Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- Ethereum pushes upward however nears increased timeframe resistance ranges

- Bulls can look to trip the development upward however should even be eager on reserving earnings

Every week in the past, Ethereum [ETH] flipped the $1,485 mark from resistance to help. Since then, it has posted features of 10.9% and rising at press time. With Bitcoin [BTC] additionally trying bullish, it appeared like your entire crypto market had a bullish outlook within the coming days.

Right here’s AMBCrypto’s Worth Prediction for Ethereum [ETH] in 2022-2023

NFT buying and selling volumes additionally took successful in October, however the variety of distinctive merchants rose by 18% in October. This recommended demand was nonetheless going robust within the NFT market.

To date, so good for the bulls who can now be careful for $1800 and $1950

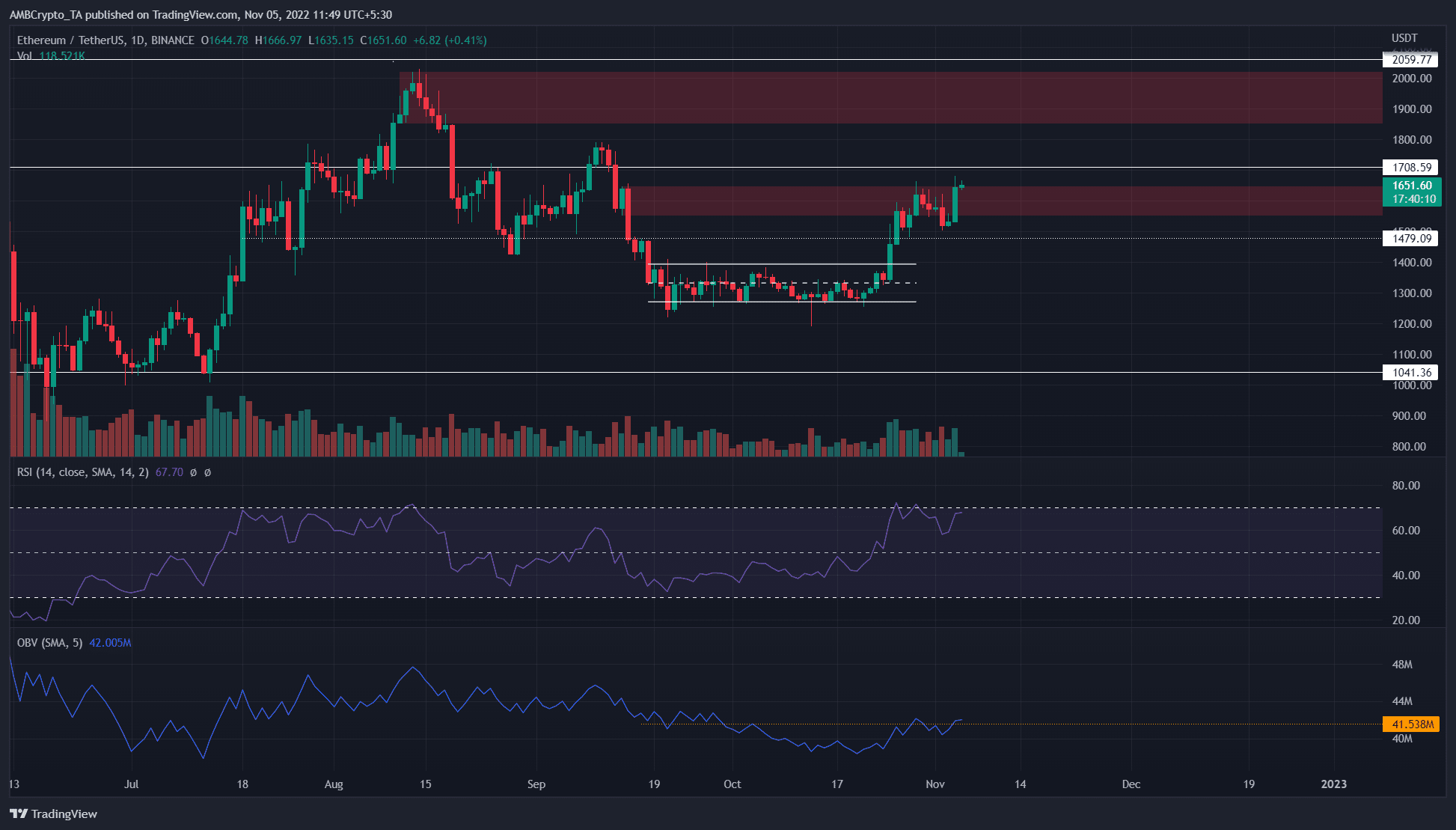

Supply: ETH/USDT on TradingView

Ethereum shaped a variety (white) between $1,270 and $1,390 in September and October. The breakout from this vary noticed ETH surge to $1,600, however the buying and selling quantity was not significantly excessive. The On-Steadiness Quantity (OBV) didn’t see a pointy transfer upward both, which recommended that purchasing stress won’t be robust sufficient to reverse the upper timeframe downtrend.

The OBV was in a position to crest a resistance stage from the previous six weeks, which supported the rally of the previous two weeks. On the time of writing, the value was above the bearish order block shaped in early September. This could doubtless encourage consumers, and one other transfer increased was doubtless.

However how a lot increased? The $1,800 stage additionally rests close to a resistance area and has a bearish order block on the every day timeframe. The $1,950 mark additionally represented an space the place sellers could be dominant. Though the Relative Energy Index (RSI) recommended a purchaser dominated market and the construction was bullish, $1,800 and $1,950 is likely to be ranges to be careful for.

Prudent merchants can contemplate taking revenue in these areas, whereas decrease timeframe merchants can search for a flip of those resistances to enter lengthy positions.

MVRV on the rise previously 5 months

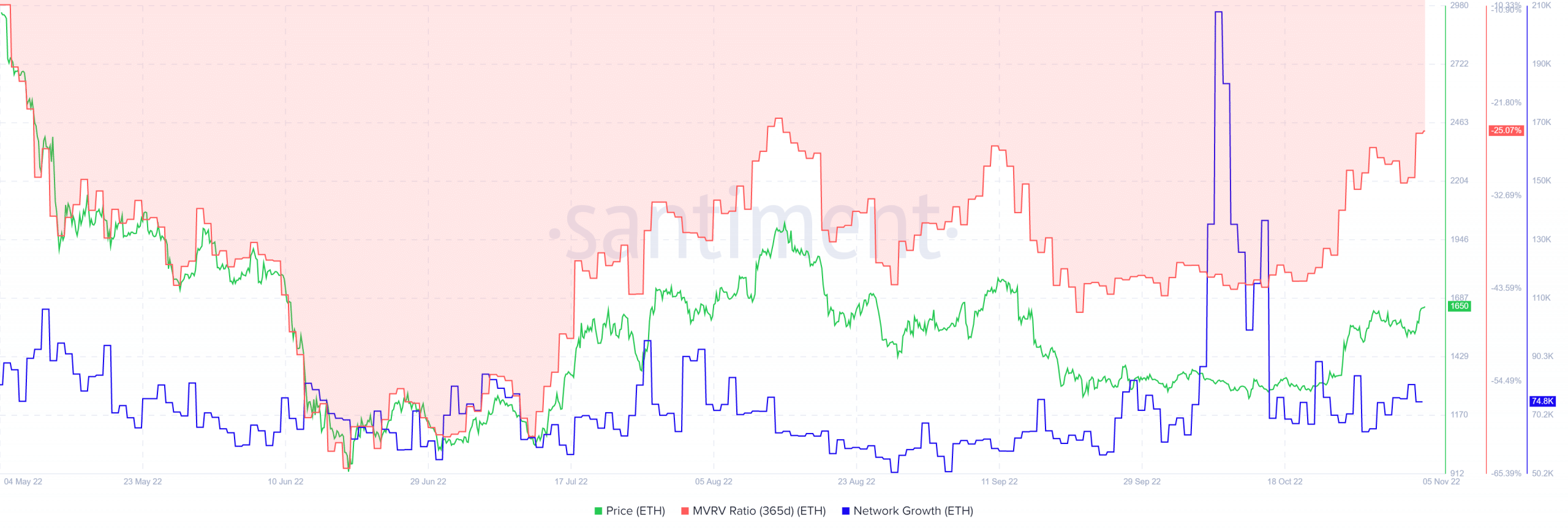

Supply: Santiment

The 365-day Market Worth to Realized Worth (MVRV) touched a close to four-year low at -60% in June 2022. Since then, the MVRV ratio has slowly climbed increased, regardless that Ethereum didn’t set up a powerful development but. This recommended {that a} good portion of the consumers of the previous 12 months had been nonetheless at a loss, however some accumulation has occurred in current months.

Community development additionally shaped a sequence of upper lows in current months, which confirmed that person adoption was on the rise. This was a constructive discovering for the longer-term buyers.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)