- MetaMask provides ETH holders an early bull run, particularly for these trying to stake their cash.

- ETH experiences a resurgence of promote stress because it approaches a key resistance vary.

Ethereum [ETH] holders now have an additional incentive to maintain their funds on MetaMask, as MetaMask staking will act as the brand new Ethereum staking program, as per an announcement on 13 January.

WEN STAKING?

We’re extraordinarily completely happy to announce that you would be able to now stake ETH with Lido or Rocket Pool by way of the Portfolio Dapp🎉

🔗https://t.co/HVLvcSDbw6 pic.twitter.com/9VkiU5jlsw

— MetaMask 🦊💙 (@MetaMask) January 13, 2023

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Previous to this announcement, ETH holders needed to transfer their funds to a unique pockets when staking as a result of MetaMask didn’t help direct staking. Nonetheless, this new announcement will permit liquid staking on Rocket Pool or Lido DAO [LDO].

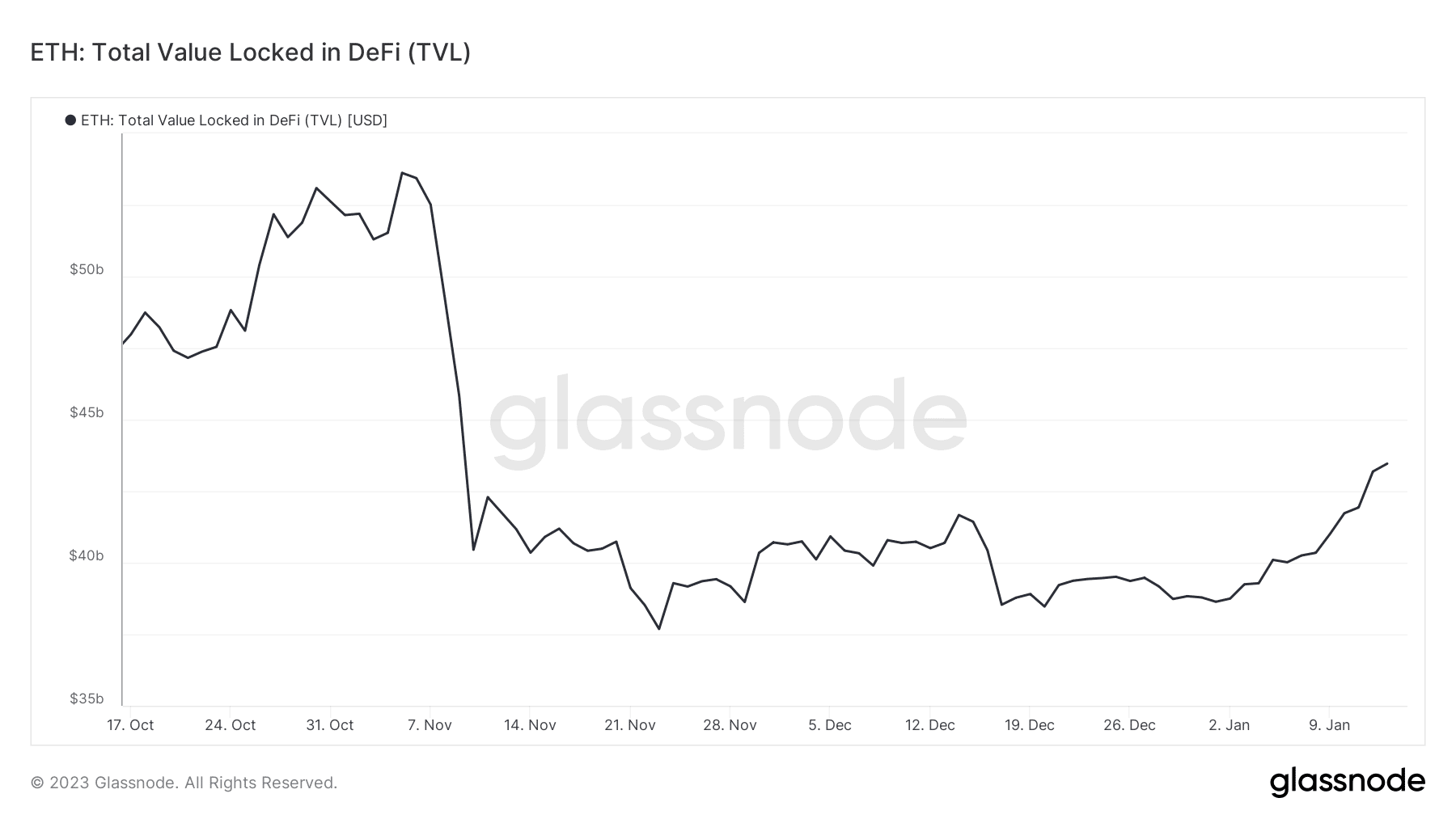

The announcement comes at a great time, because the crypto market was exhibiting indicators of restoration at press time. As such, traders will now be extra prone to maintain on to their ETH with a long-term focus. Notably, Ethereum’s whole worth locked in DeFi grew from as little as $38.6 billion on 2 January to $43.46 billion on 13 January.

Supply: Glassnode

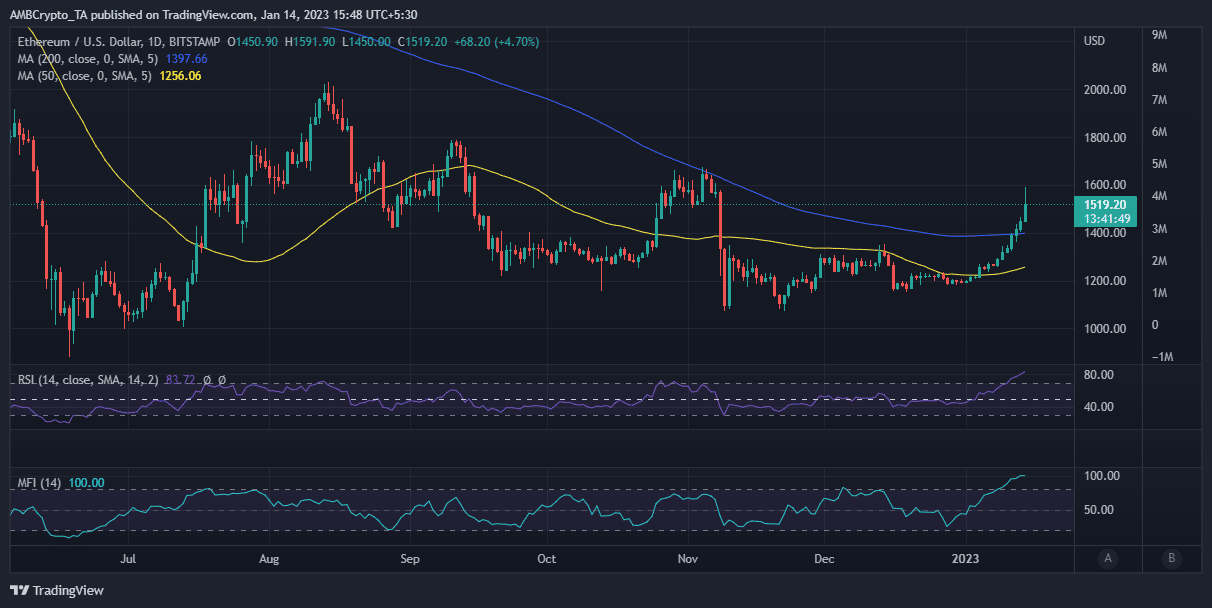

Having staked ETH is an effective way to earn passive revenue because the market recovers. However can Ethereum actually maintain its present upside? Whether or not the present rally is the beginning of the following bull run or simply one other aid rally remains to be anybody’s guess. Nonetheless, ETH is presently approaching a key resistance degree throughout the $1640 to $1660 worth vary.

Are ETH bulls getting exhausted?

A few issues to notice: ETH rallied as excessive as 1591 within the final 24 hours, placing it nearer to the resistance vary. It has since then skilled a slight pullback, indicating that promote stress was manifesting.

Supply: TraingView

What number of are 1,10,100 ETH value as we speak?

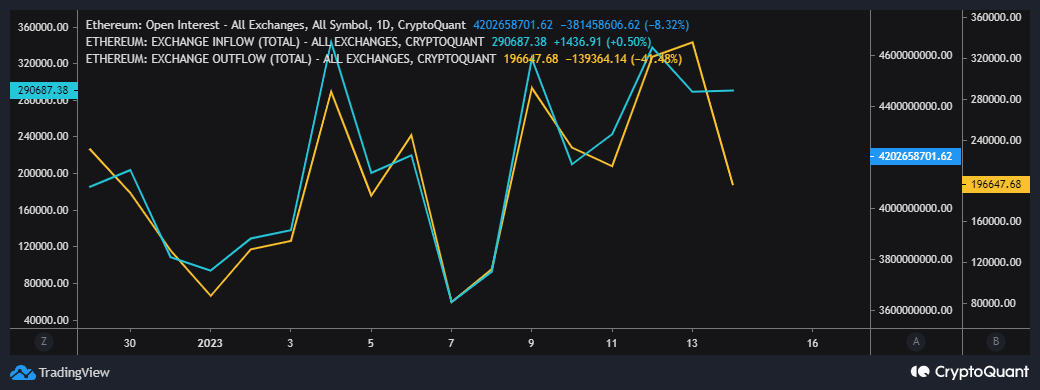

Additionally value noting is the truth that Ethereum’s native token was deeply overbought at press time. Promote stress is extra prone to manifest throughout the overbought zone. Maybe trade flows could assist gauge the extent of incoming promote stress. The newest information revealed a pointy drop in trade outflows.

Supply: CryptoQuant

The above remark prompt that the quantity of ETH flowing out of exchanges is slowing down, an inexpensive end result now that the market is in overbought territory. This end result would possibly set the worth up for a large retracement if the worth fails to rally into the following resistance vary.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)

![Ethereum [ETH] holders have a reason to rejoice, and it’s not price](https://cryptonoiz.com/wp-content/uploads/2023/01/1672376773236-0974baa2-dfc6-40ad-805a-5b49c7b1c97b-1000x600-750x375.png)