Knowledge from Coingecko, on the time of writing, data a slight restoration for Ethereum and huge cryptocurrencies. The second crypto by market cap has been trending to the draw back over the previous weeks and was seeing briefly breaking under $1,000 on sure venues.

Associated Studying | TA: Ethereum Might Resume Decline Beneath $1,100, Bears In Management

On the time of writing, Ethereum (ETH) trades at $1,180 with a 35% loss previously 7-days. In keeping with economist Alex Krüger, ETH’s worth data a 20% loss and 20% revenue throughout at present’s buying and selling session which could possibly be a primary within the cryptocurrency’s historical past.

$ETH has put in a 20% intraday spherical tripper at present.

20% down, then 20% up.

Undecided if this has ever occurred earlier than.

— Alex Krüger (@krugermacro) June 15, 2022

Just like Bitcoin, Ethereum is reacting to the draw back of the macroeconomic scenario. Because the U.S. Federal Reserve (FED) introduced a 75 foundation factors improve in rates of interest, preceded by a cascade of liquidations and detrimental information for the crypto market, BTC and ETH have been capable of regain some bullish momentum.

Doubtlessly pushed by overextended promoting stress, and panic amongst crypto buyers, ETH’s worth bounced again from round $1,000 to its present ranges. Krüger believes the present worth motion is a part of a well-established market sample:

(…) since December. Hawkish market expectations => costs tank in anticipation => hawkish FOMC => belongings rally. Partially priced in one thing. Not a meme. This has been so constant it’s developed right into a sample. It received’t final eternally.

The market might see extra volatility within the coming days. Krüger believes the market might proceed to positively react to the FED’s announcement because it was inside expectations. Thus, the bounce might see some continuation. He added:

Market favored hawkish Powell. Quick charges greater (in response to elevated hawkishness), lengthy charges decrease (in response to elevated credibility within the Fed’s capability to reign in inflation). Hoping this sticks and we get continuation.

Ethereum Sees Quick-Time period Shopping for Stress

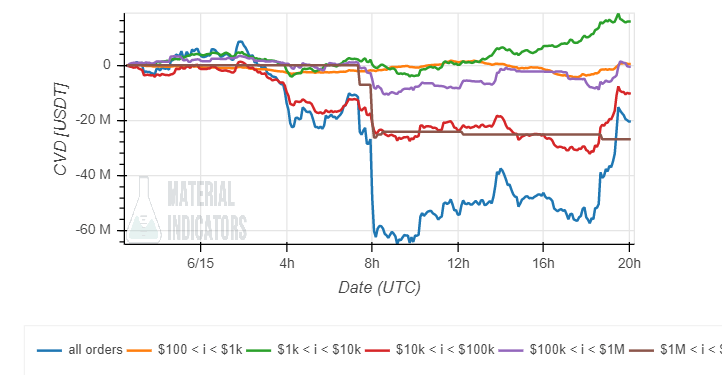

Knowledge from Materials Indicators (MI) data a rise in shopping for stress for ETH on crypto change Binance. In decrease timeframes, nearly all invertors lessons shifted from promoting to purchasing the present worth motion.

Associated Studying | Tron Falls Sharply As Solar Scrambles To Save Stablecoin

This might contribute to ETH’s present momentum and probably push the cryptocurrency to earlier ranges. Nevertheless, ETH whales (in brown on the chart under) offered into at present’s worth motion and will get in the best way of any sustainable restoration.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)