Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- ETH traders loved at the very least 30% good points within the final two weeks

- ETH short-term merchants may have some leverage given ETH’s newest upside

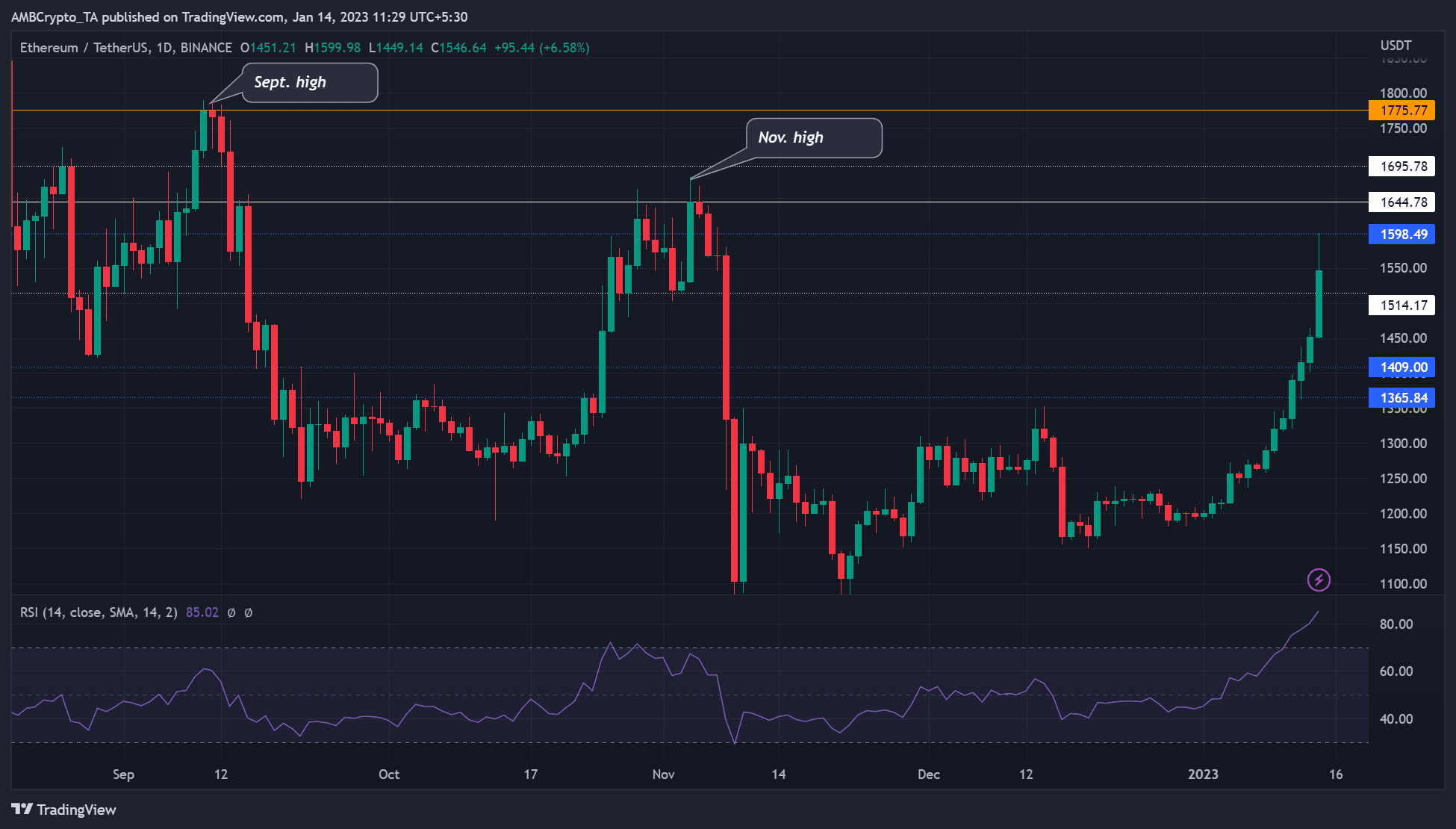

Ethereum [ETH] supplied traders over 30% good points up to now two weeks. It rallied from $1,190 to a excessive of $1,598. The rally put ETH an inch away from its November excessive of $1,680.

With a bullish BTC following eased US inflation charges, ETH may purpose at $1,644 or go above it. At press time, ETH was buying and selling at $1,550, whereas BTC was buying and selling under a short-term bearish order block at $20,956.

If BTC closes above $21K, ETH bulls could possibly be incentivized to reclaim its November excessive.

Learn Ethereum’s [ETH] Value Prediction 2023-24

The November excessive of $1,680

Supply: ETH/USDT on TradingView

ETH peaked at $1,680 earlier than FTX implosion compelled a wide-market crash, dropping it to a low of $1,100, a 35% plunge. Nonetheless, a month and a half later, ETH appears on a path to recovering all of the losses made after the November crash.

ETH was extremely bullish on the every day chart and will retest or break above November’s bearish order block at $1,644.78 within the subsequent few hours/days. Such a transfer will enable ETH holders to recuperate all of the losses incurred after the November market crash.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Nonetheless, if bears achieve extra affect out there, ETH may drop to $1,514.17, invalidating the bullish bias described above. Due to this fact, quick merchants ought to solely wager in opposition to ETH’s uptrend if it drops under $1,514 to reduce threat.

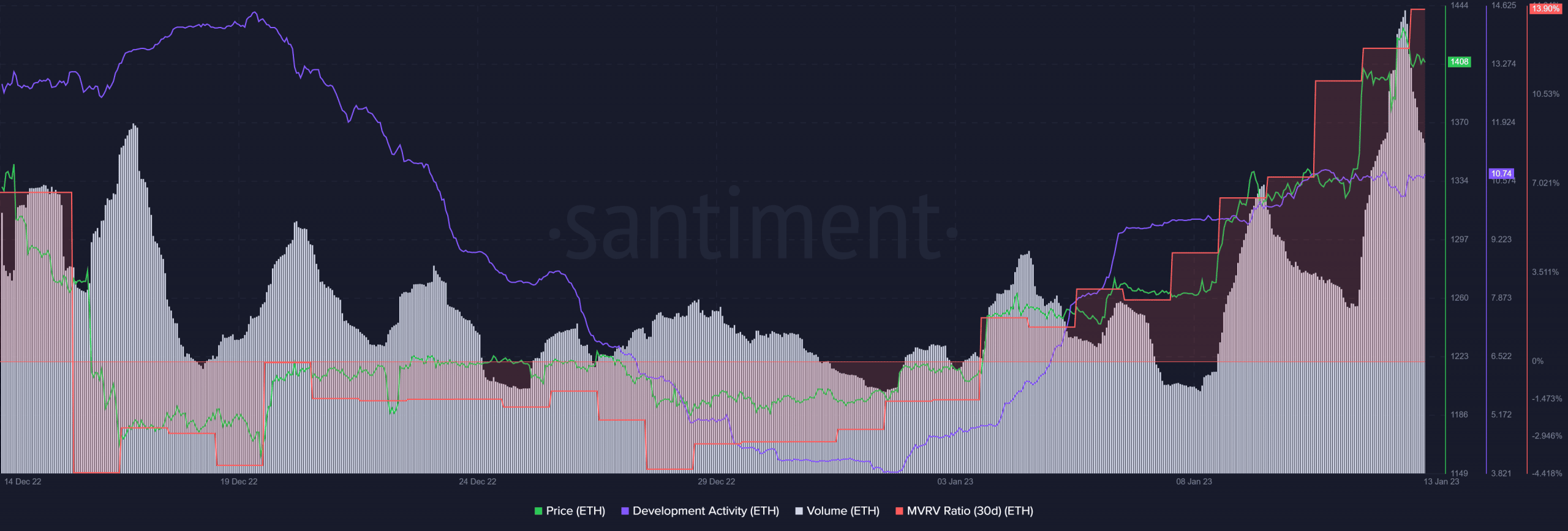

Quick-term ETH holders made income as buying and selling volumes elevated

Supply: Santiment

In line with Santiment, the 30-day market worth to realized worth (MVRV) ratio has been optimistic since 4 January and climbed even greater. This indicated that short-term merchants noticed incremental good points from January 4. Nonetheless, long-term holders (365-day MVRV) have been but to cross above the impartial line; therefore they have been but to put up any good points.

ETH’s growth exercise additionally recorded a gradual enhance up to now two weeks. This indicated that builders stored constructing the community in the identical interval. This might enhance traders’ confidence and additional prop up ETH’s worth in the long term.

As well as, ETH’s buying and selling quantity elevated in the identical interval however dropped sharply at press time. Though the drop may undermine uptrend momentum within the quick run, ETH volumes may enhance if BTC is bullish.

Due to this fact, traders ought to monitor BTC, particularly if it strikes above $21K. Such a transfer would set ETC to reclaim its November excessive.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)