- Ethereum not too long ago noticed a dip within the transaction quantity on its mainnet

- Ethereum value has, nonetheless, proven no indicators of impression from the most recent improvement

In current weeks, the value of Ethereum [ETH] has been shifting, at most, sideways. After all, provided that the cryptocurrency market witnessed a dip, this wasn’t unique to it alone.

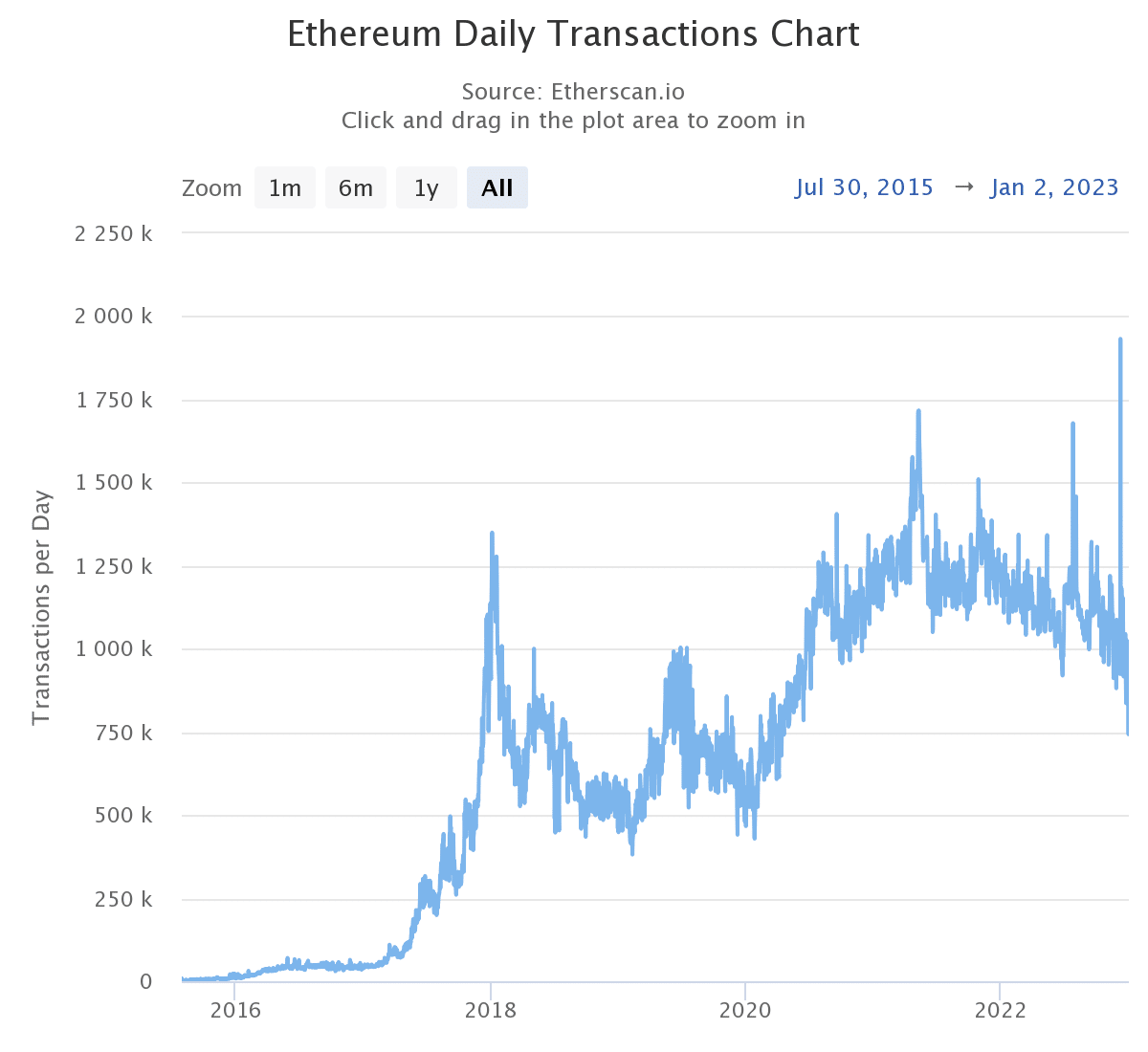

Nevertheless, Ethereum not too long ago skilled a minor decline in every day transactions. Moreover, at press time, the altcoin was having hassle crossing the customary threshold of 1 million. So, with this current improvement on this on-chain metric, is it regular or trigger for concern?

Learn Ethereum’s [ETH] value prediction 2023-2024

Mainnet transactions decline barely

In keeping with information that could possibly be seen on Etherscan, every day transactions on the Ethereum mainnet skilled a modest dip. This could possibly be the reason for some concern. As of this writing, there have been between 800 million and 900 million every day transactions, which was under the 1 million threshold.

Nevertheless, additional evaluation of the mainnet information revealed that the dip was not recurring and witnessed restoration.

Supply: Etherscan.io

Holidays and gasoline charges accountable?

The vacations and the halt in buying and selling by institutional and particular person traders could possibly be logical explanations for the autumn in every day transactions. Traditionally, the vacation season has been a time when fewer trades are seen for each shares and cryptocurrencies. Thus, creating an general bearish development.

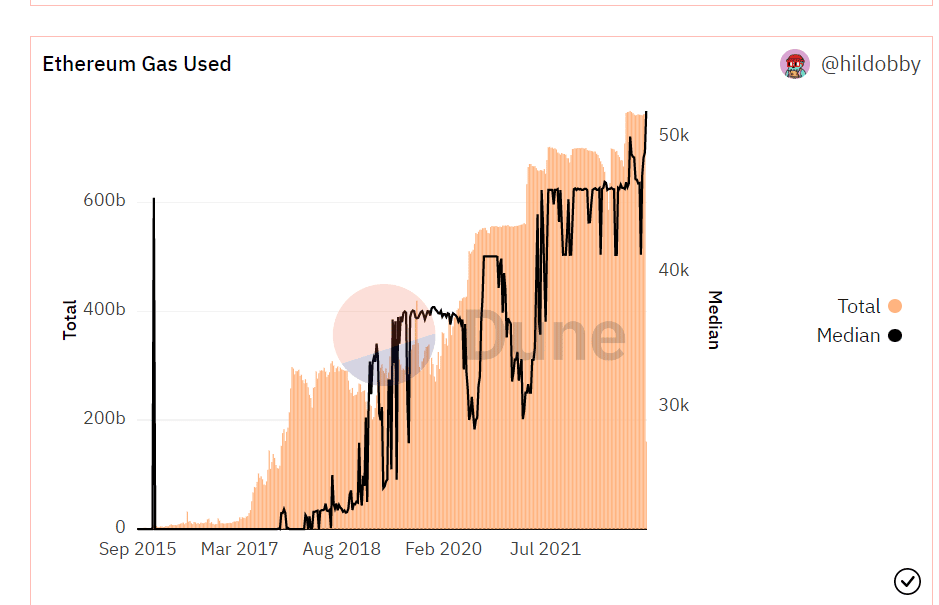

As well as, the gasoline and gasoline charges required to conduct transactions on the Ethereum mainnet could possibly be one other affordable rationalization for the discount. In keeping with a graph and statistics acquired from Dune analytics, Ethereum had over 1 billion transactions general, with gasoline utilization of over 7 billion.

It was clear from the Ethereum chart by hilldobby on Dune that the gasoline value had been rising over time. An increase within the gasoline value meant that the gasoline price would additionally enhance. It could thus elevate the price of transactions on the mainnet.

Consequently, the vast majority of shoppers have switched to Layer 2 options as a result of they provide cheaper and sooner transactions than the mainnet. This might simply clarify the current dip that was noticed.

Supply: Dune Analytics

A 0.20x hike on the playing cards If ETH hits Bitcoins market cap?

Potential implications of a sustained decline…

Decreasing the amount of gasoline consumed to course of transactions on the mainnet could possibly be one potential consequence, notably if the transaction noticed failure. The transaction would grow to be comparatively inexpensive on account of the decrease gasoline value in the long term.

The value of ETH was additionally not more likely to be impacted by the drop in transaction quantity. It was buying and selling in the identical space of $1,200 as of the time of this writing because it had executed for the earlier weeks.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)