- Ethereum addresses mendacity dormant for years just lately obtained lively.

- The whole variety of ETH moved was over 22,000, which sparked plenty of hypothesis.

Whereas Ethereum [ETH] buyers have been watching the token’s sluggish progress, some bulls have began to stir, sparking rumors about what’s going to occur subsequent. The rally got here at a time when the broader market and the worth of ETH have each been fairly underwhelming. What can buyers anticipate?

Learn Ethereum’s [ETH] value prediction 2023-2024

Ethereum bulls awaken

On 19 December, PeckShieldAlert printed an intriguing submit on its web page describing how two addresses that had been inactive since October 2018 out of the blue got here to life. The addresses despatched 22,982 ETH in whole, which at press time, was price over $27 million, to new addresses.

Given how lengthy these addresses had been inactive, there have been questions on what these transfers would possibly point out.

#PeckShieldAlert 2 Dormant addresses transferred 22,982 $ETH (~27.2M) to 2 contemporary addresses, their final motion was October 2018 (1,535 days in the past).

These $ETH originated from Genesis and Poloniex pic.twitter.com/MXKpLnypif— PeckShieldAlert (@PeckShieldAlert) December 19, 2022

Transfers of 13,103.99 ETH and 9,878 ETH allegedly originated from the Genesis and Poloniex exchanges, respectively. The PeckShield flowchart made it potential to trace ETH’s historical past in real-time.

ETH’s value fluctuated between roughly $190 and $230 when the wallets had been final lively.

The present state of ETH

The assist vary seen on the ETH each day timeframe chart between 1 December and 13 December was roughly $1,200. A decrease assist had developed following the just about 7% decline seen on 16 December, and the asset was buying and selling at $1,180 at press time.

Since September, ETH was but to keep up a break above the brief Transferring Common (yellow line). This meant that the yellow line had truly acted as a resistance at sure factors throughout its motion.

Supply: TradingView

No sell-off within the short-term, however potential within the long-term

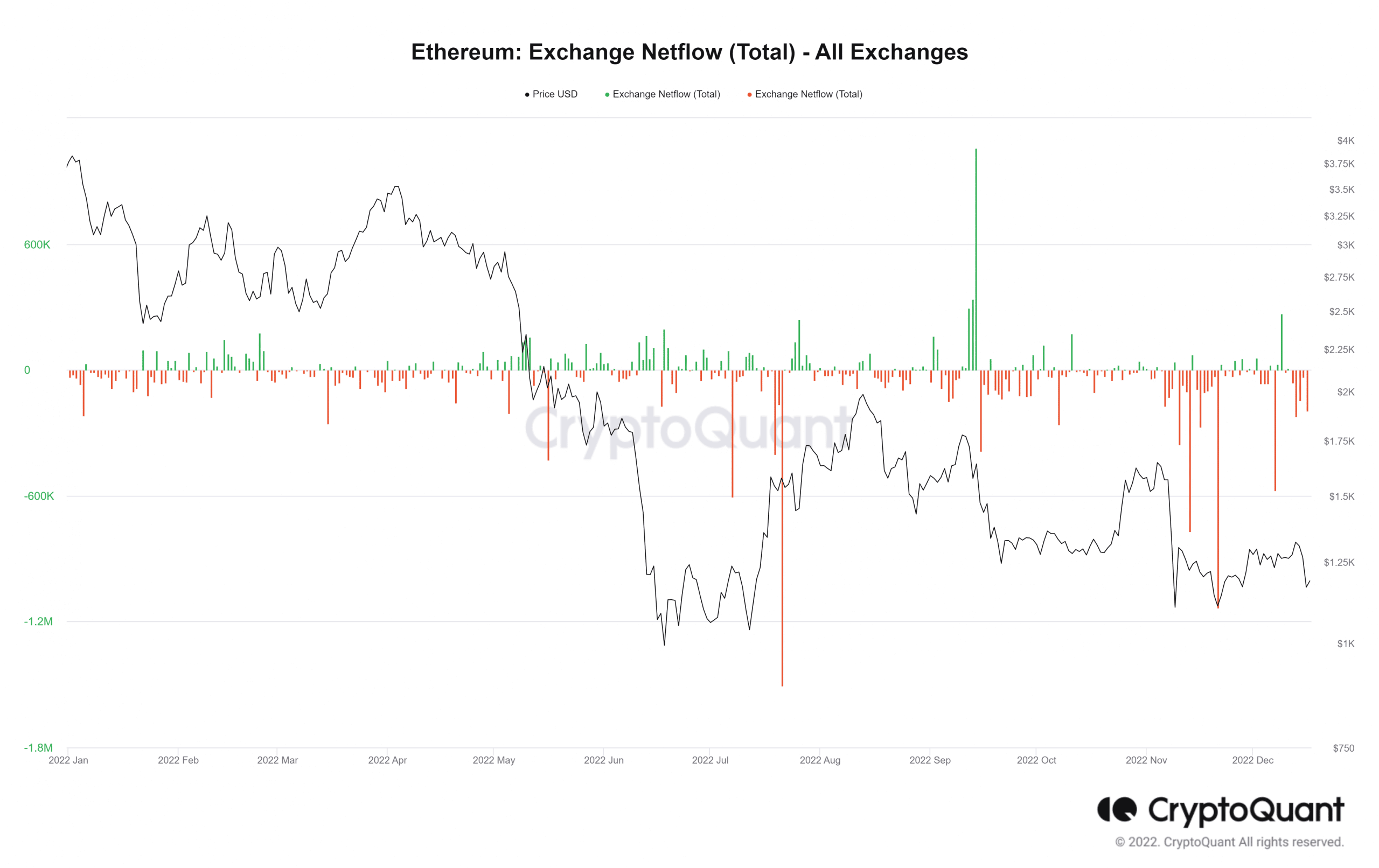

In keeping with CryptoQuant’s Alternate Netflow statistic, there have been extra ETH transactions leaving exchanges than getting into them. This might point out that holders had been hesitant to promote on the value, that means {that a} potential sell-off within the close to time period just isn’t taking place. CryptoQuant, nevertheless, forecasted a possible sell-off in 2023.

🚨 $ETH Mass-Promoting Occasion Is Coming?

1/ The #ETH2 Deposit has amassed, holding 12% of the overall provide.

Because the $ETH alternate reserve drops down to fifteen% of the overall provide and continues to lower,

What is going to occur on $ETH after the Shanghai Onerous Fork?🧵https://t.co/RrFQrLPeda pic.twitter.com/CrWhqSbxPn— CryptoQuant.com (@cryptoquant_com) December 16, 2022

As a result of impending Shanghai improve, there could also be a sell-off since buyers can be allowed to take away their stakes as soon as it’s completed, which could affect ETH’s value.

Supply: CryptoQuant

Buyers at an improved loss

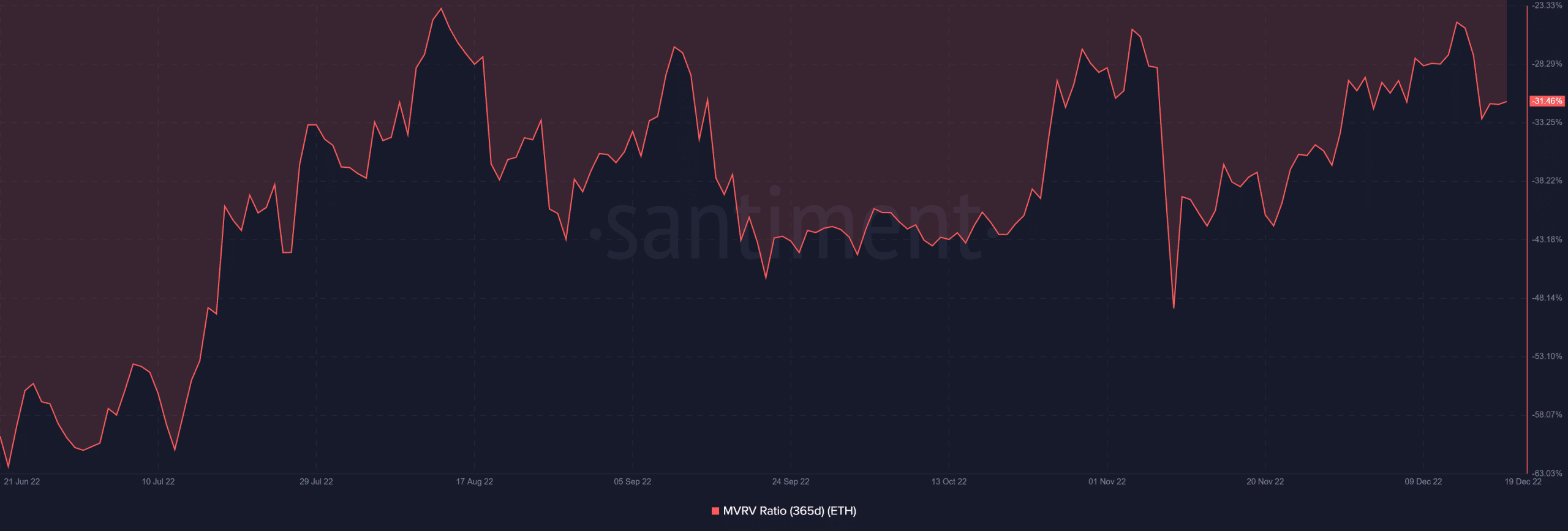

In current months, the worth of ETH fell wanting the spectacular run it skilled in 2021. The Market Worth to Realized Worth (MVRV) Ratio revealed that buyers had been holding at a loss over the earlier 12 months. Homeowners of ETH suffered a lack of greater than 31% on the present value.

Regardless that it was holding at a loss, the current share was higher than it had been round November.

Supply: Santiment

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)