- Ethereum witnessed a decline in NFT transactions, however blue-chip collections did effectively

- Ethereum noticed help from retail and enormous traders

NFT transactions on Ethereum have declined considerably, from 22% NFT dominance to eight.3% based on crypto analytics agency Glassnode. However, stablecoin transactions grew and took up the house initially conquered by NFTs. This declining curiosity from merchants might have an effect on the general NFT market negatively.

NFTs on #Ethereum accounted for 18% to 22% of transactions throughout H1-2022.

Nonetheless NFT dominance has since declined to only 8.3%, as curiosity within the house wanes through the bear market.

Stablecoin dominance has spiked since FTX from 10% to 12.5%.

Chart: https://t.co/m0UL2Xo7J5 pic.twitter.com/PgImnSIkRK

— glassnode (@glassnode) December 5, 2022

Learn Ethereum’s [ETH] Value Prediction 2023-2024

NFT blue chips stay unaffected

Regardless of the declining NFT transactions, blue chip NFT collections on the Ethereum community carried out comparatively effectively. Based on information supplied by NFTGO, collections such because the Bored Ape Yacht Membership [BAYC] witnessed a large 337% uptick by way of quantity.

Moreover, the variety of gross sales went up by 325% over the past week. Mutant Ape Yacht Membership [MAYC], one other assortment, additionally witnessed the same development by way of volume and sales.

This indicated that the decrease transactions on the Ethereum community had not affected blue chip NFTs, however might have influenced smaller and upcoming collections.

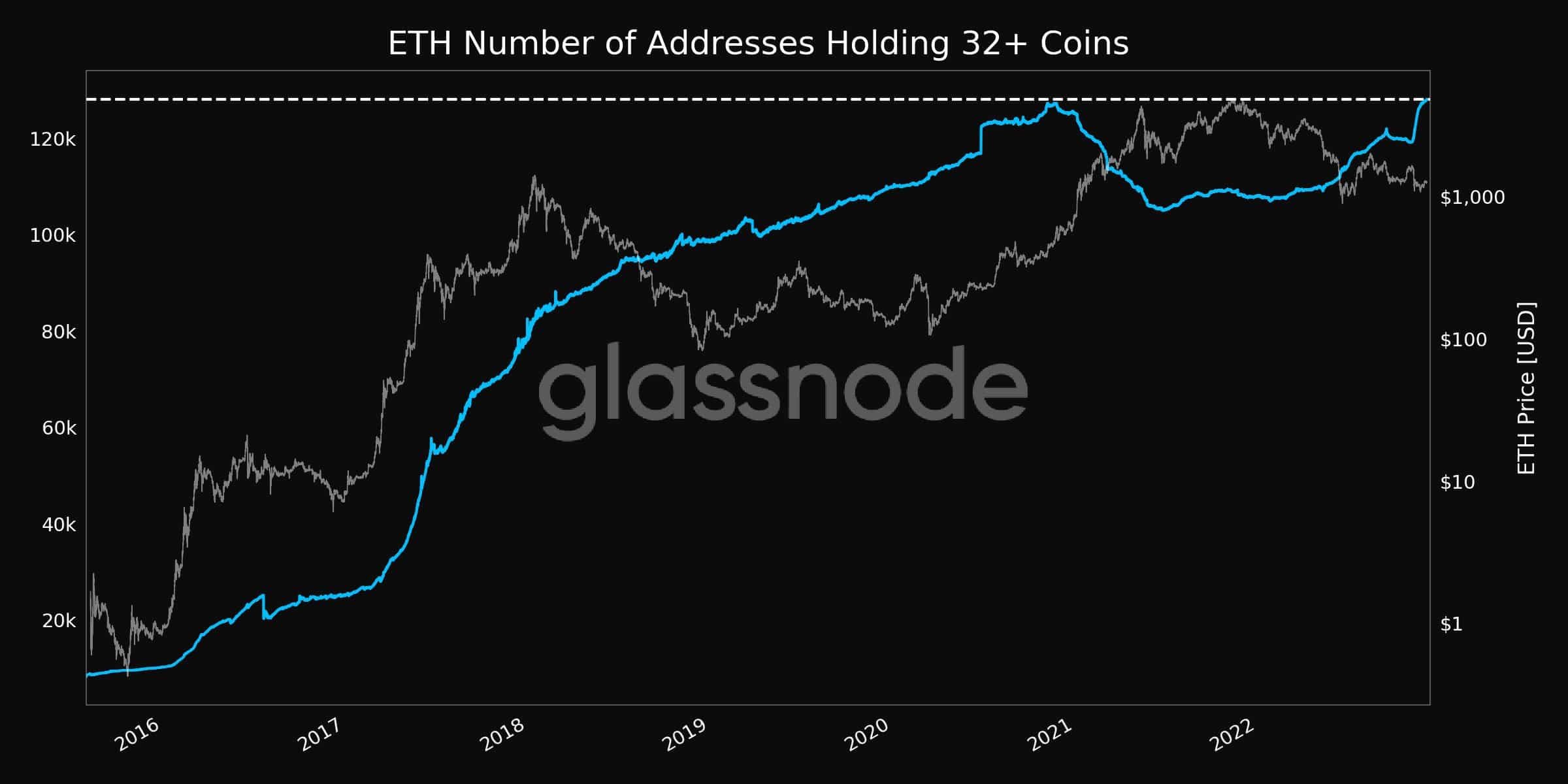

Thus, on the time of writing, massive addresses continued to help ETH. As could be seen from the picture under, the variety of addresses holding over 32 cash reached an all-time excessive of 128k addresses on the time of writing.

Moreover, retail traders confirmed religion within the altcoin as effectively. Based on Glassnode‘s information, the variety of addresses holding 0.01 cash elevated considerably and had reached a three-month excessive of twenty-two.3 million addresses.

Supply: Glassnode

Merchants begin ‘Lengthy’ ing for Ethereum

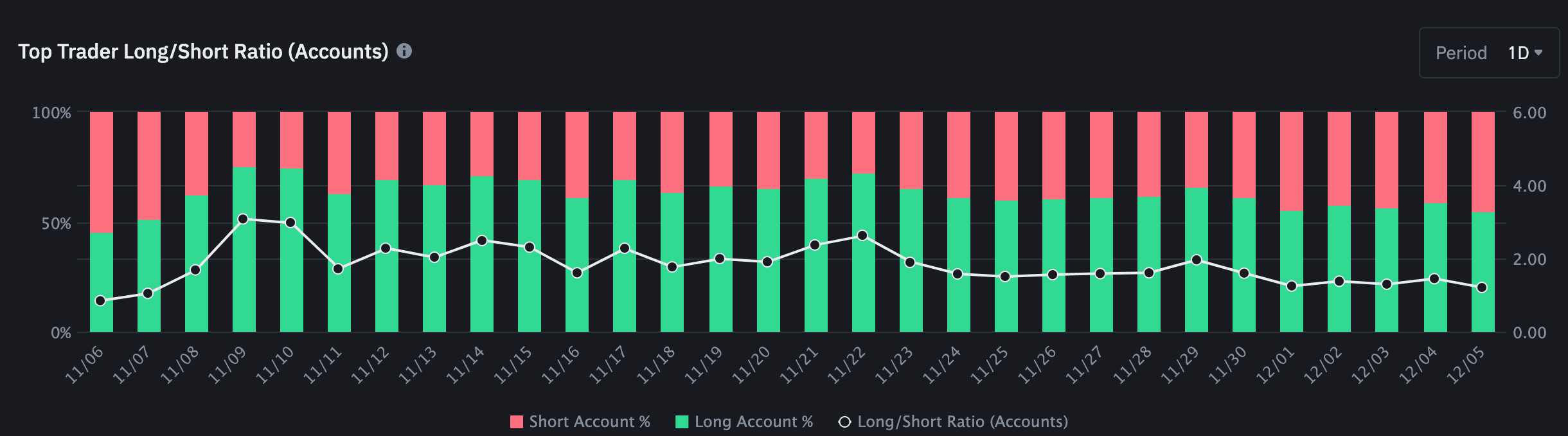

Merchants have all the time proven religion in Ethereum. Prime merchants on the Binance change took benefit of a declining ETH and went lengthy on Ethereum.

On the time of writing, over 50% of the overall traders on the Binance change had held lengthy positions on Ethereum.

Supply: Binance Futures

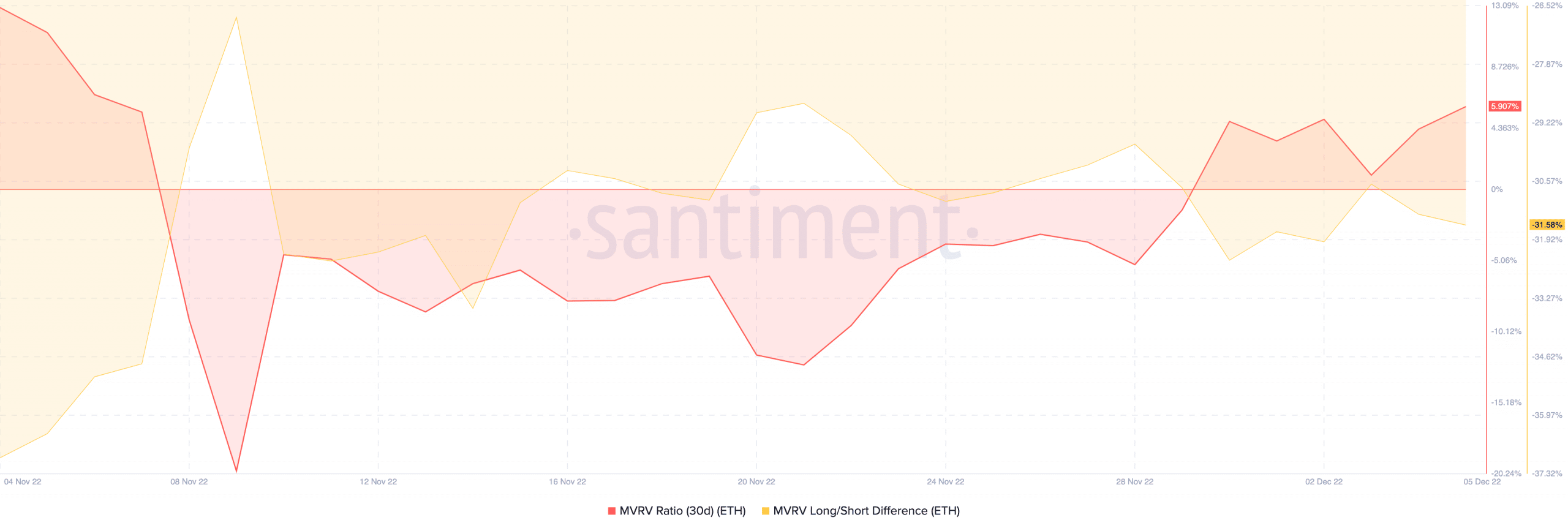

Furthermore, Ethereum’s Market Worth to Realized Worth (MVRV) ratio urged that the tide was delivering favor of addresses holding ETH. This urged that some Ethereum holders might take earnings in the event that they ended up promoting their place.

Nonetheless, the Lengthy/Quick distinction indicated that it could largely be short-term holders that may find yourself profiting in the event that they determine to promote their ETH.

Supply: Santiment

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)