Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- Ethereum noticed a big promoting quantity and shifted the decrease timeframe construction to bearish

- Technical indicators and futures merchants each confirmed additional losses have been attainable

On the time of writing, the earlier 24 hours had seen $357 million value of positions liquidated throughout main crypto exchanges. Ethereum [ETH] noticed $90 million and shed almost 9% of its worth on this interval.

Right here’s AMBCrypto’s value prediction for Ethereum [ETH] for 2022-2023

Bitcoin fell under the $20k degree and a number of altcoins posted losses in double-digit percentages within the twelve hours previous the time of writing.

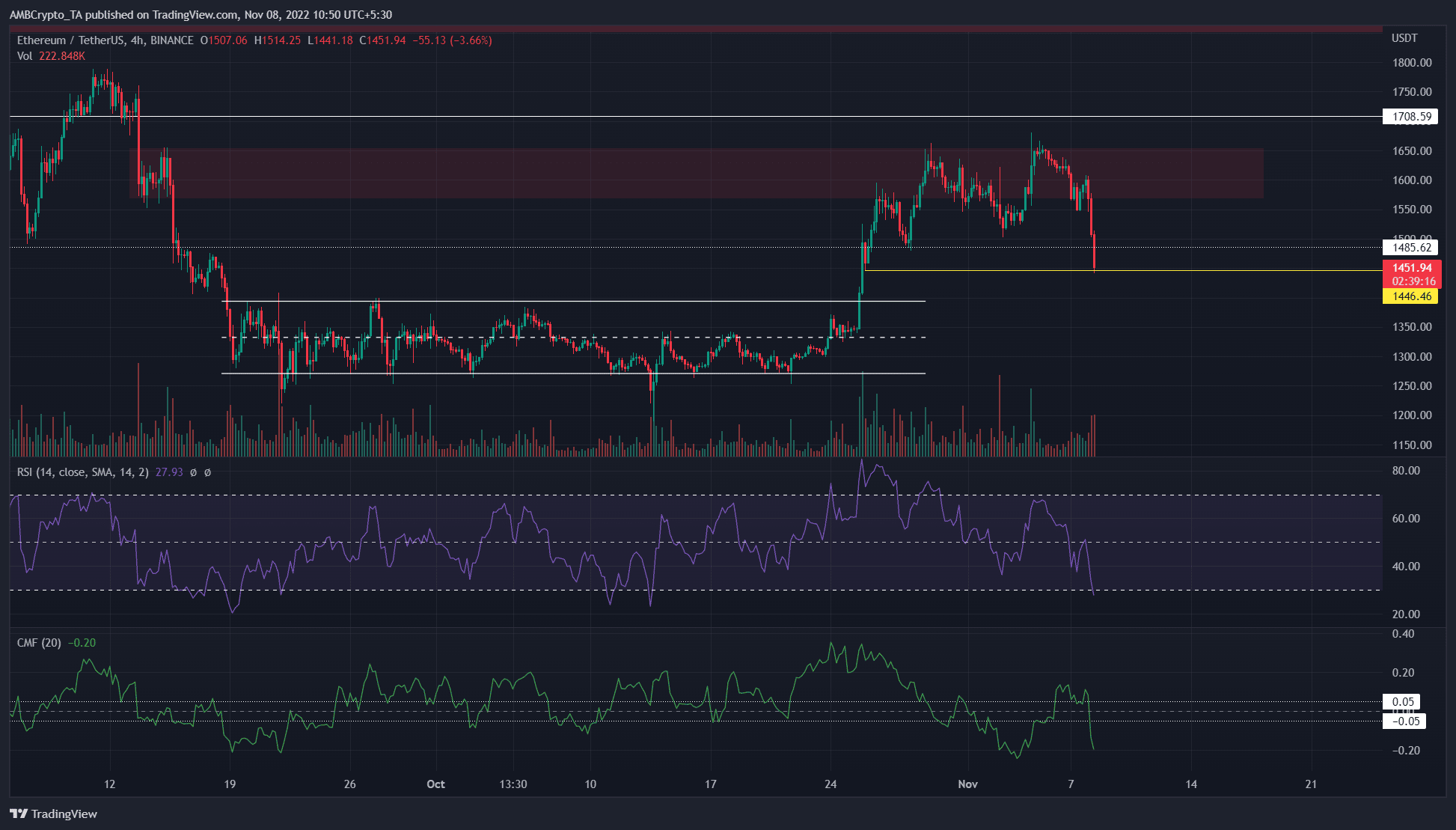

$1446 could possibly be a vital degree for the bulls to defend within the coming hours

Supply: ETH/USDT on TradingView

The 2-hour chart confirmed ETH breaking its construction from bullish to bearish up to now few days. Subsequently, decrease lows have been shaped.

On the day by day timeframe, a bearish order block was noticed within the neighborhood of $1,650. Marked in crimson, this area posed substantial resistance to Ethereum over the previous 12 months.

ETH was merely unable to push above $1,650. A latest article highlighted how a push above $1,650 might see ETH surge increased. This didn’t materialize, as a rejection close to the $1,650 mark occurred as a substitute. On the decrease timeframe, one other belt of assist lay at $1,446-$1,495.

For ETH, an hourly session shut under $1,446 might gasoline the bearish sentiment. Alternatively, a protection of the bullish order block that prolonged as much as $1,495 could be an indication that bulls had begun to purchase in earnest.

The Relative Energy Index (RSI) retested impartial 50 as resistance yesterday and confirmed robust bearish momentum. The Chaikin Cash Move (CMF) additionally fell under -0.05 to focus on heavy capital stream out of the market in latest hours.

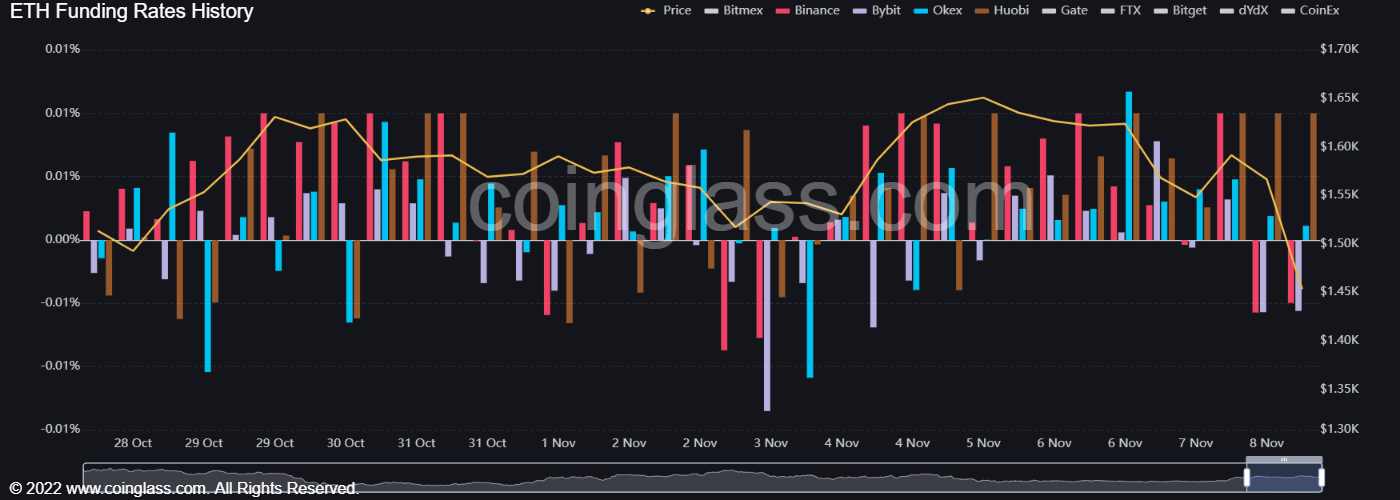

Funding price shift reveals bearish sentiment dominance in latest hours

Supply: Coinglass

The buying and selling day of seven November noticed the funding price of the Ethereum change from constructive to detrimental on Binance and Bybit. This confirmed that, on a few of the main exchanges no less than, the sentiment favored the bears. Alongside the autumn in value, the Open Interest behind Ethereum additionally fell.

Moreover, technical findings confirmed that $1,446-$1,495 could be an essential zone of assist for Ethereum over the following day or two. A session shut under $1,450 might see ETH descend to $1,365.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)