Ethereum has plunged beneath $1.3k at the moment, however the decline might not be over fairly simply but as on-chain information reveals promoting strain continues to rise out there.

Ethereum Alternate Inflows Have Continued To Go Up Throughout The Previous Day

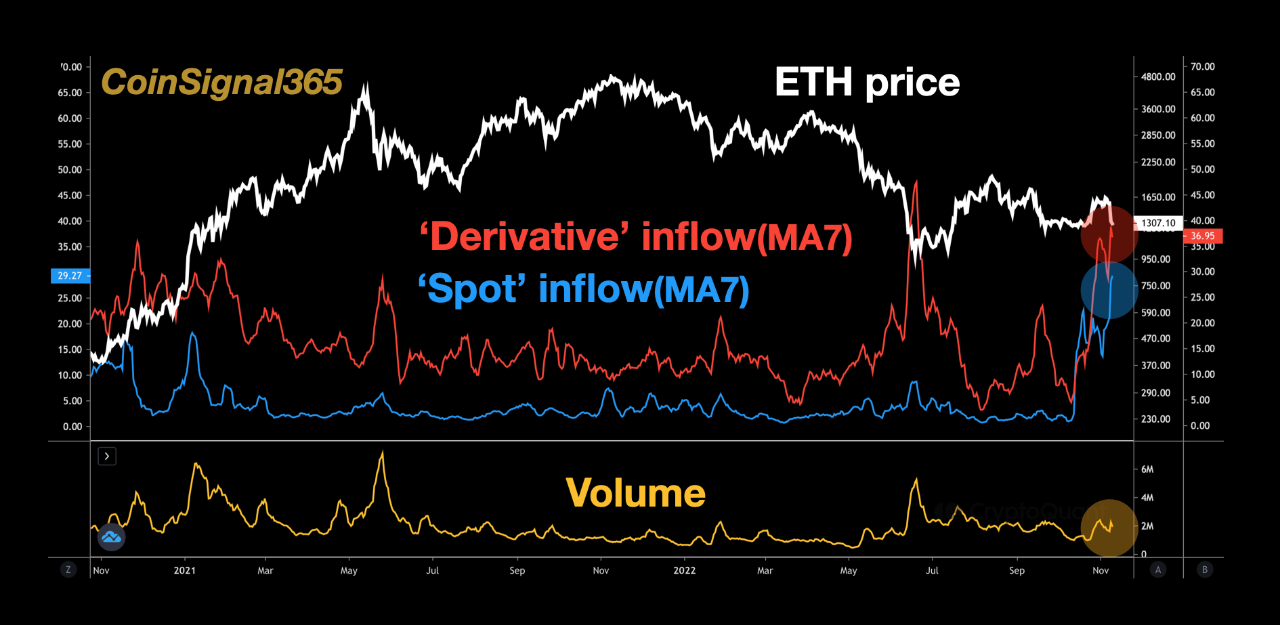

As identified by an analyst in a CryptoQuant post, the ETH by-product and spot alternate inflows are each nonetheless on the rise.

The “alternate influx” is an indicator that measures the full quantity of Ethereum coming into into the wallets of centralized exchanges.

There are two variations of this metric, the primary notes the inflows particularly going to by-product exchanges, and the opposite registers solely these transfers which are shifting to identify exchanges.

Typically, an increase within the by-product inflows results in greater volatility out there, because it implies that new futures positions are opening up, and leverage is growing.

Spikes within the spot inflows can have direct bearish results on the value of the crypto as traders often deposit to those exchanges for promoting functions.

Now, here’s a chart that reveals the pattern in each the Ethereum alternate influx indicators (7-day shifting averages) over the previous 12 months:

The 7-day MA values of the 2 metrics appear to have been fairly excessive in current days | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Ethereum alternate inflows (each sorts) spiked up simply earlier than the crash shook the market.

On this newest drawdown within the worth, the crypto has gone from $1.6k all the way in which down to only $1.2k during the last couple of days.

The principle spark behind this crash appears to have been the battle between FTX and Binance, which has come to an finish with Binance shifting to accumulate FTX.

Nevertheless, it appears to be like just like the inflows nonetheless haven’t cooled off but. Slightly, the symptoms appear to be truly climbing up much more.

This implies that Ethereum is continuous to expertise promoting strain, an indication that the present degree might not be the underside, and the crypto’s worth may observe additional decline within the coming hours.

ETH Worth

On the time of writing, Ethereum’s worth floats round $1.2k, down 21% within the final week. Over the previous month, the crypto has dropped 8% in worth.

Under is a chart that reveals the pattern within the worth of the coin during the last 5 days.

Seems like the worth of the crypto has been plunging down over the previous day | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)