intermediate

Nobody likes math till math is about cash.

It’s a well-known scene: you’ve been saving for fairly a while, possibly give up smoking or minimize down on quick meals, or went even so far as not throwing all of your payroll into the Steam Summer season Sale. A method or one other, you end up now with some spare money and a burning need to speculate.

Let’s say, you purchase Bitcoin for $10,000. Then what? You may have two choices. The primary one is to sit down and do nothing. Perhaps pray that Elon Musk gained’t tweet something edgy (once more) that may trigger Bitcoin to drop. Or, following the second possibility, you possibly can calculate the return on funding property like a professional. As scary as it might sound, it’s not past the capabilities of an individual who is aware of tips on how to push buttons on a calculator and reads this neat little information.

What Is the Return on Funding (ROI)?

Investments in cryptocurrencies can carry excessive returns: in line with coinmarketcap, Bitcoin introduced its traders greater than 29,000% ROI, and Ethereum — greater than 107,000%. Why does this — a whatchamacallit — ROI exist, and the way does it work?

Return on funding, or ROI, is well-liked in several spheres, not solely DeFi. Enterprise sharks and enterprise dolphins, entrepreneurs, startup entrepreneurs, actual property traders, and HR managers — all of them want a software to foretell income. And the return on funding formulation supplies it.

ROI metric is typically referred to as a “quick-and-dirty methodology” as a result of it’s a simple formulation that may be calculated on a serviette. Nonetheless, it’s a broadly identified monetary metric that’s often used earlier than any severe investments.

ROI is a formulation that measures an funding’s efficiency, defining whether or not it’s environment friendly and worthwhile. It may be used to guage one or a number of totally different property and evaluate them.

Don’t confuse ROI with ROR, which stands for fee of return. Know the principle distinction: ROR can denote a time frame, however ROI doesn’t do it. Abbreviations like ROMI and ROAS additionally stand for various calculations. A delicate however necessary factor to recollect.

Find out how to Calculate Return on Funding (ROI)

Not like the final season of Recreation of Thrones, ROI calculations gained’t shatter your expectations. They’re all the time the identical and fairly easy. This funding property is calculated to keep away from errors that will result in a waste of cash. The calculation offers a transparent concept of the effectivity stage of your property, offering a possibility to estimate the proportion of revenue that you simply get after investing your hard-earned funds.

ROI is a share that’s calculated by dividing an funding’s revenue (or loss) by its preliminary value or outlay. To place it merely, you are taking a quantity that you simply gained from an funding and subtract the funding value from it. That is your web earnings. Hold in there — we’re nearly completed. So, the quantity you get from subtraction is to be divided by the price of funding. Not subtracted, divided. The quantity you get is the ROI. The upper it’s, the extra worthwhile the funding.

OK, OK, maintain respiration, stick with us.

Why is the ROI metric represented by share if I get a quantity like 0.4 or 0.2? Properly, you possibly can’t simply maintain calculating ROI with common numbers and get %. So, to get a share, multiply the quantity by 100: 0.4 × 100 = 40%.

Right here Is a Video on Find out how to Calculate ROI

For these of you treasured visible learners we hitchhiked calculating ROI video from the web:

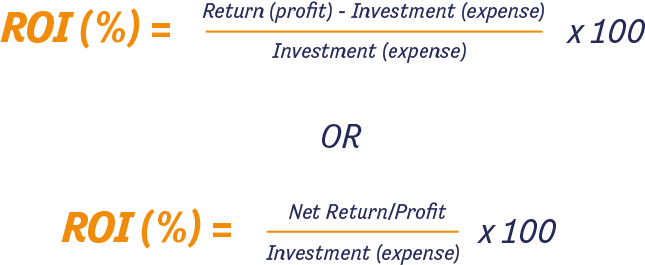

ROI Formulation

Visually, the ROI formulation is sort of easy and appears like this:

ROI = (Acquire of Funding – Value of Funding) / Value of Funding

The primary motion is calculating your web earnings (funding property achieve after prices). If you happen to already know your web earnings, simply divide it by funding value. Thoughts that in some formulation you will see on the web, funding prices are generally referred to as funding base, however it means the identical stuff. To get a share out of a quantity, multiply it by 100.

Through magora-systems.com as a result of we have been too lazy to open Microsoft Paint

ROI Instance

ROI is one of the simplest ways to be taught the potential property worth of cryptocurrencies you personal. For instance, if Elon Musk buys Solana at $120 USD/SOL, and the value spirals as much as $400 USD/SOL, which is completely potential on condition that Solana is now one of many main currencies on OpenSea, then what’s the ROI going to be?

400 / 120 = 3.3 × 100 = 333.3% return on funding

Simply wanting on the share of income makes us need to purchase SOL immediately.

An Different ROI Calculation

There are totally different formulation to calculate ROI for a enterprise enterprise, however they’re the identical in essence. It’s both:

ROI = Cash I Gained – Cash I Spent / Whole Value of Funding

or

ROI = Funding Web Revenue (which is mainly the identical Cash I Gained – Cash I Spent) / Whole Value of Funding

or

ROI = Funding Acquire / Funding Base (spoiler: it’s the identical factor as above)

As you possibly can see, an alternate strategy to calculate projected ROI is an phantasm.

Find out how to Calculate ROI for Startup

You invent the unmelting ice cream machine, which prices incurred $10,000,000. After promoting ice cream for a while, you start to hate it: the style, the feel, all the pieces.

You would like you have been promoting pooping flamingos as a substitute.

You quit the machine for $30,000,000. On this case, your web revenue is +$20,000,000. 20M/10M = 2. It signifies that your ROI is 200%. funding and an excellent ROI.

Find out how to Calculate ROI for a Advertising Marketing campaign

You’re the head of ClearlyNotYouTube. Somebody posted a meme about you on Reddit, leading to 69,000 conversions and a revenue of $1,000. That’s good since you solely spent $2 on adverts. Sadly, you’ll have $69,001,000 upkeep prices on attorneys as a result of the true YouTube sued you.

ROI = $998 – $69 001 000 = –$69M. Divide –$69M by $2 to get the fundamental ROI calculation. Your ROI shouldn’t be wanting good. You’ll find yourself with what’s referred to as destructive ROI.

What Is Annualized ROI?

In shorthand, it’s the ROI you want in case your funding alternative is measured in years. An annualized ROI is an annual fee of return on funding, which takes under consideration how lengthy the funding is held. It exhibits how your funding performs throughout a sure time interval. The formulation for yearly ROI is extra sophisticated:

Annualized ROI = ((1 + ROI) 1/n – 1) × 100%

N within the formulation stands for the variety of years for funding.

Evaluating Investments and Annualized ROI

The yearly ROI is a neat strategy to evaluate returns between varied investments. For that, you will want the next formulation:

AROIₓ = Annualized ROI for crypto X

AROIₙ = Annualized ROI for crypto N

Then, subtract the upper quantity from the decrease to see how worthwhile is one crypto preliminary funding as compared with the opposite.

Find out how to Calculate ROI in Excel

As “not cool” because it sounds, making ROI calculations in Microsoft Excel is faster than doing it on a calculator and far quicker than doing it on a serviette. It additionally supplies monetary safety.

Step 1. Open Excel.

Step 2. Wait until it hundreds.

Step 3. Wait some extra until it hundreds, possibly make some tea, learn a few Shakespeare’s sonnets — they’re good for the soul.

Step 4. Excel lastly hundreds, hurray.

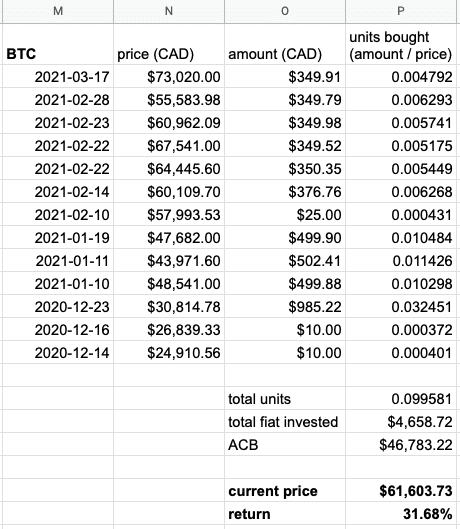

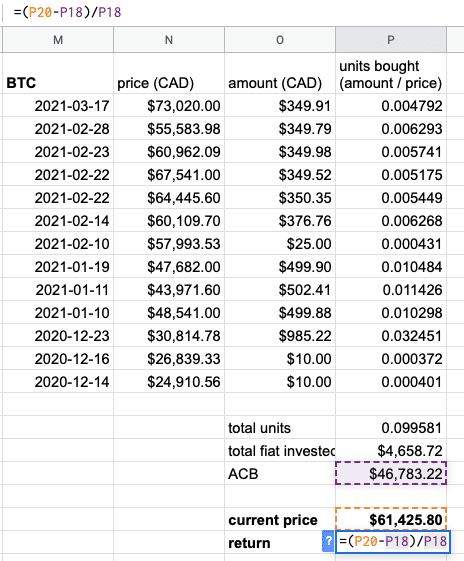

Step 5. With a clean workbook, create the next cells for ROI calculations:

- Transaction date

- The worth on the time of buy

- The quantity you paid for crypto USD, EUR, CAS, and so on.

- The variety of cash you got

The template will appear to be this (examples by Steven Cheong on Medium):

Enter the present worth of crypto, as proven within the instance. For Google Sheets, you possibly can sort “=GOOGLEFINANCE(Your crypto identify)” within the present worth cell. To get a ROI, use the next formulation: return = (present worth – common worth) / complete prices.

Voilà, that’s the way you calculate the ROI in Excel with no third occasion ROI calculator.

Disclaimer: Please notice that the contents of this text will not be monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)