Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- Lengthy and short-term ETH holders noticed positive aspects

- If BTC’s bearish sentiment persists, ETH may discover new assist at $1217.22 and $1166.83

Ethereum [ETH] witnessed a drop simply because it headed into the weekend. It misplaced the $1,300 psychological degree after Bitcoin [BTC] struggled to commerce above $17K. At press time, ETH was buying and selling at $1270.69 and will proceed on a downtrend all through the weekend primarily based on the technical evaluation indicators.

If the bearish momentum persists, ETH may discover new assist ranges at $1,217.22 and $1,166.83.

Learn Ethereum’s [ETH] worth prediction 2023-2024

ETH fails to interrupt the $1306 resistance once more: Will bears take full management?

Supply: TradingView

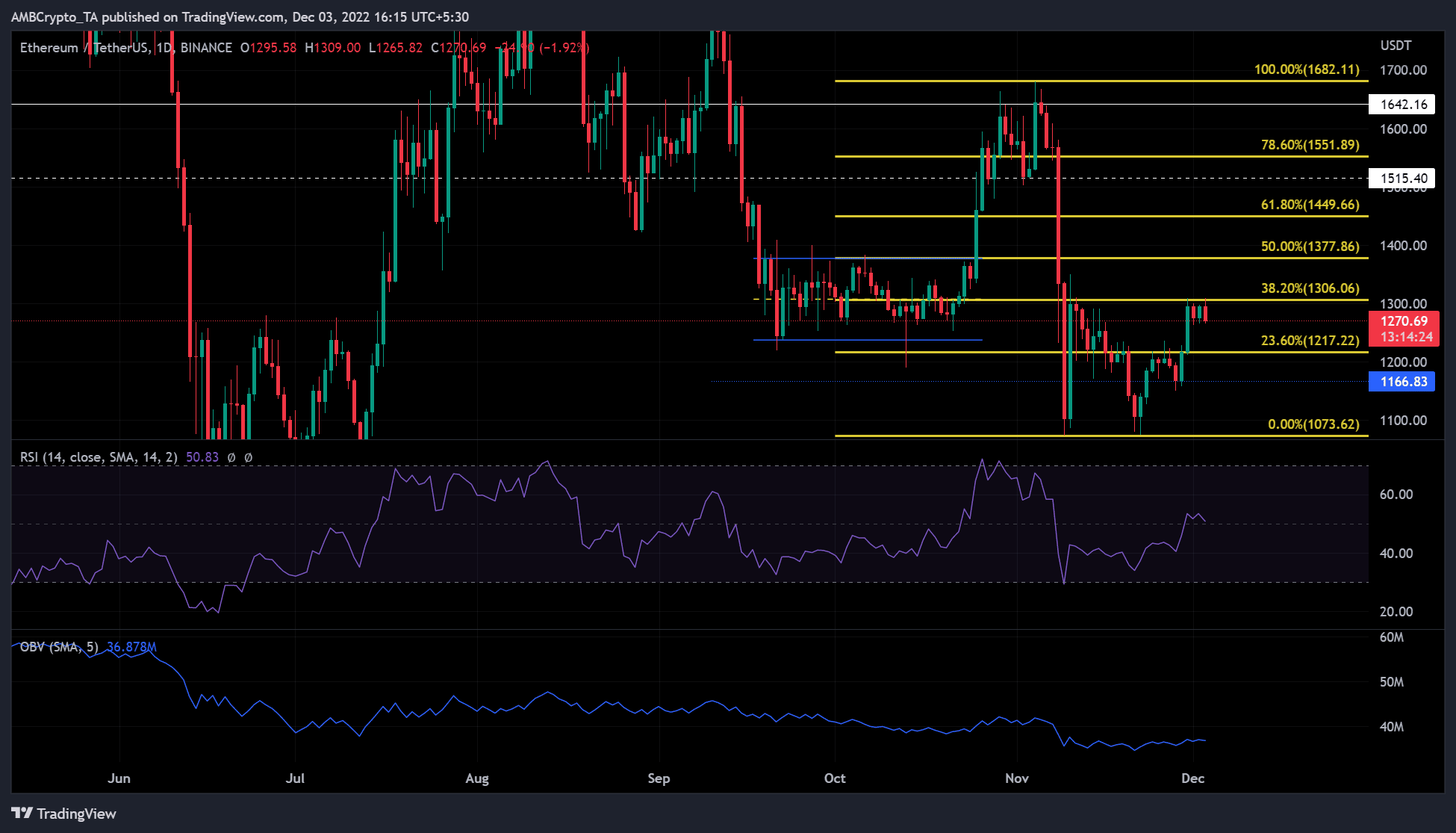

ETH has been working throughout the $1,239 – $1,378 vary throughout September and October. An upside breakout from the vary led ETH to pump by over 20%, reaching a excessive of $1,682.11 in early November. However the market crash pressured a downtrend that led to huge worth correction the final time ETH tried a rally.

At press time, ETH confronted vital resistance on the 38.2% Fib degree, which additionally doubled as a bearish order block. Technical indicators recommended that ETH may drop additional. The Relative Power Index (RSI) moved sideways and rested on the 50-neutral degree with a drop in thoughts. This confirmed that consumers’ exhaustion may give sellers extra leverage.

Moreover, the On-Stability Quantity (OBV) additionally moved sideways after forming a delicate slope upwards. It confirmed an absence of serious buying and selling volumes to again shopping for strain. Thus, shopping for strain could possibly be undermined. Subsequently, ETH may head down and decide on new assist ranges at $1,217.22 and $1,166.83.

Nonetheless, an intraday shut above $1306.06 will invalidate the above bearish bias. In such a case, ETH may set sail northwards regardless of quite a few obstacles towards the 100% and 78.6% Fib pocket ranges.

Quick and long-term ETH holders noticed income, however ….

Supply: Santiment

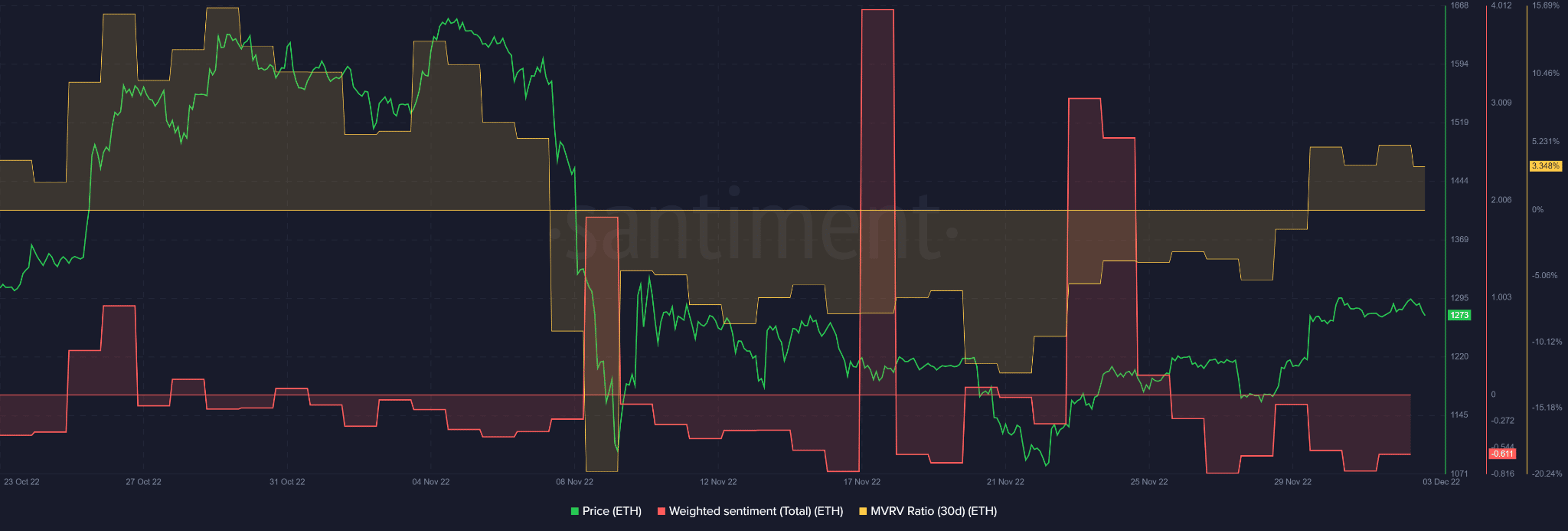

Regardless of the current bearish sentiment, ETH posted positive aspects to its brief and long-term holders. For instance, the 30-day Market Worth to Realized Worth (MVRV) was optimistic from 29 November. This confirmed that short-term ETH holders made income for the reason that finish of November.

Sadly, ETH noticed a unfavorable sentiment on the time of publication that might delay additional uptrend momentum. Thus, promoting strain could construct over the weekend and early subsequent week if BTC’s sentiment stays bearish.

Nonetheless, if BTC regains $17K and maintains upward momentum, ETH’s market construction could have a transparent bullish route. Subsequently, ETH traders ought to be cautious and ideally make a transfer if the market route is far clearer.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)