- ETH reserves transferring out of centralized exchanges had not decreased.

- Traders who collected within the final one year have been nonetheless in losses.

- Probabilities of short-term revival remained low.

Ethereum [ETH] reserves on Centralized Exchanges (CEXes) had massively diminished by a far better momentum, a CryptoQuant publication revealed. In accordance with the disclosure, revealed by Straightforward OnChain, the altcoin transfers from these exchanges have been an incredible 30% enhance greater than that of Bitcoin [BTC].

Supply: CryptoQuant

Learn Ethereum’s Value Prediction for 2023-2024

Observe the chief, keep true to the trigger

This incidence was not unusual particularly because the FTX collapse propelled traders towards CEX mistrust. Moreso, Ethereum’s co-founder, Vitalik Buterin made feedback encouraging self-custody throughout the identical interval.

In the meantime, that was not the one inference from the continual exodus. In a circumstance like this, it inferred that traders weren’t solely involved about asset security.

Nevertheless, the motion signified perception in ETH and resolve to carry for the long run. The settlement for long-term possession may be borne out of Ethereum’s yearly efficiency which produced a 69.95% decline.

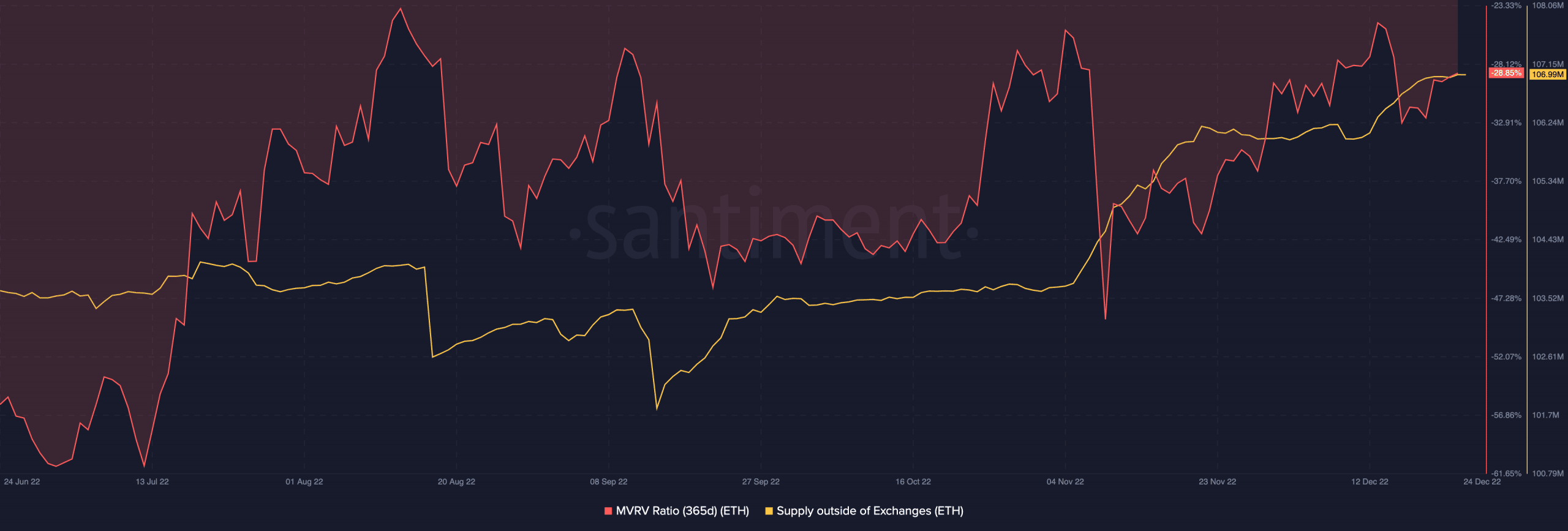

On assessing the 365-day Market Worth to Realized Worth (MVRV) ratio, Santiment confirmed that ETH was comparatively unimpressive at -28.85%. Though it was a step forward of the unlucky lower in July.

For context, the MVRV ratio reveals the connection between the present worth of an asset and the common worth it was acquired at. Since this was nonetheless in a low area, it indicated that the ETH worth had fallen below the combination value by a far margin. Therefore, traders have been dealing with low earnings and enormous unrealized losses.

Supply: Santiment

The provision exterior of exchanges additional aligned with Straightforward OnChain’s opinion of a CEX exit. At press time, Santiment information revealed that ETH’s provide into custodial wallets was on an unbelievable enhance to 106.99 million

A 0.21x worth enhance if ETH hits Bitcoin’s market cap?

Throughout the interval, investor sentiment in the direction of Ethereum modified. This was proven by the concern and greed index because it left the intense concern zone whereas edging towards the impartial place. With its situation on the time of writing, Ethereum was much less more likely to produce a full-blown market fluctuation.

Ethereum Concern and Greed Index is 38 — Impartial

Present worth: $1,220https://t.co/UNTtngVEMChttps://t.co/pkmBdi9X26 pic.twitter.com/Sy0X1p8EIg— Ethereum Concern and Greed Index (@EthereumFear) December 24, 2022

In for the lengthy journey?

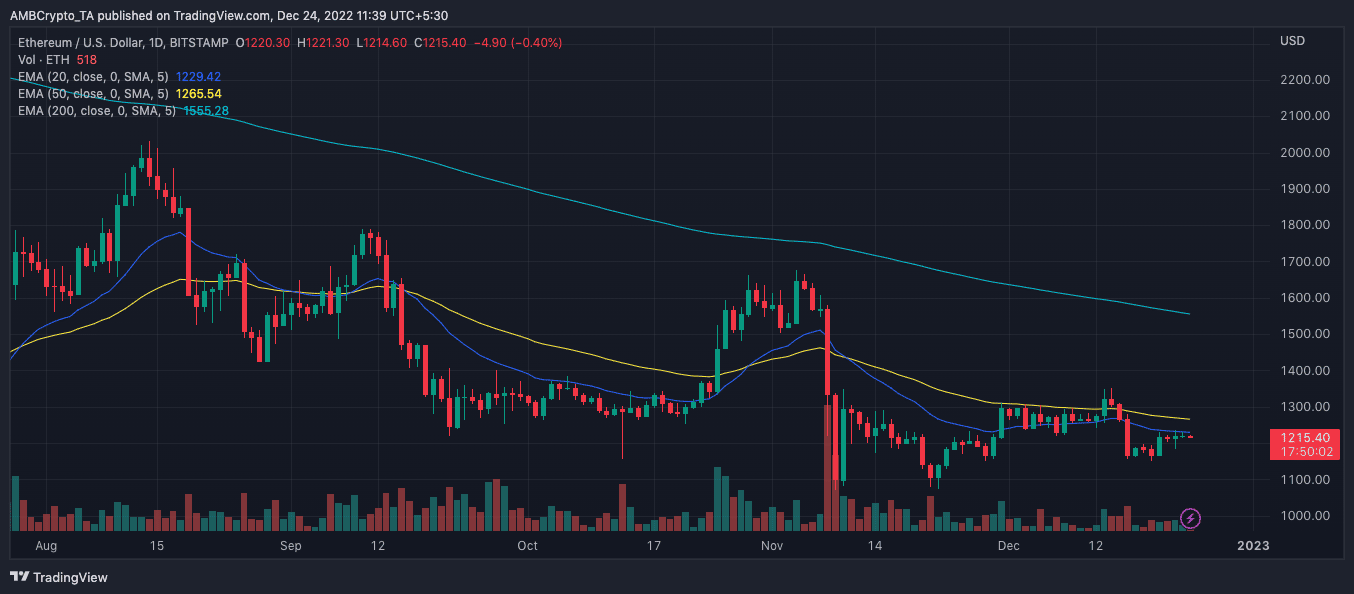

On the charts, ETH’s short-term projection indicated a wrestle between the bulls and bears. Per the Exponential Shifting Common (EMA), ETH may discover it difficult to commerce past the $1,200 area.

This was as a result of the 50 EMA (yellow) was positioned above the 20 EMA (blue). A scenario like this interprets to lagging weak point from the shopping for part.

On the longer timeframe, there was, nonetheless, hope for respite. At press time, the 200 EMA (cyan) entrenched above the 20 and 50 EMAs. This standing implied that traders may sit up for the mid and long-term for doable important upticks. This is perhaps the case barring any additional adverse occurrences that might push for capitulation.

Supply: TradingView

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)