Abstract:

- Bitfinex Bitcoin whale, Joe007, has warned that Celsius Community’s property may very well be locked for a ‘lengthy very long time’ identical to Mt. Gox’s crypto has been locked since 2014.

- Celsius Community has filed for Chapter 11 chapter.

Bitfinex Bitcoin whale referred to as @Joe007 has warned that Celsius Community’s property may very well be locked for a very long time because of the firm submitting for chapter.

@Joe007 gave the instance of Mt. Gox’s chapter submitting of 2014 that has solely lately began to point out indicators of resolving with collectors requested by the alternate’s trustees to declare how they need their locked crypto distributed.

@Joe007 shared his insights into Celsius Community submitting for chapter and its property being frozen for a very long time by way of the next tweet.

In sensible phrases, it signifies that as much as $9B in Celsius crypto property are actually locked, probably for a protracted very long time. Keep in mind how lengthy it took to kind out 2014 MtGox chapter? https://t.co/T1iLax8B8K

— Joe007 alerts·teams·funds? Rip-off! (@J0E007) July 14, 2022

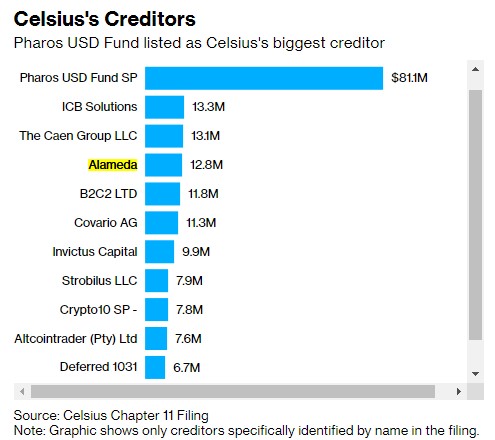

Celsius Community Information for Chapter, Displaying Pharos USD Fund as its Greatest Creditor, which Has Hyperlinks to Alameda Analysis.

As earlier talked about, Celsius Community filed for chapter, and a Bloomberg report has unveiled that Celsius owes an organization referred to as Pharos USD Fund a complete of $81.1 million.

Based on the crew at Bloomberg, looking for Pharos USD Fund on Google doesn’t ‘yield any outcomes.’

Moreover, Pharos USD Fund is an affiliate of Lantern ventures; a London-based ‘proprietary buying and selling agency centered on cryptocurrencies.’ Lantern has about $400 million below administration, with over 50% belonging to buyers outdoors the US.

What’s attention-grabbing is that Lantern’s Chief Govt Officer, Tara mac, is a co-founder of Sam Bankman-Fried’s funding agency referred to as Alameda Analysis. Info gathered from LinkedIn states that one other Lantern worker, Victor Xu, was a dealer for Alameda for 9 months in 2018.

Alameda Analysis is in itself owed $12.8 million by Celsius Community.

Nonetheless, Celsius Community Will Stay Operational.

To notice is that Celsius Community has acknowledged that it has ample liquidity to the tune of $167 million in money to help sure operations throughout restructuring according to its chapter course of. It explained:

Celsius has $167 million in money readily available, which can present ample liquidity to help sure operations through the restructuring course of.

To make sure a clean transition into Chapter 11, Celsius has filed with the Courtroom a collection of customary motions to permit the Firm to proceed to function within the regular course. These “first day” motions embody requests to pay workers and proceed their advantages with out disruption, for which the Firm expects to obtain Courtroom approval. Celsius isn’t requesting authority to permit buyer withdrawals presently. Buyer claims will probably be addressed by way of the Chapter 11 course of.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)