Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

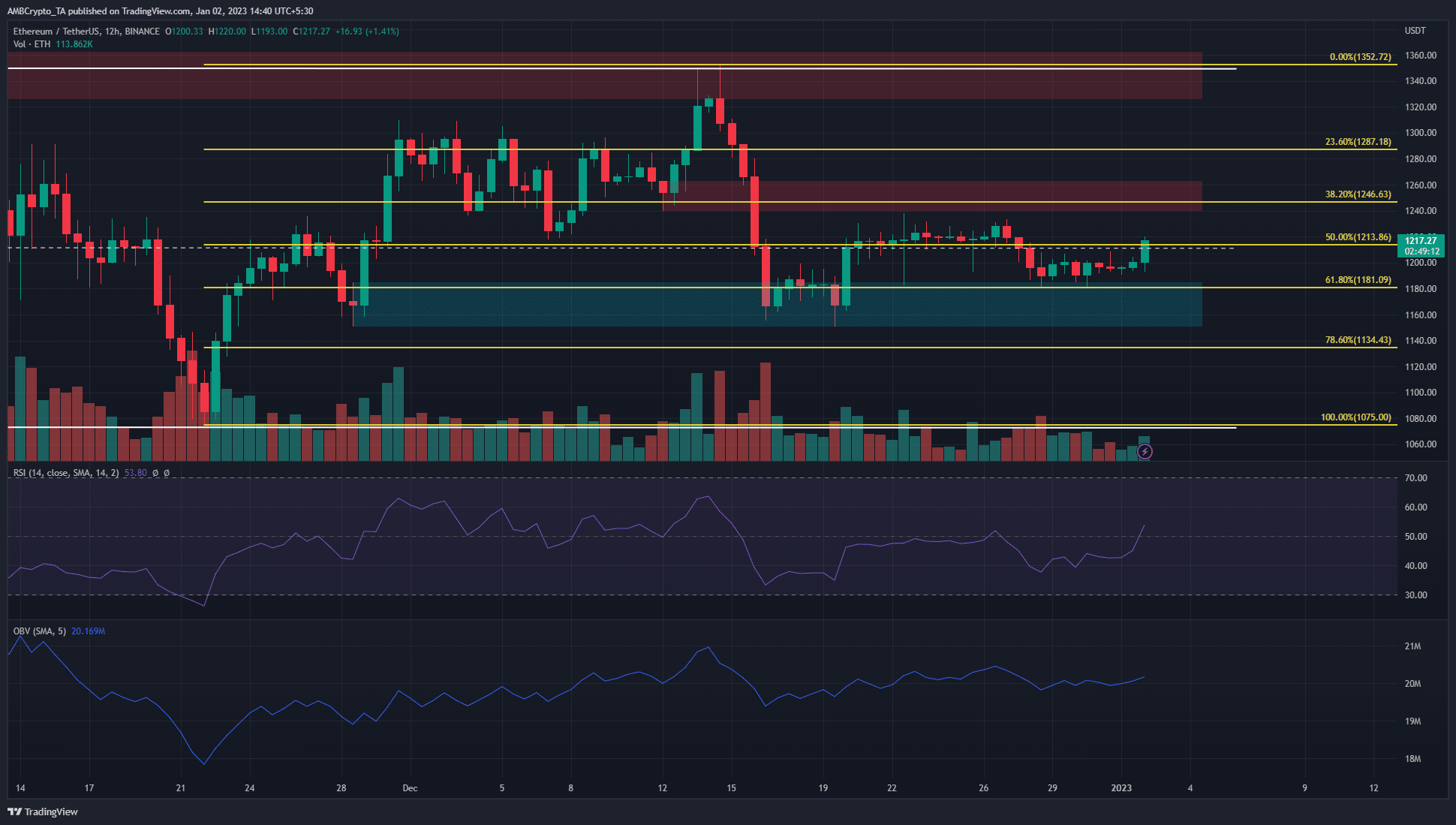

- Ethereum approaches a bearish breaker on the 12-hour chart.

- Its transfer again above the mid-range mark provided bulls some hope that the vary highs may very well be the subsequent goal.

Very similar to Bitcoin, Ethereum additionally had a quiet festive season on the worth charts. Not a lot volatility was witnessed. In latest weeks, the $1160 and $1245 ranges of assist and resistance have been essential.

Learn Ethereum’s Worth Prediction 2023-24

On the time of writing, Ethereum exchanged fingers at $1217. Buying and selling quantity has additionally picked up marginally over the previous couple of days. May the start of the brand new 12 months see ETH climb again to $1350, and even greater?

The 12-hour bearish breaker at $1245 stays a problem

Supply: ETH/USDT on TradingView

Ethereum has traded inside a spread extending from $1350 to $1075 since 10 November. On 12 December, ETH shaped a bullish order block and climbed upward to the vary highs at $1350 on 13 December.

A few days thereafter ETH confronted a pointy rejection and fell again to the $1160 degree. In doing so, the bullish order block was flipped to a bearish breaker.

Are your ETH holdings flashing inexperienced? Examine the Revenue Calculator

At press time, the market construction was bearish. ETH has shaped the next low after the mid-December drop however is but to interrupt above the decrease highs at $1237. The RSI stood at 53.8 and will rise additional if Ethereum registered extra beneficial properties over the day.

The OBV has been flat since mid-December, which indicated neither the consumers nor the sellers have been notably sturdy. But, the OBV has climbed since mid-November, which confirmed consumers had some success in latest months.

The upper timeframe charts confirmed that the $1300-$1350 space has seen a big quantity of buying and selling again in September and October. Due to this fact, alongside the bearish breaker, this space is more likely to provide further resistance to bullish strain.

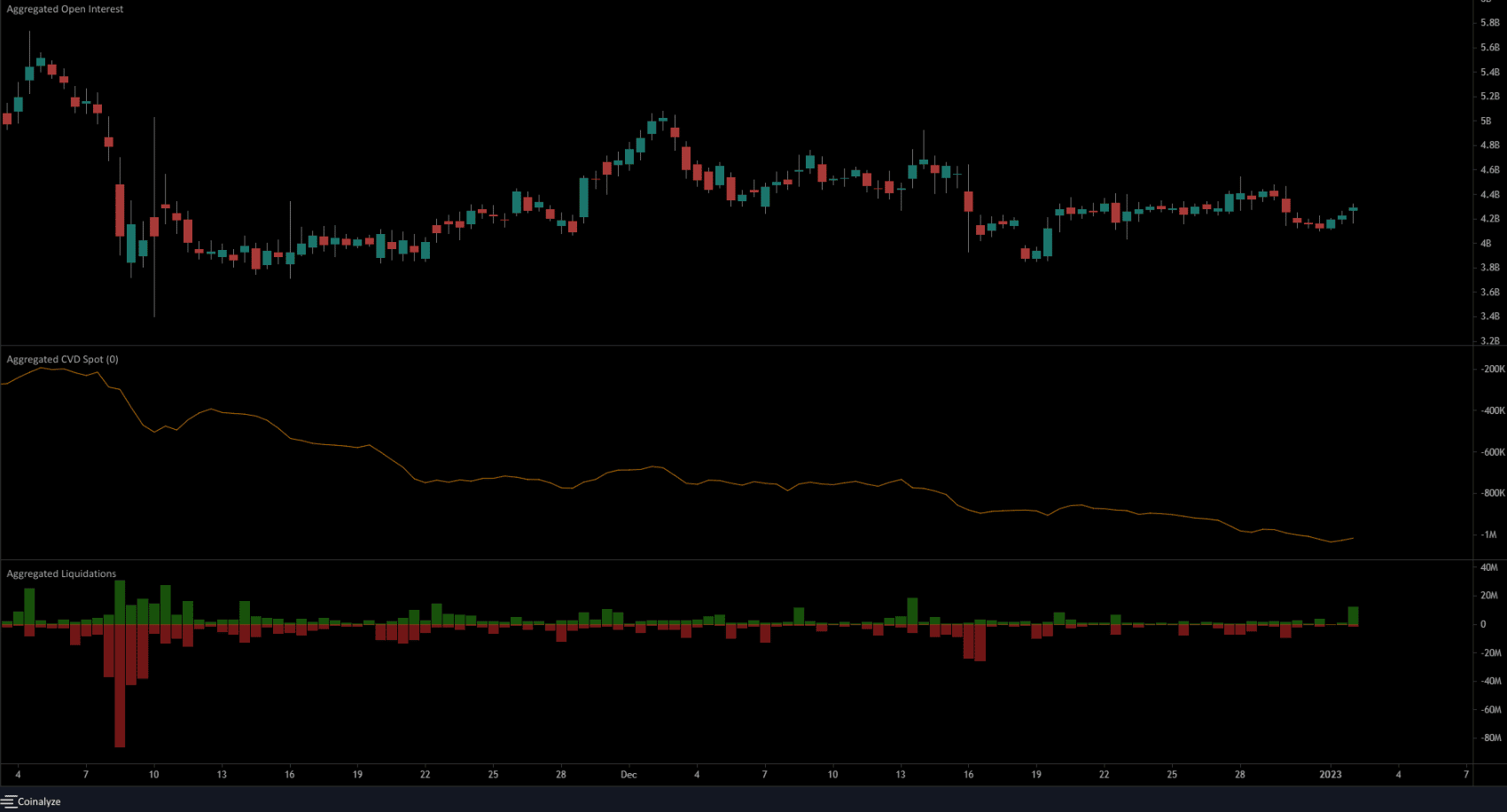

Spot CVD is in decline and the transfer again above $1200 pressured brief liquidations

The spot Cumulative Quantity Delta has been in regular decline in latest weeks. This highlighted a scarcity of demand behind ETH, which meant any vital bounce in costs are for the bears to promote.

The previous 12 hours noticed Ethereum publish beneficial properties of almost 2.5%. This was sufficient to liquidate $12.1 million value of brief positions. Bears can anticipate a retest of the $1235-$1240 space earlier than seeking to brief the asset. A transfer above $1240 and a retest may provide bulls a shopping for alternative concentrating on $1350.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)