Glassnode has identified a weird consistency between the present and former Bitcoin cycles when it comes to a metric, right here’s what.

Bitcoin Breaks Above 200-Day Easy Transferring Common Line

A “easy shifting common” (SMA) is an analytical device that produces a median of any given amount over a selected time period. As its identify already implies, it strikes together with the amount and modifications its worth accordingly.

SMAs could be fairly helpful for learning long-term developments, as they easy out the curve and filter out any short-term fluctuations within the related amount that haven’t any bearing on the longer developments anyhow. As is normally the case with instruments like these, an SMA could be taken for any size of time, however a couple of intervals like 7 days and 30 days typically discover probably the most use.

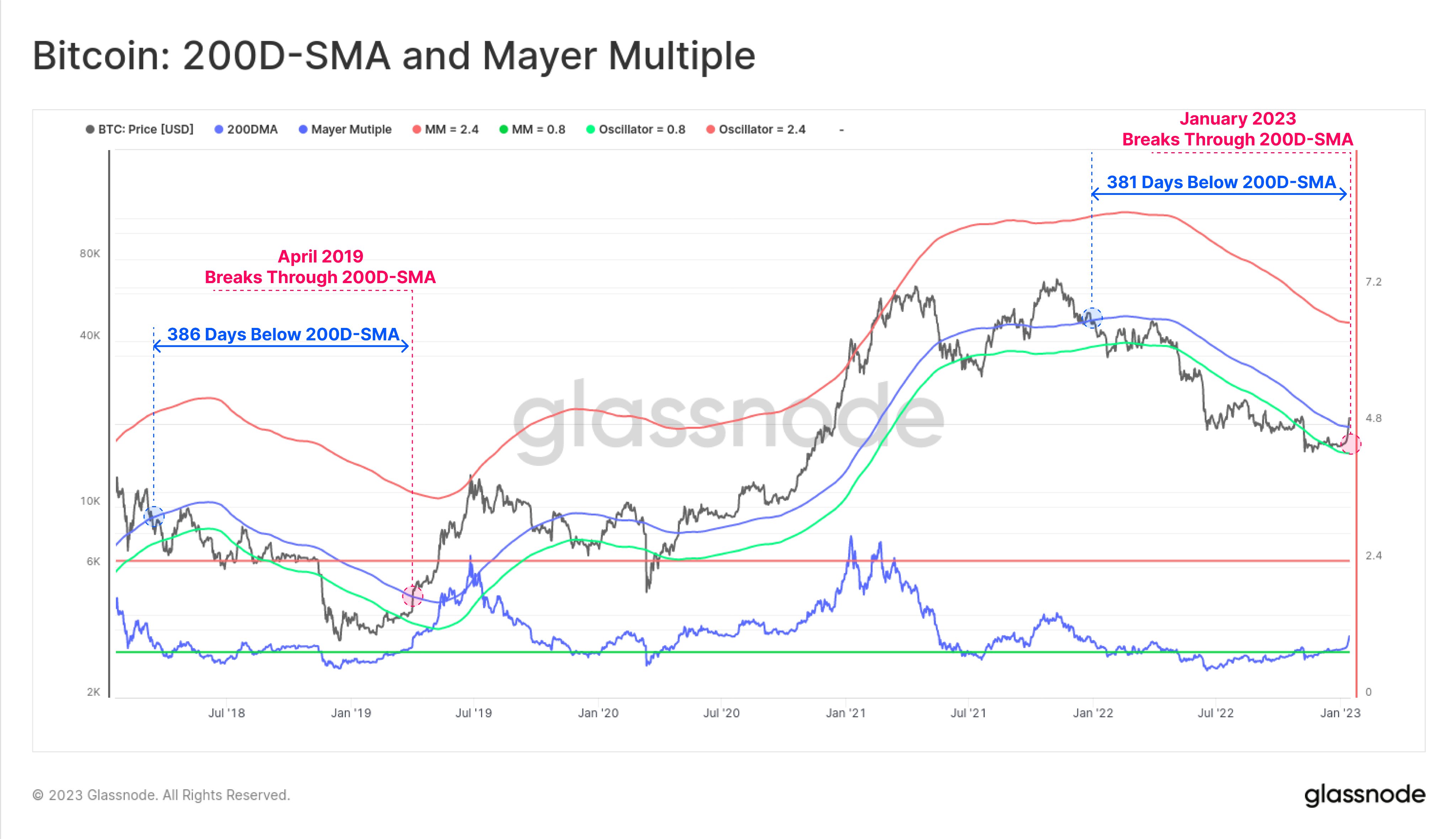

In accordance with knowledge from the on-chain analytics agency Glassnode, BTC has spent 381 days underneath its 200-day SMA curve on this cycle. The 200-day SMA is a vital line for BTC as each the bear-to-bull and vice versa transitions have traditionally taken place with breaks above or beneath this stage.

Here’s a chart that exhibits the pattern within the 200-day SMA for Bitcoin over the previous few years:

The worth of the crypto appears to have damaged above the 200-day SMA in current days | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin worth had dipped beneath the 200-day SMA across the begin of the bear market and had stayed there till very lately. In whole, the crypto had spent 381 days beneath this stage, earlier than the newest rally got here alongside and helped the coin lastly escape above this line.

Within the chart, Glassnode has additionally highlighted the pattern for the metric in the course of the earlier bear market. It seems like in that cycle as properly, the crypto’s worth had declined beneath the 200-day SMA because the bear started to take maintain. Additionally, the eventual break above the extent results in the tip of the bear marketplace for the coin again then.

Nonetheless, probably the most fascinating of all is the period that Bitcoin stayed beneath this stage in that cycle: 386 days. Amazingly, that is very almost the identical variety of days (381) that BTC took to interrupt above the road within the present cycle.

If this weird consistency is something to go by, then the newest push above the 200-day SMA may imply the present bear market may be finished as properly.

The chart additionally exhibits knowledge for an indicator referred to as the “Mayer A number of” (MM) which gauges the present distance between the value of Bitcoin and the 200-day SMA. Its worth is solely calculated by dividing the worth of the crypto by the 200-day SMA. Bottoms within the crypto have normally taken place beneath the 0.8 MM stage, which BTC is now firmly above.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $20,800, up 21% within the final week.

BTC consolidates slightly below $21,000 | Supply: BTCUSD On TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Glassnode.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)