On-chain information exhibits the Bitcoin alternate whale ratio has sharply declined just lately, an indication which will show to be bullish for the value of the crypto.

Bitcoin 7-Day MA Alternate Whale Ratio Has Quickly Gone Down Not too long ago

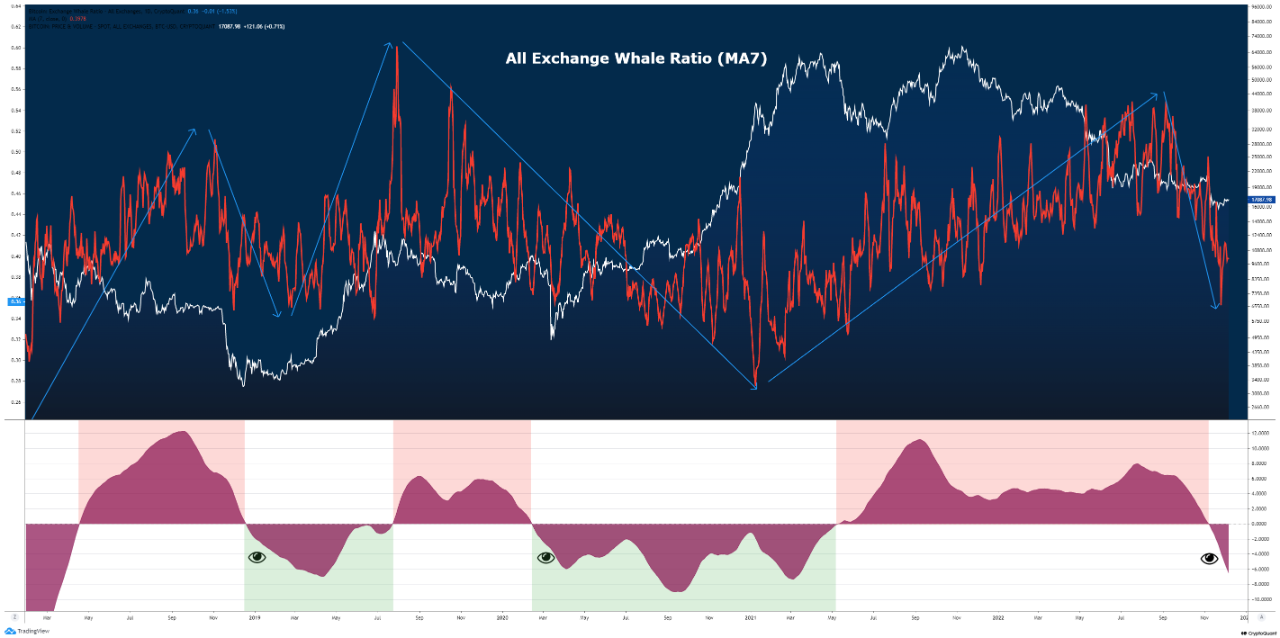

As identified by an analyst in a CryptoQuant post, the metric additionally noticed the same decline through the finish of 2018.

The “alternate whale ratio” is an indicator that measures the ratio between the sum of the highest ten transactions going to exchanges, and the whole alternate inflows.

The ten largest transfers to exchanges are assumed to be coming from the whales. So, this ratio tells us what a part of the whole alternate inflows is being contributed by these humongous holders proper now.

When the worth of this metric is excessive, it means nearly all of the inflows are made up by whales presently. Since one of many essential causes buyers deposit to exchanges is for promoting functions, such values may very well be an indication that whales are dumping massive quantities, and may therefore be bearish for the value of the crypto.

Then again, the indicator having low values suggests whales are making a more healthy contribution to the inflows, and will thus be both impartial or bullish for the worth of BTC.

Now, here’s a chart that exhibits the development within the 7-day shifting common Bitcoin alternate whale ratio over the previous few years:

Appears just like the 70-day MA worth of the metric has been sharply falling off in current weeks | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin alternate whale ratio had a reasonably excessive worth just some months again.

Nonetheless, since then, the indicator has been observing some speedy downtrend, and the ratio has now attained fairly tame values.

Which means that whales have been lowering their influx volumes just lately, suggesting that promoting stress from them could also be getting exhausted.

The quant has additionally highlighted the development within the alternate whale ratio through the earlier Bitcoin cycle within the chart. It looks as if the same downtrend as now was additionally seen again in late 2018, when the underside of that bear market fashioned.

The analyst notes that whereas it’s inconceivable to say if the present sharp decline within the whale ratio means the underside is in for this cycle as nicely, it’s probably that at the very least the volatility will now start to chill down.

BTC Value

On the time of writing, Bitcoin’s worth floats round $16.8k, down 1% within the final week.

BTC has declined through the previous day | Supply: BTCUSD on TradingView

Featured picture from Thomas Lipke on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)