Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- ETH was in a short-term value correction.

- It might retest the $1,247 assist or drop decrease.

- A patterned breakout on the upside would invalidate the bias.

Bitcoin’s [BTC] try to interrupt the $17K resistance on 4 January tipped Ethereum [ETH] to purpose on the $1,300 mark. Nonetheless, BTC confronted rejection at $16.95K, blocking ETH’s rally at $1,270.

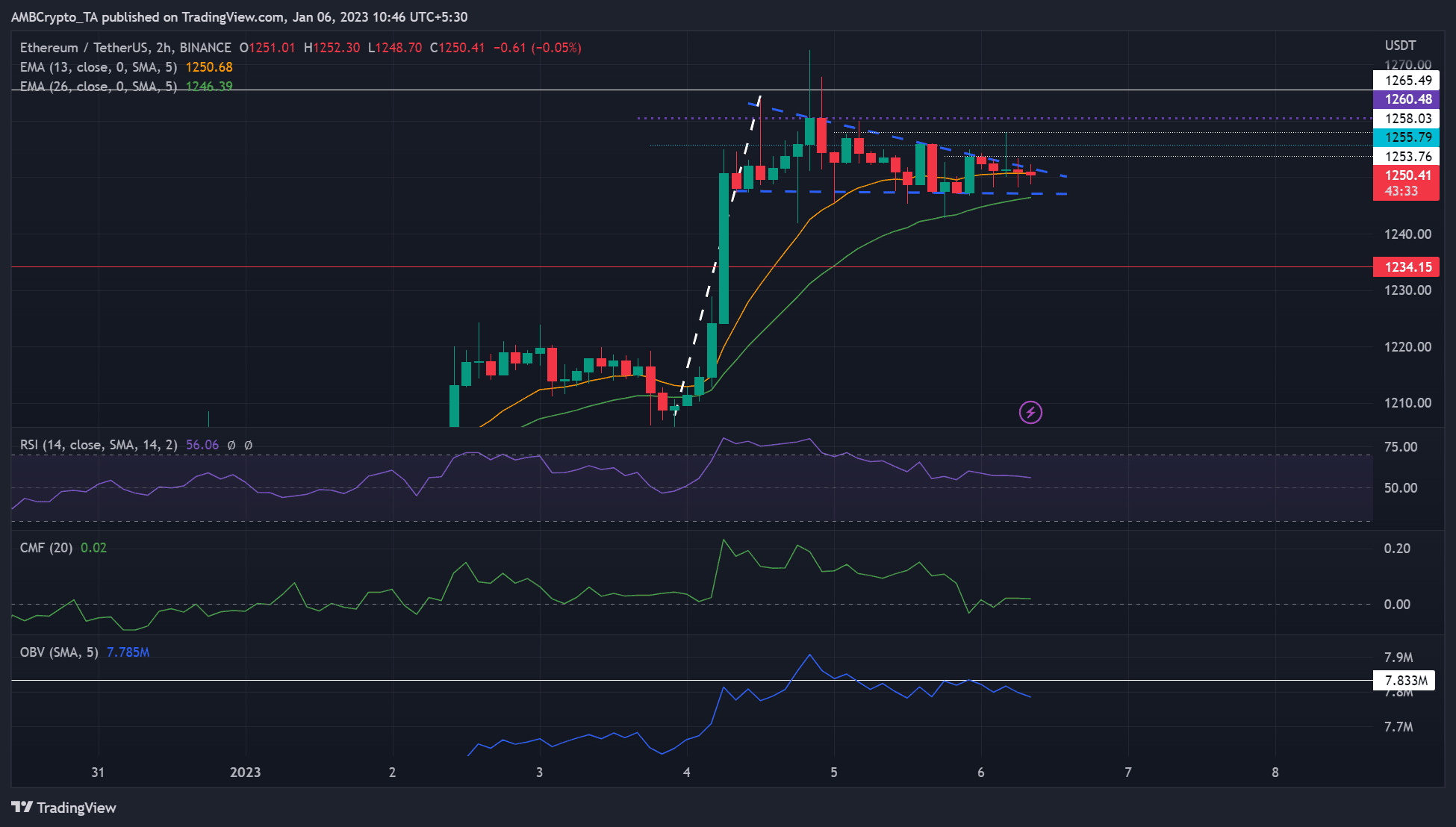

The worth motion for the previous few hours shaped a descending triangle sample on the 2-hour chart alongside a flagpole that might be deemed an general bullish pennant sample.

Nonetheless, buyers must be cautious as a result of technical indicators didn’t point out bullish momentum within the subsequent few hours.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

A bullish pennant: Is an upside breakout possible?

Supply: ETH/USDT on TradingView

A patterned breakout to the upside and related positive aspects have been unlikely, as prompt by technical indicators.

Particularly, the On Steadiness Quantity (OBV) dipped, that means shopping for strain was restricted. The RSI had additionally retreated steadily from the overbought zone and was close to the midpoint, indicating shopping for strain had eased.

Though the Chaikin Cash Move (CMF) crossed above the zero mark, it moved sideways and remained near the impartial degree. It confirmed patrons had the higher hand however not excellent leverage to maintain sellers in test.

Subsequently, sellers might push ETH decrease to retest $1,247 assist or 26-period EMA of $1,246.39. Nonetheless, a bearish BTC might push ETC even decrease to a patterned breakout on the bearish goal of $1,234.15.

However a convincing patterned breakout on the upside would invalidate the bias. Such an upswing will purpose on the $1,265.49 goal, however bulls should clear a number of obstacles.

Are your holdings flashing inexperienced? Verify the ETH Revenue Calculator

ETH noticed elevated demand in derivatives markets

Supply: Santiment

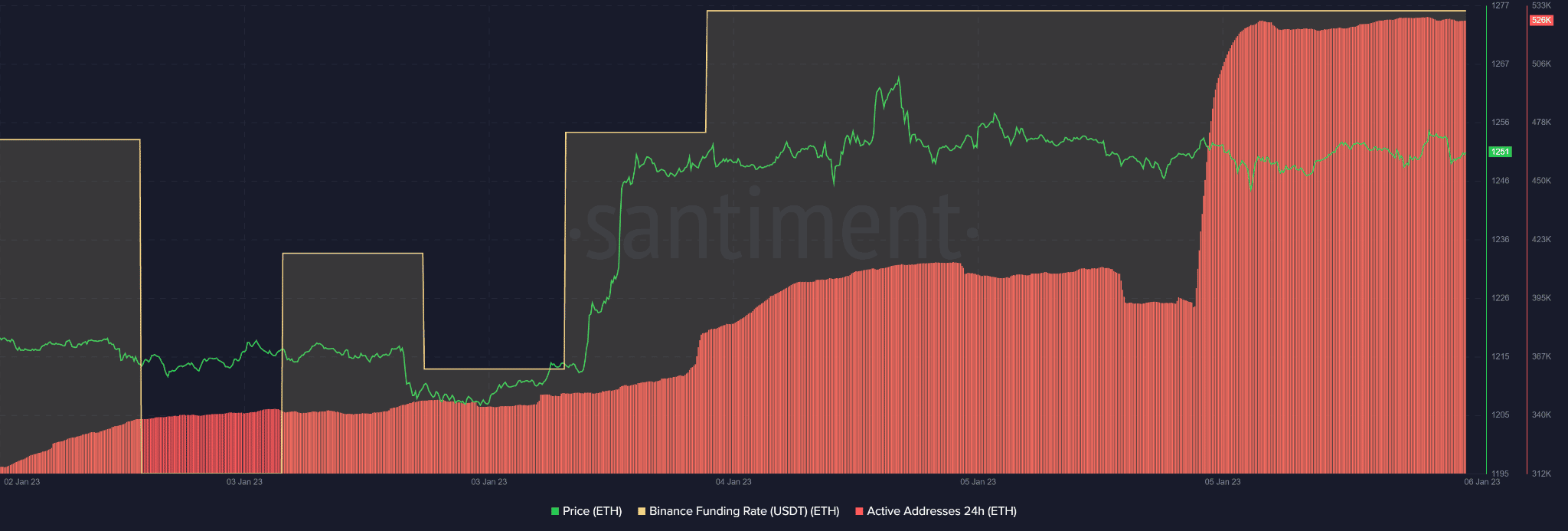

Regardless of the worth correction, ETH nonetheless recorded an elevated demand within the derivatives markets, as indicated by a optimistic and elevated Binance Funding Charge for the ETH/USDT pair.

As well as, the each day lively tackle remained comparatively unchanged regardless of the dip in OBV seen on the 2-hour value chart.

Subsequently, buyers ought to monitor a convincing CMF break beneath the zero mark to verify an additional downtrend earlier than coming into any brief positions. As well as, a bullish BTC would invalidate the bias and tip ETH for an uptrend; therefore value monitoring too.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)