Ethereum[ETH] kicked off this week with a slowdown of the bullish momentum that it delivered final week. Traders are actually leaning in the direction of the aspect of warning particularly because the market enters one other uncertainty interval. The upcoming FOMC assembly may need quite a bit to do with the present end result.

Right here’s AMBCrypto’s value prediction for Ethereum [ETH] for 2022-2023

ETH buyers are doubtless ready for the FOMC assembly. This was as a result of the result might decide how the charges bulletins will sway market sentiment. In the meantime, Glassnode’s current alerts revealed that ETH fuel charges simply reached a four-week low.

📉 #Ethereum $ETH Complete Fuel Utilization (7d MA) simply reached a 1-month low of 4,542,790,690.964

View metric:https://t.co/dtnQHnd45B pic.twitter.com/BBLDE7YF1F

— glassnode alerts (@glassnodealerts) October 31, 2022

The low fuel charges noticed in the previous couple of hours confirmed the drop in investor buying and selling exercise associated to ETH. The Glassnode evaluation crew additionally noticed a drop within the variety of Ethereum addresses holding greater than 32 ETH. This determine reportedly dropped to new a month-to-month low. Might these observations level in the direction of decrease demand for ETH?

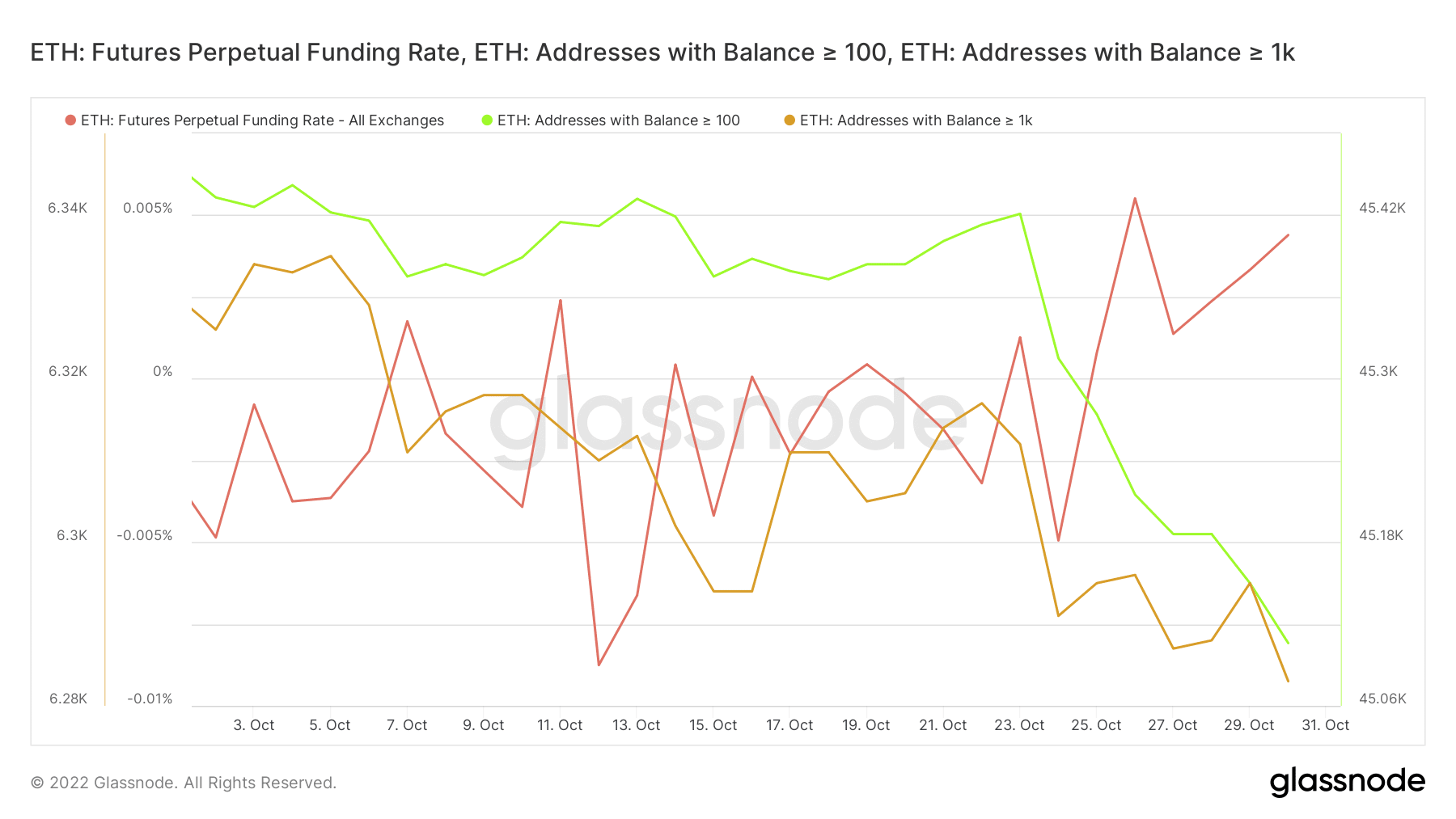

The above observations underscore much less demand for ETH available in the market. A take a look at whale addresses confirmed this. For instance, ETH addresses holding between 100 and 1,000 cash dropped considerably throughout the weekend.

Supply: Glassnode

Nonetheless, the demand within the derivatives market painted a special image. Its futures perpetual funding charge did drop barely after hitting a month-to-month excessive on 26 October. This was notably across the identical time that ETH’s value grew to become overbought. It regained the upside a day later, and noticed a big improve since then. The futures funding charge might have behaved this fashion on account of a rise in bearish positions.

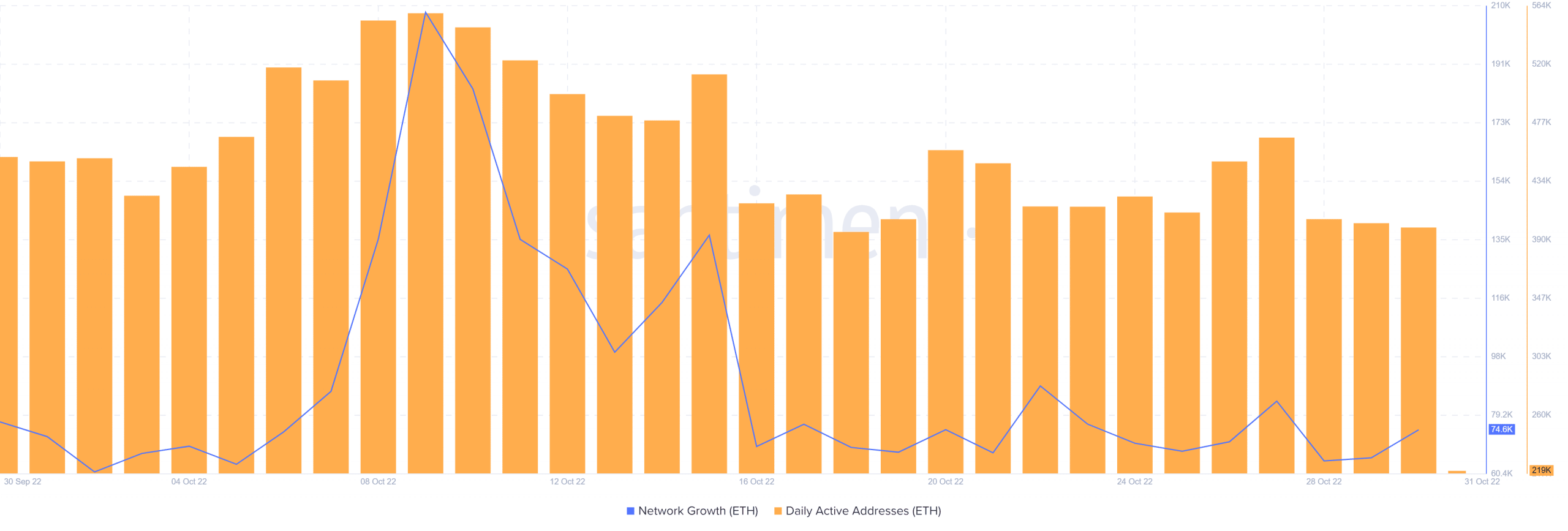

Ethereum’s every day energetic addresses additionally skilled a big decline within the final 4 days in step with the return of uncertainty. Community progress noticed a rally final week however have dropped out barely in the previous couple of days.

Supply: Santiment

These observations have been per the noticed drop in buying and selling exercise throughout the weekend after final week’s rally. One other potential purpose may very well be the that purchasing stress dropped barely when the value pushed into the overbought zone.

ETH’s value motion has been experiencing resistance above the $1,600 value stage particularly within the final three days. This may very well be thought of as a sign of decrease bullish demand, in addition to elevated promote stress.

Supply: TradingView

Moreover, ETH noticed some outflows within the final two days after its current peak. Nonetheless, the selloff has notably been low, suggesting that many merchants opted to carry on to the prospects of extra upside.

Traders at present questioning whether or not it’s nonetheless time to purchase ETH might wish to maintain off on that buy. The FOMC-related uncertainty means we would see a possible selloff this week, undoing current good points. The truth that some whales had additionally been lowering their balances additionally underscored the potential of extra value slippage.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)