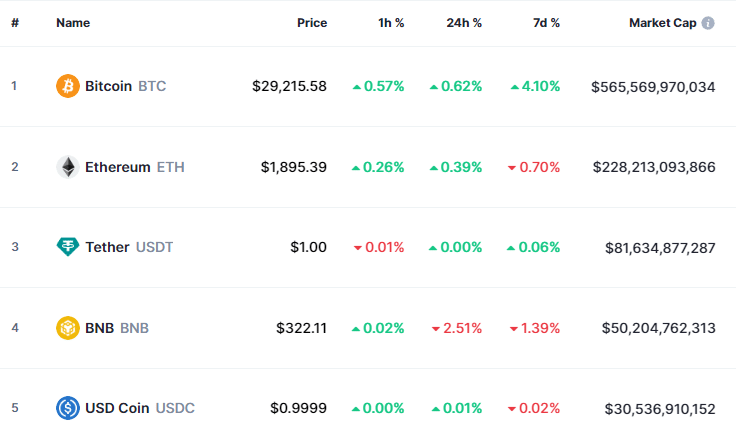

The crypto market has skilled a fair proportion of ups and downs, with durations of fast development adopted by sharp declines. Regardless of these fluctuations, the general pattern has been constructive: extra individuals and companies have been adopting digital belongings, and the market capitalization of cryptocurrencies has been reaching new heights.

There have been a number of large-scale scandals, just like the one with Sam Bankman-Fried and the collapse of his crypto firm FTX — a cryptocurrency trade and crypto hedge fund. Nonetheless, even regardless of scandals like that, the crypto “bubble” hasn’t popped but.

A number of main monetary establishments and companies, reminiscent of JPMorgan and Sq., have additionally began to spend money on and provide cryptocurrency-related companies, signaling a rising acceptance of digital belongings as a official asset class.

Let’s check out how the cryptocurrency market is doing proper by way of the lens of its numerous use circumstances.

Cryptocurrency as an Funding

As cryptocurrencies have grow to be extra widespread, they’ve attracted the eye of buyers who view them instead funding alternative. Whereas some have achieved vital good points by investing in cryptocurrencies, others have skilled losses because of the unstable nature of the market.

Regardless of the dangers, many retail and institutional buyers alike proceed to be drawn to the potential for prime returns and the chance to diversify their portfolios with digital belongings. Because the market matures and regulatory frameworks are established, cryptocurrencies will doubtless proceed to realize acceptance as a viable funding choice.

Crypto and Enterprise

Other than being an funding choice, cryptocurrencies provide quite a few advantages and alternatives for companies. As an example, accepting cryptocurrency as a type of cost will help companies attain a broader buyer base, decrease transaction prices, and enhance transaction speeds.

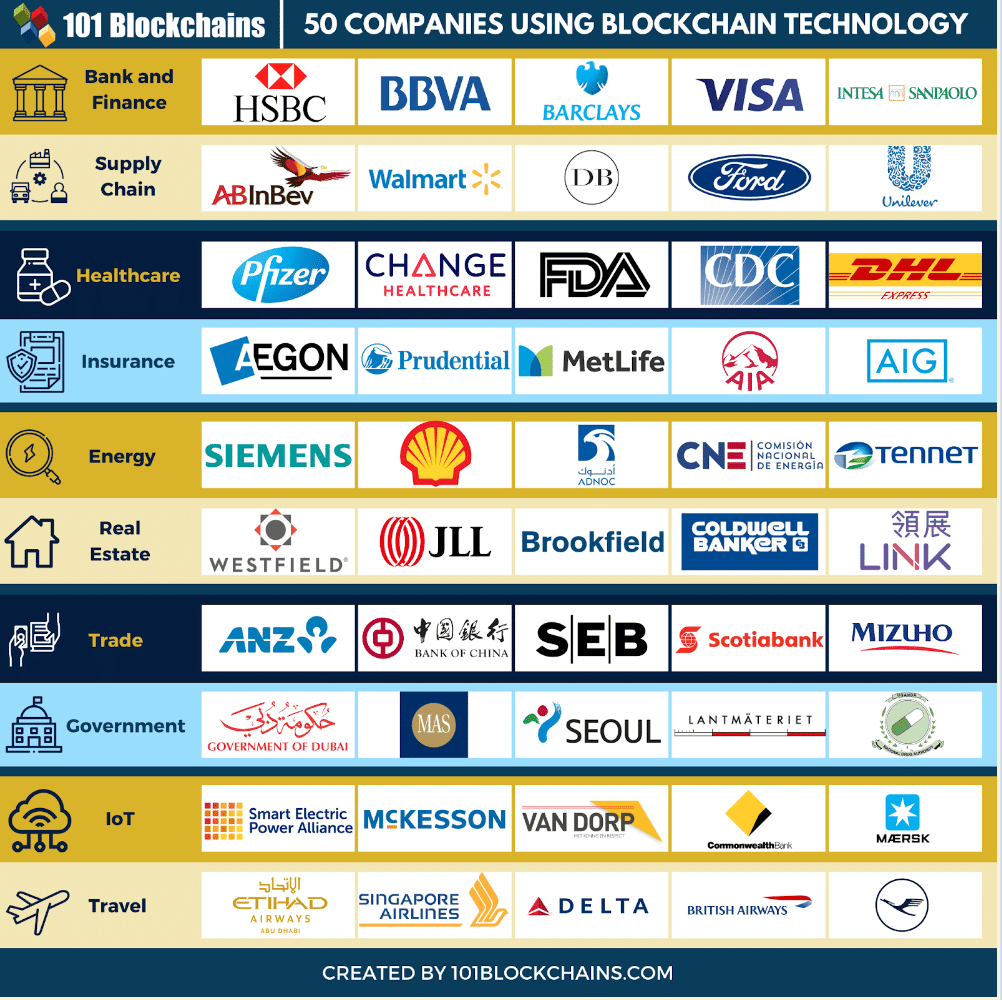

Moreover, blockchain expertise, which underpins cryptocurrencies, has a variety of functions past digital currencies. Companies can use blockchain to enhance provide chain administration, create safe digital identities, and facilitate clear and environment friendly information sharing.

Some main companies, reminiscent of Tesla and Microsoft, have begun to simply accept cryptocurrency funds, and extra companies are anticipated to observe swimsuit because the market continues to develop and mature.

There are additionally quite a few digital asset corporations — not solely corporations that straight work with crypto (exchanges, wallets, and so forth.) but in addition initiatives that merely use crypto tokens to reinforce their current companies, like video games and group hubs. Such platforms have quite a bit to realize from crypto and blockchain expertise.

Crypto Regulation

Because the adoption of cryptocurrencies has elevated, so has the eye of regulators and governments worldwide. For instance, the SEC has proposed new guidelines on how crypto corporations can custody buyer belongings and issued some official warnings to Coinbase. Many nations are actually working to develop and implement regulatory frameworks to manipulate using digital belongings and crypto buying and selling platforms, shield customers, and forestall illicit actions reminiscent of cash laundering and fraud.

Whereas some have criticized rules for doubtlessly stifling innovation and development, others argue {that a} clear regulatory surroundings will assist legitimize cryptocurrencies and promote their adoption on a bigger scale. For instance, in the USA, the Workplace of the Comptroller of the Forex (OCC) has granted a number of crypto corporations, together with Paxos and Anchorage, conditional approval to function as federally chartered banks. This growth signifies a rising acceptance of cryptocurrencies throughout the conventional monetary system.

Institutional curiosity in cryptocurrencies has additionally grown, with main monetary gamers just like the Silicon Valley Financial institution exploring partnerships with cryptocurrency corporations and providing crypto-related companies. As regulatory readability improves, it’s doubtless that extra monetary establishments and companies will enter the cryptocurrency area, additional bolstering the market’s development.

So, Is Crypto Lifeless?

Contemplating the present state of the cryptocurrency market, crypto corporations, and main cryptocurrencies, it’s clear that crypto is much from being useless. Whereas the market has skilled fluctuations and confronted regulatory challenges, the general pattern has been one in every of development, innovation, and elevated adoption.

The growing curiosity in digital belongings and blockchain expertise from buyers, companies, and governments demonstrates that cryptocurrencies have gotten extra extensively accepted and built-in into the worldwide monetary system.

Some individuals argue that the explanation why crypto had such fast development up to now was all attributable to lack of regulation — however we don’t know what these future rules and safety legal guidelines will seem like and whether or not they may have the ability to cease the expansion of a completely decentralized, borderless asset.

In conclusion, whereas the way forward for cryptocurrencies will not be with out dangers and uncertainties, it’s evident that these belongings have come a great distance since their inception and can proceed to form the way forward for finance and expertise. Crypto, in all chance, is right here to remain, and the query “Is crypto useless?” will be confidently answered with a convincing “no.”

FAQ

Why are cryptocurrencies crashing? And can they recuperate?

Cryptocurrencies are topic to volatility and might expertise vital value fluctuations attributable to numerous components, reminiscent of adjustments in market sentiment, regulatory developments, and macroeconomic components affecting monetary markets. It’s important to know that market crashes should not distinctive to cryptocurrencies and might happen in conventional monetary markets as nicely.

Cryptocurrencies could crash attributable to detrimental information or occasions, reminiscent of regulatory crackdowns or safety breaches on crypto exchanges. These occasions can result in panic promoting amongst buyers, inflicting costs to drop quickly. Nonetheless, historical past has proven that cryptocurrencies are inclined to recuperate after a crash, though the timeline and extent of the restoration could differ.

Many buyers are optimistic concerning the long-term prospects of cryptocurrencies, particularly as blockchain expertise continues to develop and discover new use circumstances. Though it’s inconceivable to foretell the longer term with certainty, the general pattern within the cryptocurrency market has been one in every of development and elevated adoption, suggesting that cryptocurrencies are more likely to recuperate from crashes over time.

Is crypto a nasty funding?

The reply as to if crypto is a nasty funding relies on your particular person threat tolerance, funding targets, and information of the cryptocurrency market. Cryptocurrencies are recognized for his or her volatility, which signifies that they’ll provide vital potential returns but in addition include the next degree of threat in comparison with extra conventional investments.

For some buyers, the potential rewards of investing in cryptocurrencies outweigh the dangers, whereas others could want to stay with extra conventional funding choices. It’s important to conduct thorough analysis and perceive the dangers earlier than deciding to commerce crypto or spend money on digital belongings.

Diversification is a key precept in investing: many buyers select to allocate a portion of their portfolio to cryptocurrencies to unfold their threat and benefit from the potential development out there. In any case, it’s essential to speculate solely what you may afford to lose and search skilled recommendation if wanted.

Is Bitcoin useless?

Regardless of periodic value drops and detrimental information surrounding the cryptocurrency market, Bitcoin is much from being useless. Since its inception in 2009, Bitcoin has skilled a number of crashes and durations of decline, however it has persistently recovered and continued to develop over time.

Bitcoin stays the biggest and most well-known cryptocurrency, with a market capitalization that dwarfs most different digital belongings. It has attracted the curiosity of many buyers, companies, and even governments, which view it as a retailer of worth, a hedge in opposition to inflation, or a method of conducting transactions extra effectively.

As the primary and most established cryptocurrency, Bitcoin has confirmed its resilience and adaptableness within the face of challenges. Whereas it’s inconceivable to foretell the longer term with certainty, the general pattern for Bitcoin has been one in every of development and elevated adoption, indicating that it’s removed from useless and can doubtless proceed to play a big position on the planet of digital belongings.

Disclaimer: Please notice that the contents of this text should not monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)