Over time, the crypto market has maintained an in depth relationship with the inventory market. Ethereum, the second-largest cryptocurrency, rose in lockstep with U.S. shares for the primary time in February. Because of this, the token’s 40-day correlation coefficient with the S&P 500 reached 0.65.

Regardless of the brake anxious traders have placed on worth exercise previously week, the Ethereum (ETH) worth is poised to rise over the weekend. Though buying and selling quantity has elevated during the last week, and thus ought to have resulted in additional constant fluctuations, worth responsiveness has been affected by geopolitical information, earnings, and inventory market whipsaws.

Ethereum Value Witnesses Turbulence

The value of Ethereum has had a grueling week for traders and merchants, with giant swings in response to earnings, geopolitical occasions, and traders turning from risk-on to risk-off like a lightweight swap. However with volatility comes alternative, and as all of those occasions wind down in direction of the weekend, bulls could have the playground to themselves and may drive the value as much as $3,500 in the event that they decide the precise entry ranges. Count on the RSI to rise over 50 once more, with a number of room earlier than buying and selling into overbought territory.

In keeping with statistics from Santiment, a crypto market habits evaluation software, Ethereum has a powerful (+ve) correlation with the S&P 500 index. Following a 1.8 p.c drop within the S&P 500 index’s figures, the value of ETH elevated by 3%.

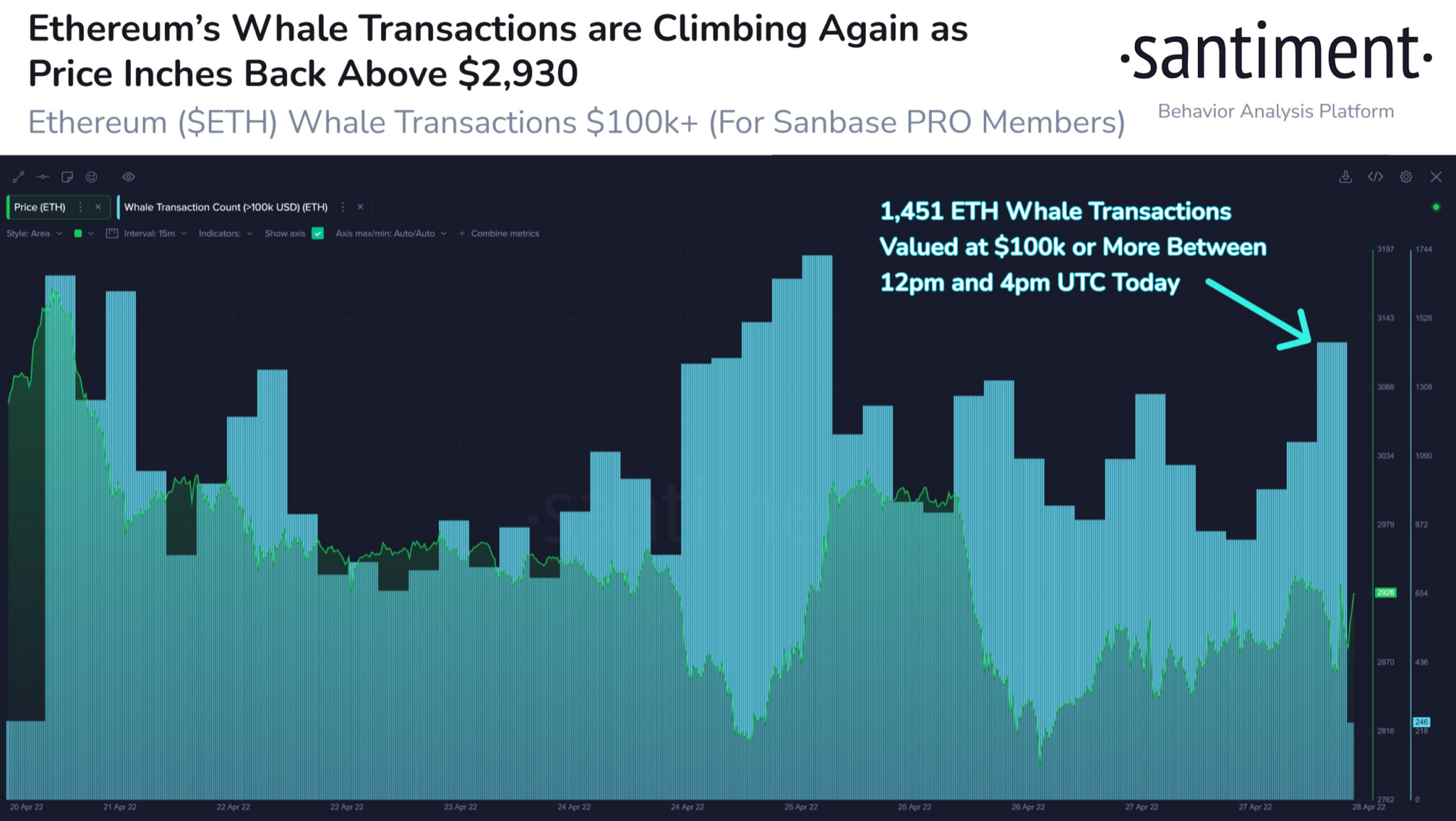

Supply: Santiment

The tweet from April twenty ninth added,

“Aided by a +1.8% day within the SP500, Ethereum has jumped again above $2,930 with its tight correlation to equities markets.”

Now, as seen within the graph above, ETH’s strongest patrons, the whales, have retaliated by shopping for further ETH. On that day, the variety of whale transactions value greater than $100,000 surged dramatically.

In a four-hour interval, 1,451 such transactions have been documented. The bounce, in line with Santiment, prompt that key stakeholders have been listening to the value improve.

Recommended Studying | Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum

Is Equities Market Correlation Good For ETH?

This wasn’t the primary time ETH had proven indicators of a creating relationship with the inventory market. The 2 sank collectively on March thirty first, as reported three weeks earlier, however started climbing once more after April 1st. Ether surged in tandem with the SP500 since mid-March.

Each optimistic state of affairs within the crypto-verse is accompanied with a unfavourable counterpart. That’s, in any case, a truth. This situation isn’t any exception. Crypto’s sturdy affiliation with equities, specifically, may work wonders. Completely different respected entities, however, have censored cautionary conditions for a similar.

ETH/USD has remained under $3k. Supply: TradingView

Arthur Hayes, the previous CEO of BitMex, raised warning flags about this hyperlink on this occasion. Surprisingly, the inventory market seems to be headed for an enormous drop via 2022 because the Federal Reserve tightens financial coverage to battle inflation.

Associated Studying | Bitcoin Futures Foundation Nears One-12 months Lows, How Will This Have an effect on BTC?

Featured picture from Pixabay, Santiment, chart from TradingView.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)