- The Ethereum Merge was profitable, with follow-up upgrades anticipated in 2023

- Staking withdrawals are anticipated to start within the first quarter after OFAC compliance enchancment

The Ethereum [ETH] mainnet transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) was the first motive the second greatest blockchain was within the highlight in 2022. The Merge, because it was named, marked the most important mechanism change in crypto historical past.

Nonetheless, it wasn’t an all-year easy journey for the blockchain as traders’ expectations dampened. Furthermore, the blockchain’s validators wanted assist adapting to OFAC compliance insurance policies. However earlier than we dive deep into all that, let’s do a fast run again of how Ethereum fared in 2022.

Learn Ethereum’s [ETH] Value Prediction 2023-2024

The Merge: A change lastly achieved

Previous to the Merge, the crypto ecosystem was confronted with a number of challenges which in flip, negatively affected the crypto market. Exploits, scams, and notably the Terra [LUNA] collapse despatched the general market capitalization into dilapidation.

So, on account of the Ethereum Merge occurring in September, the group stuffed their hearts with hope of stability within the sector.

On 15 September 2022, the Ethereum staff publicly introduced that the Merge was profitable round 6:43 a.m UTC. This was after Ethereum recorded triumphs with the Ropsten, Rikenby testnets, and Bellatrix upgrades.

And we finalized!

Glad merge all. It is a large second for the Ethereum ecosystem. Everybody who helped make the merge occur ought to really feel very proud at the moment.

— vitalik.eth (@VitalikButerin) September 15, 2022

We’re good. It is carried out. We Merged. Holy shit. Superb work everybody 🥂🐼! https://t.co/bhbNS8LkZR pic.twitter.com/zx1d3L7Iox

— timbeiko.eth (@TimBeiko) September 15, 2022

Though the Merge helped cut back Ethereum’s vitality consumption by 99.5%, it did not lend a serving to hand to the excessive gasoline charges on the community. Throughout the occasion, the Ethereum Basis hosted a digital Merge viewing occasion with revered co-founder Vitalik Buterin in attendance.

Throughout the occasion attended by 1000’s of individuals, Vitalik shared particulars of some “going ahead” plans. In the middle of the occasion, the co-founder famous that the PoS transition was solely part of a protracted roadmap that can spur into 2023. He identified that plans had been additionally in place for the surge, verge, purge, and splurge improve.

In the meantime, the Ethereum growth staff already put one foot ahead with its 2023 goals. Earlier in December, it communicated in regards to the Shanghai improve, propelling it towards processing staking withdrawals.

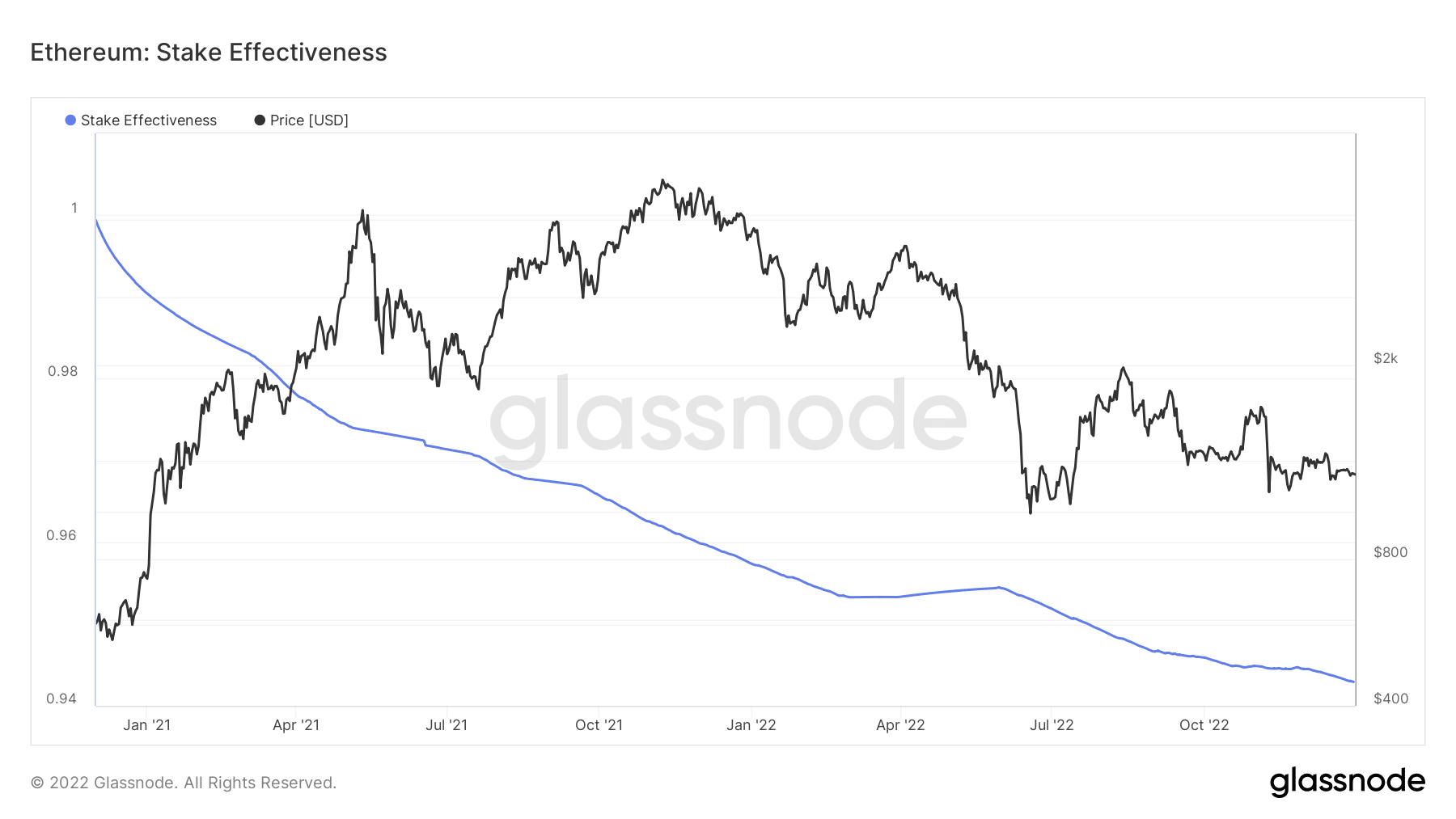

Regardless of the push, Ethereum struggled to enhance adoption for staking actions. In fact, it would nonetheless be early days, however Glassnode data revealed that efficiency on this side has been largely unimpressive.

According to Glassnode, the Ethereum stake effectiveness has been in free fall. At press time, it was 0.942. The lower indicated that only some validators had been collaborating in placing up their staked Ether [stETH] to work.

Supply: Glassnode

ETH: Fatigue within the midst of optimism

By way of its market efficiency, ETH traders had been optimistic that the historic occasion would deliver some respite to the ailing cryptocurrency. The explanation for the passion was not far-fetched.

Within the lead-up to the Merge, Ethereum’s arduous fork, Ethereum Traditional [ETC], constantly carried out excellently as its hashrate frequently spiked. In response to CoinMarketCap, the ETC price increased from $14.41 to $43.53 between July and September.

It was just like Ethereum’s staking protocol, Lido Finance [LDO]. In distinction, ETH traders had been left hanging even after CNBC called the times earlier than the Merge “the final probability” to build up ETH. Days after the occasion, ETH’s value decreased by about 15%, because it introduced conversations about shopping for the rumor and promoting the information.

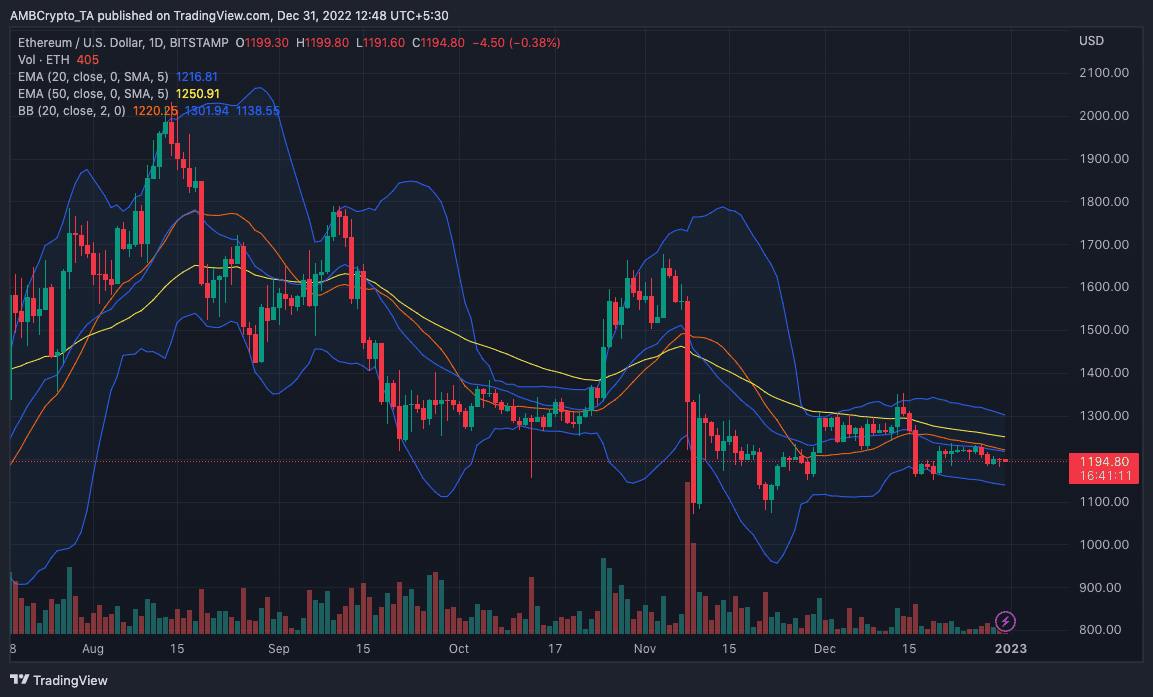

On the time of writing, ETH was changing hands at $1,195. Nonetheless, ETH may fall under the present worth heading into 2023. Indication from the Exponential Transferring Common (EMA) advised this potential.

Based mostly on the each day chart, the 20 EMA (blue) positioned under the 50 EMA (yellow). This commentary meant {that a} worth lower was seemingly, and a drop under $1,000 may very well be imminent. Per its volatility, the Bollinger Bands (BB) didn’t mirror excessive ranges. So, because the worth touched neither the higher nor decrease bands, ETH was not oversold or overbought.

Supply: TradingView

Layer-Two (L2) to the rescue

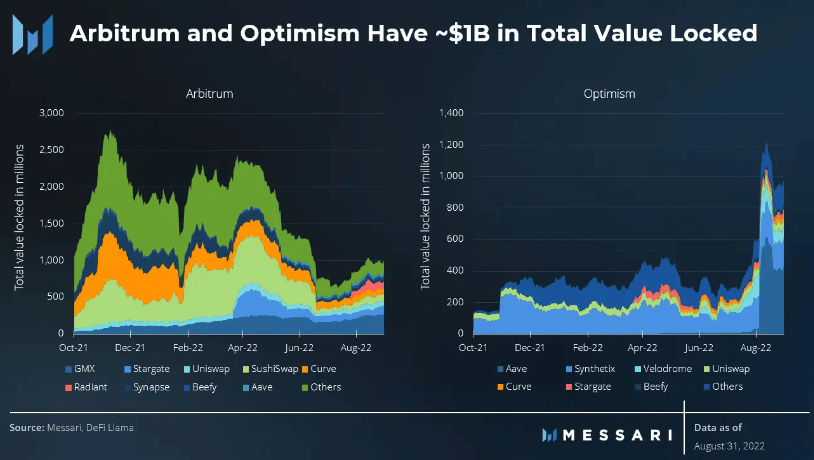

Whereas Ethereum struggled with optimistic post-Merge outcomes, L2 protocols like Arbitrum and Optimism [OP] stuffed in for the downturn. Within the third quarter (Q3), Messari reported that transactions on each protocols grew tremendously.

Transactions on Arbitum grew from 39,000 in January 2022 to 115,000 in August; Optimism loved a 3.5x hike from 41,000 to 142,000 inside the similar interval. This progress additionally impacted the Complete Worth Locked (TVL) of the L2 gems to $1 billion.

In flip, Arbitrum and Optimism scaling meant that Ethereum’s rollup scalability was absolutely operational. If improved, it might translate to elevated adoption inside the Ethereum blockchain within the coming 12 months. As with potential traction, the roll-up providing transactions at a less expensive price might additionally drive consideration.

Supply: Messari

Censorship persists nonetheless

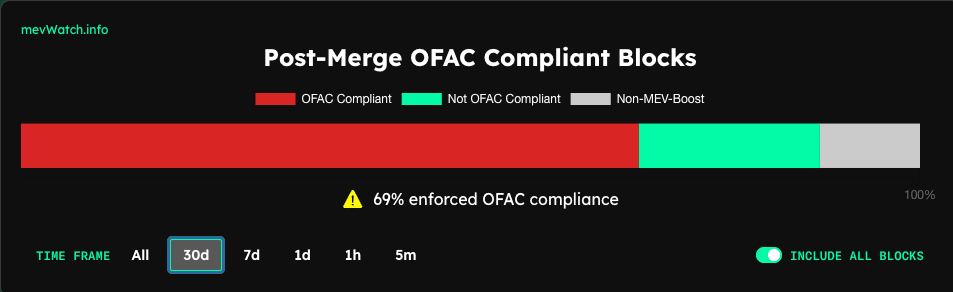

Amid the backwards and forwards, the Workplace of International Asset Management (OFAC) in the US punished an Ethereum decentralized protocol, Twister Money. The sanctions got here as allegations of seemingly unlawful actions utilizing the crypto combine platform.

This was a wake-up name for Ethereum validator because it had struggled to develop into OFAC compliant amid the danger of censorship. In the meantime, validators from the Ethereum finish responded to the duty with efforts to enhance Miner Extractable Worth (MEV).

On the time of writing, Ethereum’s post-Merge OFAC grievance block had hit 69% within the final 30 days. In response to MEV Watch, solely 11.14% had been within the non-MEV enhance area. Though they recorded progress, Ethereum validators may have to do extra to flee the hammer from the authorities.

Supply: MEV Watch

As for its opponents, Solana [SOL] has been badly hit because the FTX contagion, particularly as Sam-Bankman Fried (SBF) was a infamous shiller of the cryptocurrency.

In latest instances, lively growth on the Solana chain was nearly nonexistent. SOL additionally misplaced about 97% of its worth in 2022. Cardano [ADA], alternatively, had been on the forefront of growth exercise. However for its token, it was not a superb 12 months, identical to the broader market.

Going into the brand new 12 months, what awaits Ethereum?

As 2023 begins, Ethereum builders introduced that the group ought to count on extra upgrades to the blockchain. In response to its protocol developer. Tim Bieko, activating staking withdrawals is a precedence for the staff.

To recap:

– Shanghai/Capella’s scope has been finalized: withdrawals are precedence #1️⃣ , together with the power for validators to replace their withdrawal credentials. EOF, and some different minor modifications are anticipated on the EL facet. The replace has all the main points 👀— timbeiko.eth (@TimBeiko) December 13, 2022

He famous additional that the EIP-4844 could be important in serving to validators with the withdrawal course of. Billed to start out from the primary quarter in 2023, Ethereum might expertise a hike in demand as a result of staking participation.

“Blobspace is coming .oO! With Shanghai/Capella centered round withdrawals, EIP-4844 would be the most important focus of the following improve”.

Moreover, the business expects Ethereum to have a busy schedule within the coming 12 months. Nonetheless, there was no certainty that ETH would react positively to the anticipated developments.

In a recent video posted on his YouTube Web page, crypto analyst Nicholas Merten inspired his subscribers to keep away from getting too enthusiastic about ETH in 2022. Citing an incoming collapse, Merten stated,

“Our goal vary for Ethereum is someplace round $300 to $500. I don’t suppose it’s going to dwell there for lengthy, but it surely has to do with the truth that proper now, there’s a large skeleton closet that’s over $1.5 billion of cumulative liquidations that may probably occur within the DeFi [decentralized finance] ecosystem.”

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)