intermediate

There are few issues which are scarier to each novice and skilled merchants alike than shedding cash quickly. The markets are sometimes treacherous, and plenty of buyers have been unlucky sufficient to seek out out simply how ruthless buying and selling could be.

What Is a Bull Entice?

Bull traps are technical indicators that present a false pattern reversal. A bull entice happens when the worth of an asset on the Foreign exchange, crypto, or inventory market immediately surges upward after a chronic decline solely to proceed falling quickly afterwards.

A bull entice will also be referred to as a “useless cat bounce”.

How Does a Bull Entice work?

Usually, bull traps happen in the midst of bear markets and create a false sign that may trick buyers into pondering that the worth of an asset they’re buying and selling has begun to get well.

When a bear market is occurring, buyers typically search for shopping for alternatives whereas anticipating a value restoration to dump their property and make a revenue. When the worth of an asset seemingly recovers and shoots up, many see it as an opportunity to make a fast buck.

Oftentimes throughout bull traps the worth of an asset rallies past key resistance ranges as extra merchants enter the market in anticipation of a mooning. Nonetheless, because it’s only a bull entice and never an actual rally, not too lengthy after it rises, the worth falls once more. Because the bull entice reveals itself and the worth begins to say no, many buyers start to panic and promote their property en masse to attempt to reduce their losses, pushing the worth even decrease.

The merchants that purchased property within the quick interval when the worth motion was bullish find yourself getting caught in a bull entice.

Methods to Determine a Bull Entice

Bull traps are slightly widespread in all markets and Foreign currency trading, however they sadly happen particularly typically within the crypto market. Studying to determine them is vital to minimizing the chance of shedding your funds whereas buying and selling.

Whereas one of the best ways to determine a bull entice includes performing technical evaluation and studying charts, there’s a neater technique to do it, too. Typically you don’t want precise market knowledge to see that the rally is a entice: it may be sufficient to only observe the group. If no one is fired up a couple of rally and persons are largely in search of alternatives to promote, and particularly if there was no information that would encourage robust strikes and bullish value actions, then you’re possible going through a bull entice.

Buying and selling quantity is proven in virtually all buying and selling terminals, and is a superb indicator of whether or not a rally is real or not. The overall rule of thumb is that if there are robust strikes out there however the buying and selling quantity hasn’t modified, then it’s prone to be a entice.

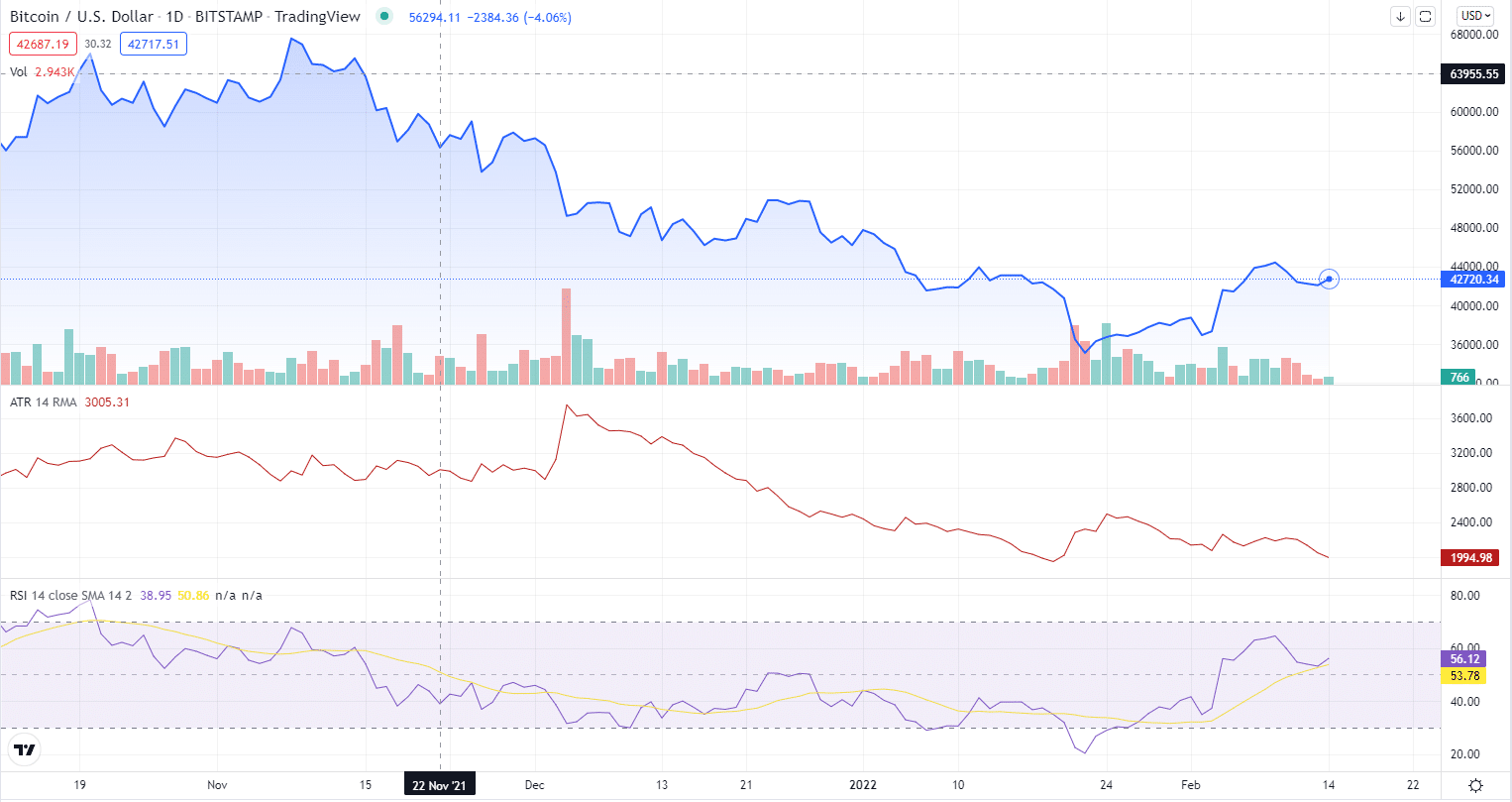

The technical indicators that may assist you to determine a bull entice are “Common True Vary” and the RSI (Relative Energy Index). If the previous is declining throughout bullish value motion and the latter can’t break via the 50 centerline studying, then the worth rally is prone to be a bull entice. Right here’s an instance of what these two indicators appear like. Most buying and selling terminals clearly show the 50 studying for the RSI.

What’s the distinction between bull traps and bear traps?

A bull entice is the other of a bear entice: the previous tips merchants into shopping for an asset and opening lengthy positions, whereas the latter catches merchants who open quick positions and scares many novice buyers into promoting off their property at a loss.

Listed below are the principle variations between the 2.

| Bull Entice | Bear Entice |

| Indicators a false upward pattern | Indicators a false downward pattern |

| Methods bullish buyers | Traps quick sellers and “weak fingers” |

Bull Entice Instance

There are a lot of examples of bull traps within the crypto market – in any case, they sadly occur slightly typically.

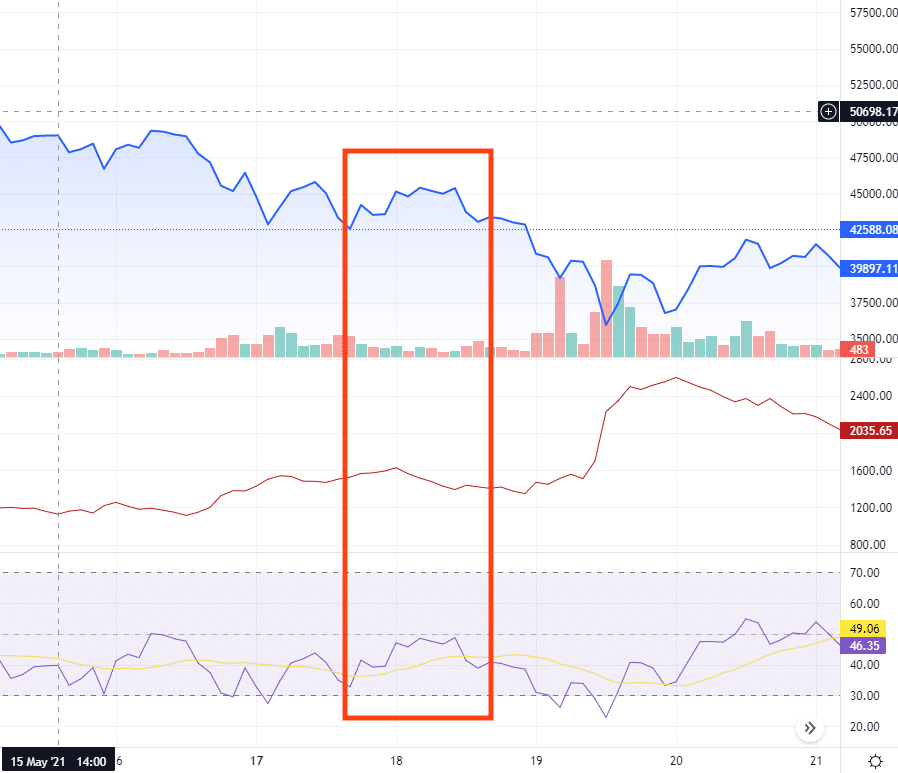

Right here’s an instance from Might 2021. It was a bear market, and BTC was in decline after an extremely lengthy and profitable rally. On Might sixteenth, there was a short value restoration, with Bitcoin going from 46K USD to 49K. Nonetheless, as you’ll be able to see on the chart, the ATR – the crimson line – didn’t go up at that second, and the RSI – the purple line – stayed firmly under 50. It was a bull entice, and the worth of BTC continued to say no quickly after.

Methods to Keep away from Bull Traps?

Please notice that we can’t offer you precise funding recommendation. Nonetheless, there are some common guidelines that each dealer can comply with to keep away from shedding their funds to a bull entice.

To start with, by no means neglect doing market analysis. The extra you research patterns and value motion, the better it can turn out to be so that you can determine bull traps and different false patterns in the marketplace.

You may also both attempt to learn to carry out technical evaluation and research varied technical indicators or carry out market analysis by following individuals and web sites that do all this for you, e.g. TradingView.

Many merchants use cease loss orders once they suspect there’s a bull entice taking place. This order sort is usually a useful gizmo for mitigating danger in a risky market.

How Do You Commerce a Bull Entice?

Bull entice buying and selling is slightly dangerous, however realistically not very avoidable in crypto markets. Most merchants that need to profit from bull traps flip to quick promoting – promoting borrowed property whereas the rally remains to be on after which shopping for them again because the entice closes and the costs go down. They function on the idea that the general downward momentum will proceed.

Nonetheless, we might advise towards utilizing this technique except you totally perceive all of the dangers concerned (of which there are a lot of) and are an skilled dealer that has a fully-fleshed out funding technique and understands the market properly. In case you do select to commerce a bull entice, we suggest utilizing cease loss orders.

What Occurs After a Bull Entice?

Bull traps finish in a continuation of a bear market. The non permanent rally they trigger might final anyplace from a number of hours to a couple days, and typically even longer, however it can nonetheless be comparatively short-lived – and can at all times be adopted by additional decline.

Disclaimer: Please notice that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)