Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought-about funding recommendation

- Ethereum surged above a spread to point out bullish intent

- This wave of shopping for may propel ETH as excessive as $2000

Ethereum noticed highly effective bullish momentum prior to now week, however it slowed down in the previous few days. The FOMC assembly was additionally across the nook, and buyers could possibly be ready on the sidelines for the fallout earlier than making their selections.

Right here’s AMBCrypto’s Worth Prediction for Ethereum [ETH] in 2022-23

From a technical standpoint, it appeared probably that Ethereum may witness a pullback towards $1400. Nonetheless, the market construction remained bullish, and such a drop would supply alternatives to purchase the asset.

Every day order block supplied resistance, ETH may see a dip

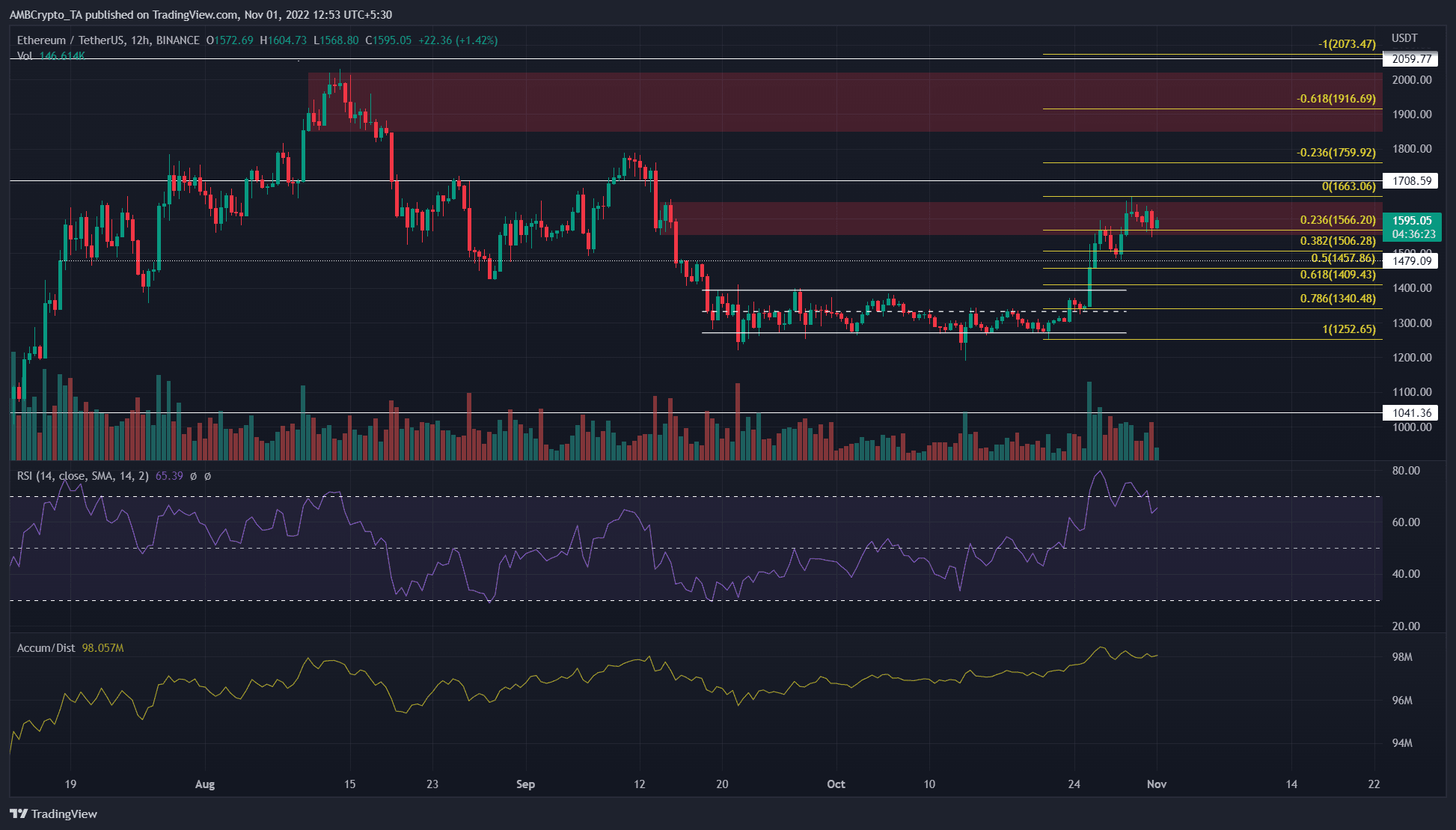

Supply: ETH/USDT on TradingView

Since mid-September, Ethereum has traded inside a spread (white) from $1270 to $1395. The mid-point of this vary lay at $1333 and has been revered as assist and resistance on this interval.

Previously week, Ethereum has been in a position to make a break above this vary. It surged on large buying and selling quantity, and the A/D indicator additionally confirmed greater lows fashioned. This meant shopping for stress was a lot better than the promoting stress, and indicated a wholesome rally.

Nonetheless, prior to now few days, the RSI started to make a collection of decrease highs. Within the meantime, ETH made greater highs and tried to push previous the bearish order block round $1600.

The confluence of the bearish order block and the current bearish divergence steered that Ethereum may see a pullback on the charts. The Fibonacci retracement ranges highlighted the 61.8% degree to lie at $1409. Bulls can look to purchase a pullback to the $1400-$1450 space.

To the north, the Fibonacci extension ranges had shut confluence with the $1900 resistance zone and the $2060 resistance degree.

Funding charge constructive and accumulation was probably

Supply: Santiment

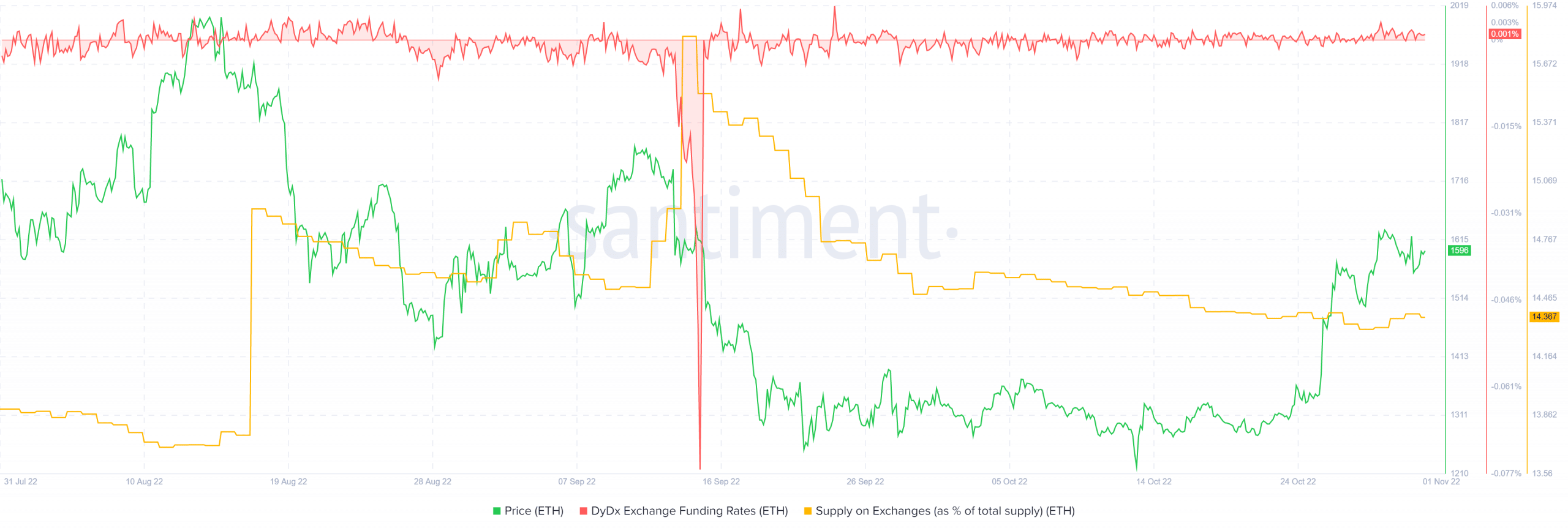

The funding charge information from Santiment confirmed that it was constructive in current days. This revealed lengthy positions paid the quick positions, and was an indication that speculators had been bullishly positioned.

The Provide on exchanges metric was additionally in decline. Throughout this time the worth has surged from the $1350 space. This confirmed that there was a chance of ETH being moved off the alternate wallets and into chilly storage. Therefore, it could possibly be an indication of accumulation and a scarcity of intense promoting stress.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Ethereum [ETH] traders can anticipate a pullback to this region](https://cryptonoiz.com/wp-content/uploads/2022/11/PP-2-ETH-cover-1000x600-750x375.jpg)