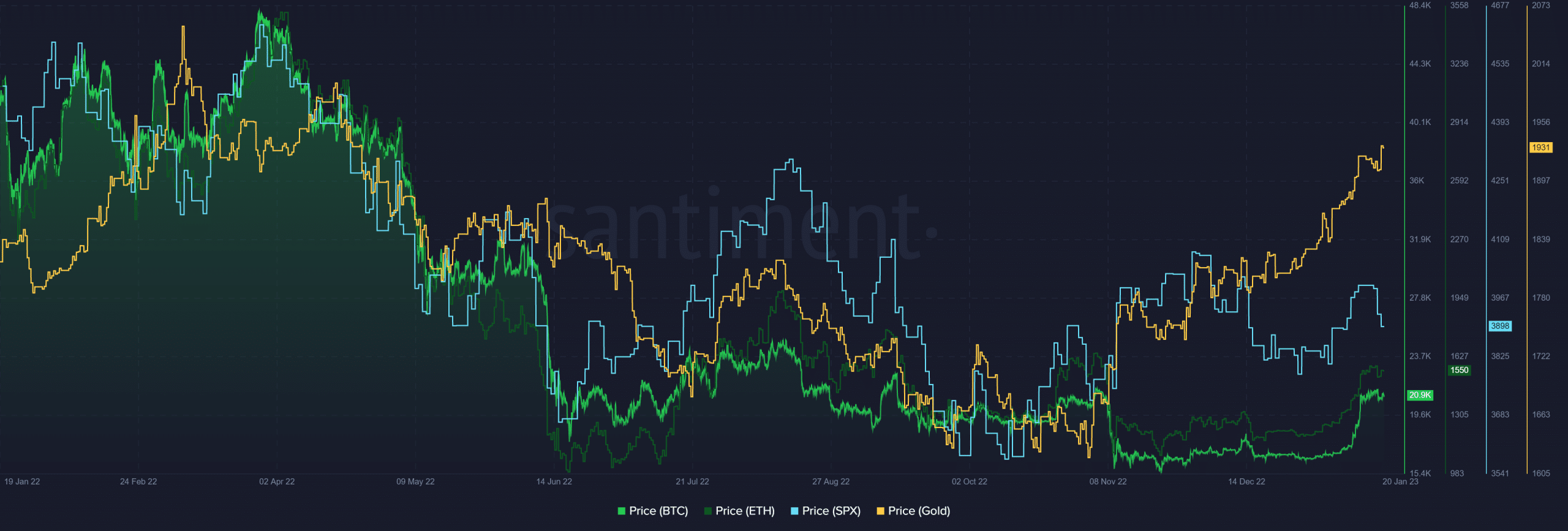

- The S&P 500 metric confirmed a value correction whereas Ethereum continued an uptrend.

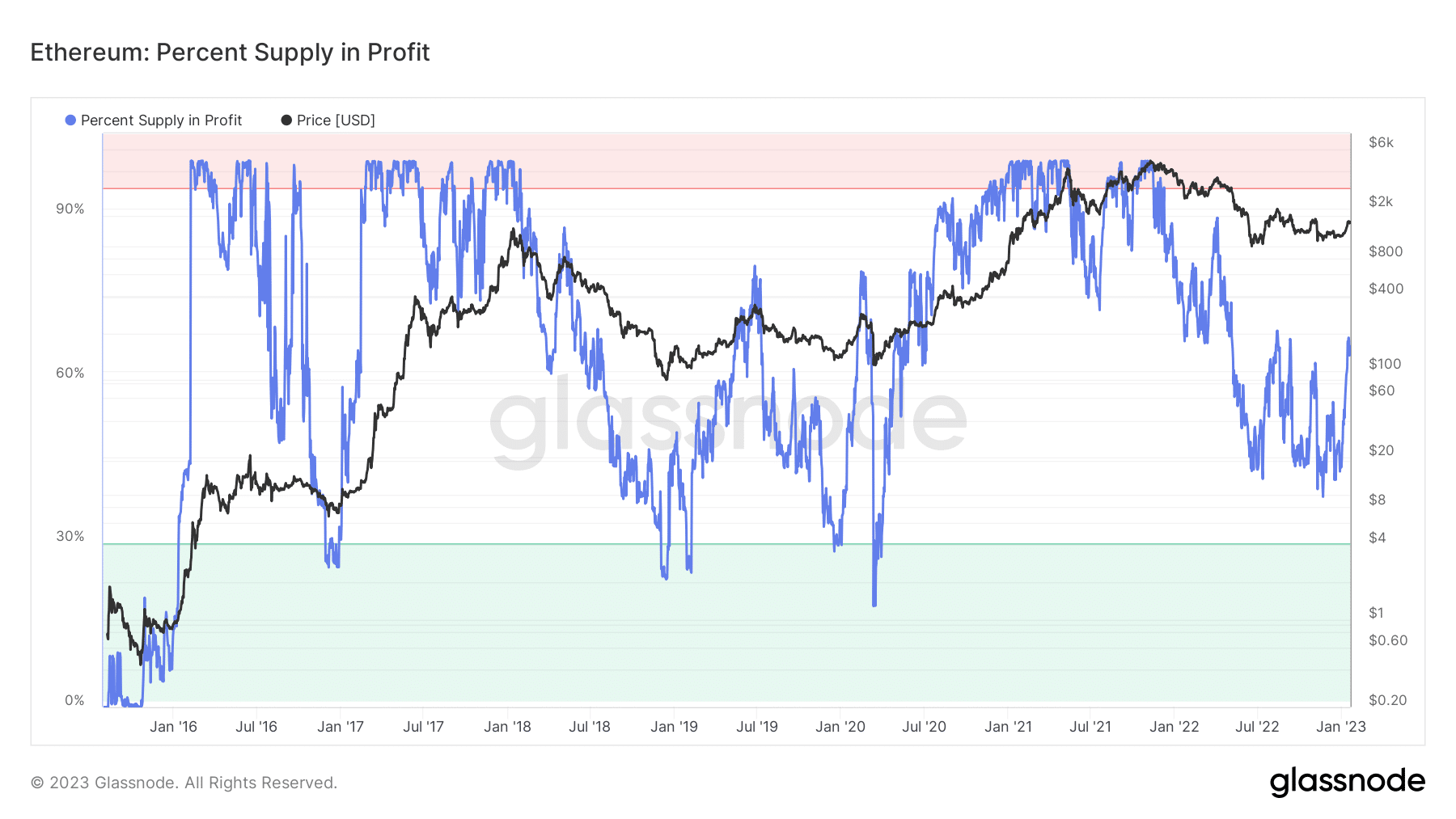

- P.c Provide in Revenue was over 67% at press time, representing a four-month excessive for Ethereum.

The worth of Ethereum [ETH] rose dramatically over the previous few days, which indicated a bull development. Consequently, the current exercise of the S&P 500 metric and its correlation with crypto might present some indication as to the identical.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Ethereum and fairness costs go in reverse instructions

Current data indicated that Ethereum’s value was trending reverse to the S&P 500. Per Santiment’s data, at press time, the worth of the S&P 500 index underwent a correction following its earlier rising trajectory.

When the S&P 500 (a proxy for equities) and cryptocurrency present no relationship to at least one one other, a bull market is claimed to have begun.

Supply: Santiment

The Normal & Poor’s 500 (S&P 500) measures the collective inventory market efficiency of 500 of the biggest publicly traded companies in the US. The index elements are chosen by Normal & Poor’s, an S & P International division, and broadly characterize the U.S. inventory market.

P.c Provide in Revenue hits four-month excessive

Apart from the inventory market’s motion, the share of provide in revenue is a number one signal of an Ethereum bull run. Over 67% of the P.c Provide was worthwhile, as evidenced by knowledge from Glassnode.

The graph additionally confirmed that the current stage of the P.c Provide in revenue was at its highest in 4 months. The importance of this statistic in evaluating the Ethereum bull run is that the larger the P.c Provide in revenue, the extra possible a bull run is in play.

Supply: Glassnode

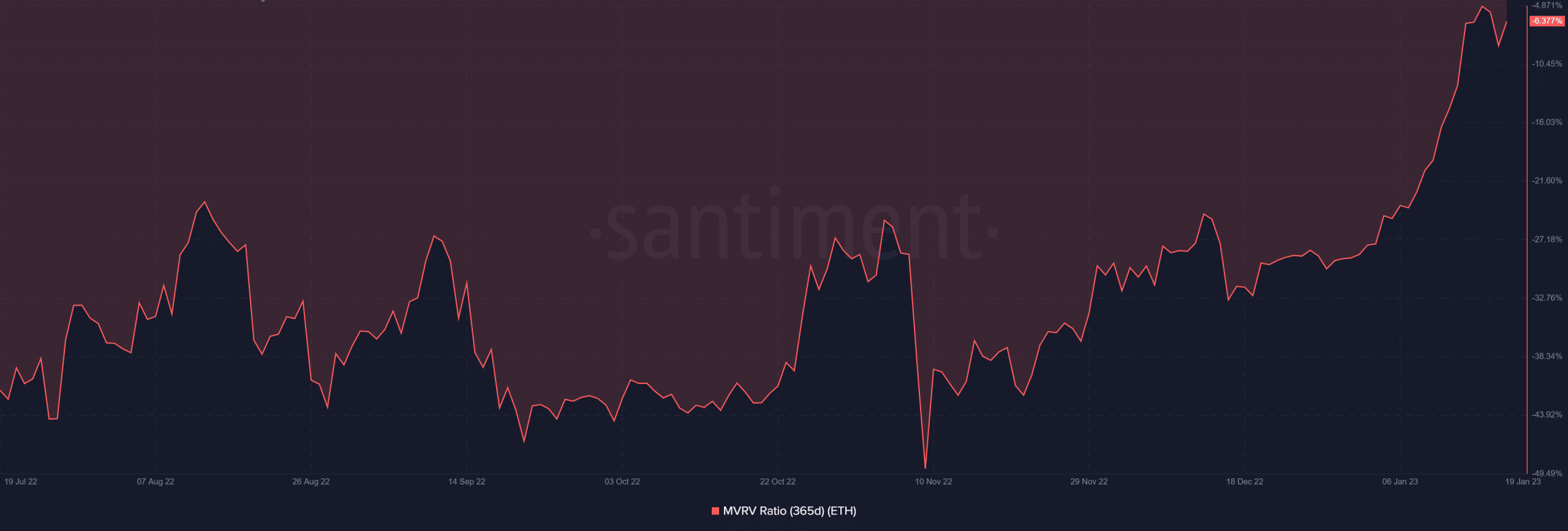

MVRV exhibits lowered loss

When the 365-day Market Worth to Realized Worth (MVRV) ratio is included, the case for a bull market turns into stronger. The MVRV ratio was roughly 6.3% on the time of writing. The present MVRV stage indicated a 6% lower within the worth of Ethereum.

Although a loss, the stretch to recoup the sooner loss advised a bull market. Nonetheless, it might be an entire run when it turned the holdings within the 365-day interval into revenue.

Supply: Santiment

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

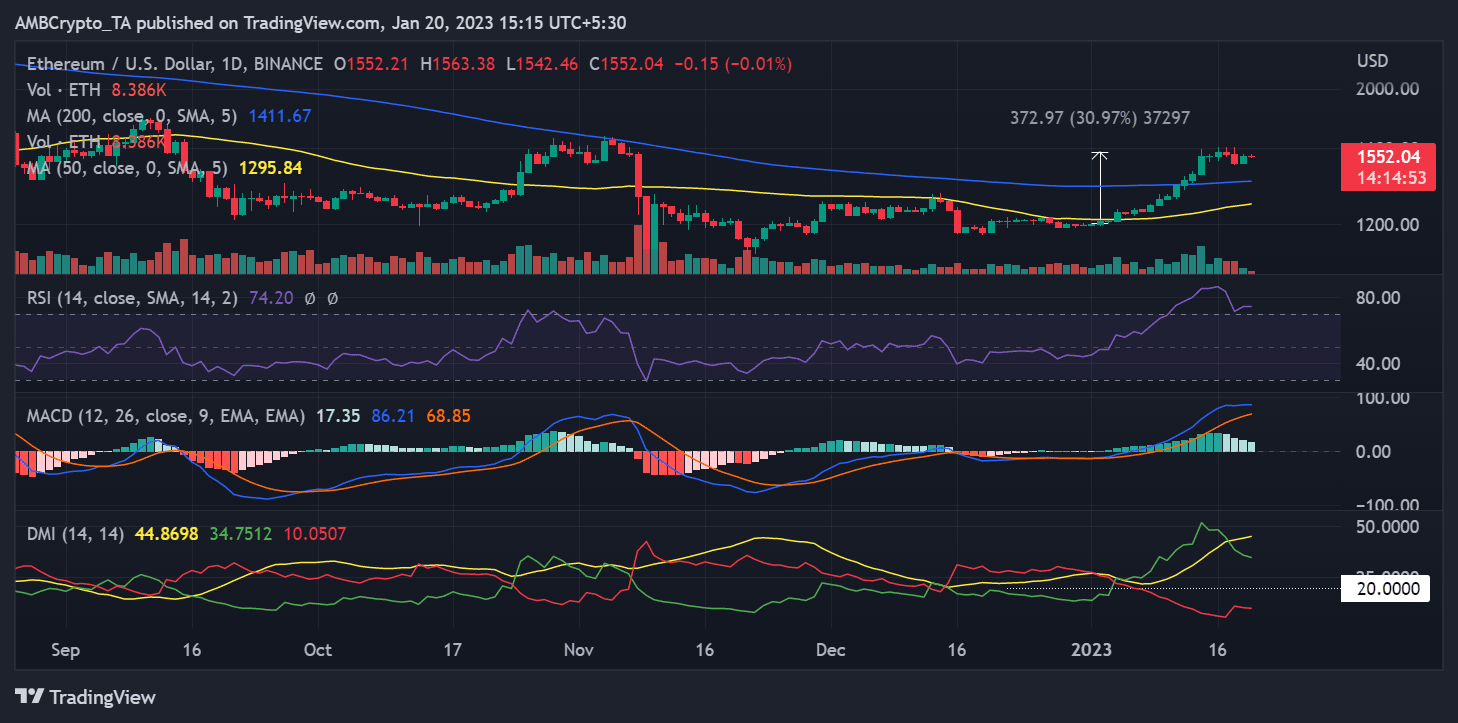

Ethereum stays within the overbought zone

A each day timeframe chart of Ethereum’s value confirmed that it was buying and selling close to $1,550 as of this writing. The present value area represented a acquire of practically 30% at press time, as calculated utilizing the Value Vary device.

Moreover, Ethereum’s Relative Energy Index (RSI) readings indicated that the worth was comparatively secure within the overbought territory.

Supply: Buying and selling View

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Ethereum [ETH] metric sees correction: Hopes of a bull run rise](https://cryptonoiz.com/wp-content/uploads/2023/01/ethereum-wale-1000x600-750x375.jpg)