- Polygon introduced its partnership with Warner Music Group and yet-to-launch music NFTs platform LGND Music.

- The community confirmed that it commenced the primary batch of one-third vesting and distribution additional to its February fundraising.

Blockchain tasks appear to be scampering for end-of-the-year wins following the collection of issues which have plagued the ecosystem for the reason that starting of 2022.

Ethereum’s [ETH] sidechain community Polygon [MATIC] was no totally different because it clinched one other partnership with media big Warner Music Group.

Learn Polygon’s [MATIC] Worth Prediction 2023-2024

In accordance with a collection of tweets revealed on 6 November, Polygon confirmed that it has partnered with Warner Music Group. It additionally partnered with the soon-to-launch Polygon-based market LGND Music to supply entry to some artists signed to Warner Music Group to launch “their digital collectibles & join followers with particular content material and experiences.”

🎷🎸🎺🎻🥁🎹

A brand new period within the music business 🎶@LGND_music introduced a multi-year partnership with @warnermusic and Polygon for a brand new collaborative, digital collectible platform, LGND Music https://t.co/fXxnaPouPH pic.twitter.com/MrdJ4fR8mS

— Polygon – MATIC 💜 (@0xPolygon) December 6, 2022

In a press release, the CEO of Polygon Studios Ryan Wyatt, mentioned,

“Web3 has the ability to remodel the music business for each artists and followers. The best way that we personal and expertise music is evolving, by absolutely embracing decentralized applied sciences and collectibles, this unique partnership between Polygon, LGND, and WMG represents an thrilling milestone for the music business. Polygon is proud to be powering this modern initiative that can elevate music possession and convey extra music lovers and artists to Web3.”

The yr to this point has been marked by a collection of partnerships between Polygon and main firms throughout numerous sectors. It has introduced partnerships with Behance, Disney, Coca-Cola, Nike, and even tech big Meta.

Along with its partnership with Warner Music Group and LGND, Polygon confirmed one other replace round its ecosystem. The $450 million funding round introduced in February commenced the primary batch of one-third vesting and distribution of MATIC tokens in a three-year unlock interval two weeks in the past.

👇🏿Here is an replace on the strategic token Sale of 2021👇🏿

Final yr, we raised $450 mn from Marquee buyers in a non-public token sale. The primary batch of vesting & distribution for 2022 unlock occurred two weeks in the past.

Study extra ➡️ https://t.co/qByviTEg5B

— Polygon – MATIC 💜 (@0xPolygon) December 6, 2022

In February, Polygon raised round $450 million by way of a non-public sale of its native MATIC token in a funding spherical led by Sequoia Capital India. This included a $50 million funding from troubled Alameda Analysis.

Know this to guard your holdings

MATIC traded at $0.9054 at press time, per knowledge from CoinMarketCap. This represented a 58% decline from its 30-day excessive of $1.20.

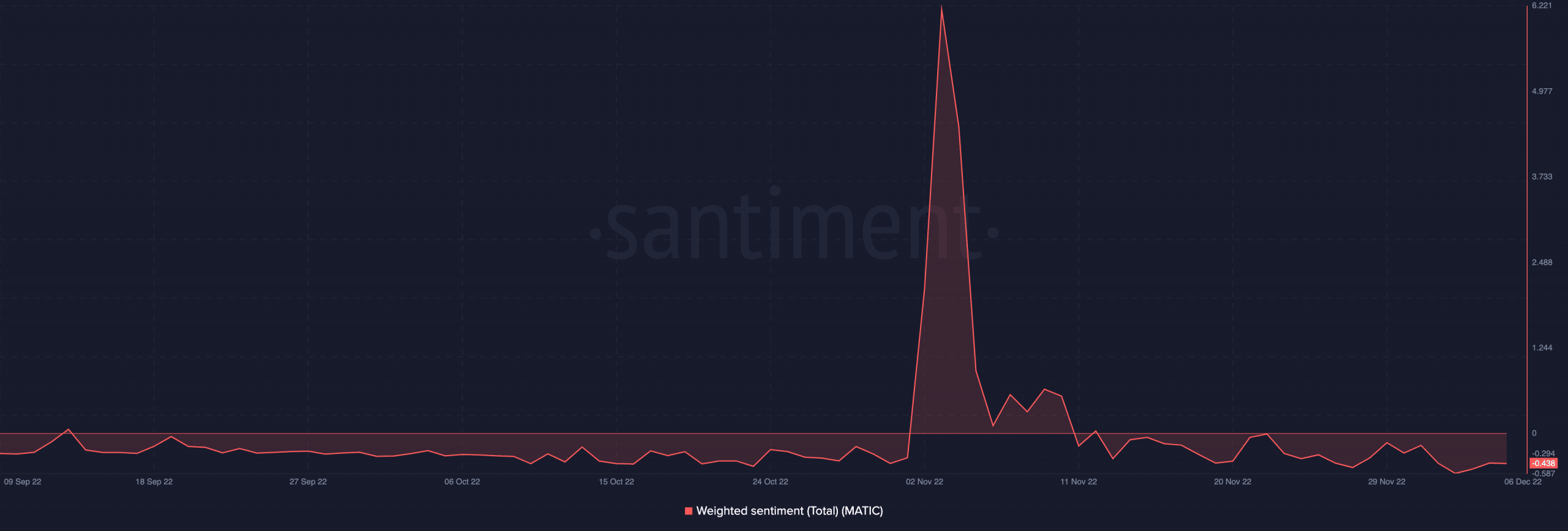

With detrimental buyers’ sentiment trailing the crypto asset since FTX’s implosion, the information of the latest partnership with media big Warner Music Group did not influence MATIC’s worth. Moreover, the affirmation that it commenced the vesting and distribution of MATIC tokens additionally did not dazzle MATIC.

Within the final 24 hours, MATIC’s worth declined by 0.51%, and the amount traded was additionally down by 29%, knowledge from CoinMarketCap confirmed.

Supply: Santiment

On 5 November, simply earlier than the FTX debacle began, on-chain evaluation revealed that MATIC’s Community Revenue/Loss metric (NPL) touched a excessive of 283.61 million. This confirmed that buyers – on common – offered at a big revenue. MATIC offered at a excessive of $1.12 inside the similar interval.

Nonetheless, following FTX’s implosion and decline within the basic market, MATIC’s worth plummeted, inflicting the NPL to fall as nicely. This represented MATIC’s decline from a neighborhood high it recorded previous to FTX’s collapse.

Supply: Santiment

Because the market makes an attempt to regain steadiness following a considerably bearish November, one can count on the collection of ecosystem updates inside Polygon to revive buyers’ conviction earlier than the shut of This fall 2022.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)