Abstract:

- Celsius Community has fully paid off its Bitcoin mortgage, resetting its liquidation worth to zero.

- The lending platform has been paying off its mortgage on the Maker Protocol since mid-June and after it introduced pausing of withdrawals.

- The entire reimbursement of its Bitcoin mortgage could possibly be a part of Celsius Community’s restructuring plan and dedication to creating all its customers complete.

Celsius Community has fully paid off its Bitcoin mortgage and thus resetting its liquidation worth again to zero.

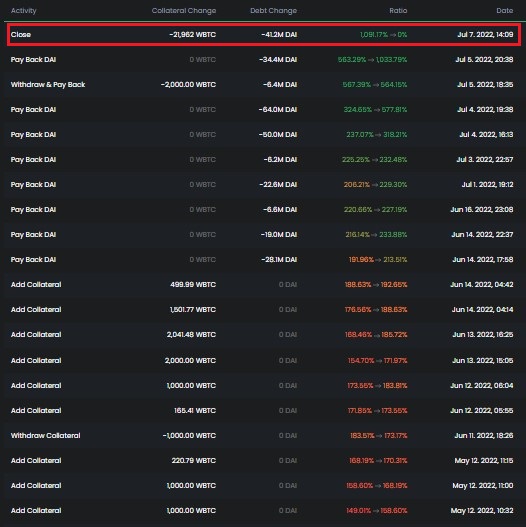

In accordance with DeFiExplore.com, Celsius Community paid a complete of 41.2 million DAI to shut its mortgage from the Maker protocol and retrieve 21,962 Wrapped Bitcoin (BTC) as collateral.

Celsius Has Been Paying Off its Bitcoin Mortgage Since June 14th.

The transaction has been highlighted within the screenshot under. Additionally, from the screenshot, it may be noticed that Celsius Community has been making funds on its Bitcoin mortgage since June 14th and instantly after it paused withdrawals on June thirteenth.

As well as, it may be noticed that Celsius had beforehand been including extra collateral to its mortgage from mid-Could and after the crypto markets have been shaken by UST’s collapse.

Celsius Clearing its Mortgage May Be A part of its Restructuring Plans and Making its Customers Entire.

Celsius Community clearing its mortgage might open the doorways to a whole or partial resumption of withdrawals on the lending platform. The transfer is also a part of Celsius’ restructuring plans after it lately let go of 25% of its workforce.

A restoration plan has already been proposed by the workforce at Bnk to The Future Capital, which had earlier been engaged by Celsius to handle the neighborhood a part of its $750 million Sequence B funding spherical. The restructuring plan consists of three proposals:

- A restructuring of Celsius Community and permit depositors to learn from any type of restoration by way of monetary engineering.

- A pool of Bitcoin whales to co-invest with the neighborhood in a fashion much like how Bitfinex dealt with its 2016 hack.

- An operational plan that permits a brand new entity and workforce to rebuild and make depositors complete.

Bnk To The Future Capital founder and CEO Simon Dixon has regularly confused on Twitter the significance of a ‘depositors first’ method in checking out the problems at Celsius Community. In one among his most up-to-date Twitter updates, he confused that Celsius Community wanted to keep away from submitting for chapter like Mt. Gox did again in 2014. did. He explained:

I add that the Celsius Community neighborhood might want to apply strain to forestall crypto property being bought in Chapter 11 like we did in Mt. Gox. If not depositors lose & low-cost Bitcoin can be scooped up at the price of harmless misled traders. Let’s stop that #DepositorsFirst.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)