Abstract:

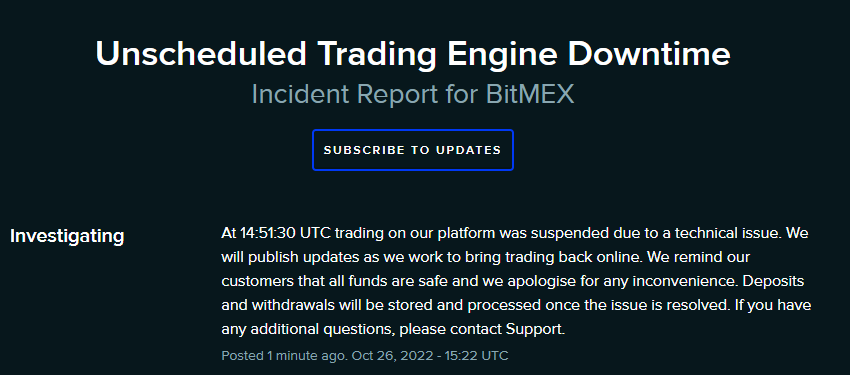

- Crypto alternate BitMex alerted customers to an unscheduled buying and selling engine downtime on Wednesday.

- The platform mentioned buying and selling services have been suspended resulting from technical points and warranted customers that every one funds and property are secure.

- In the present day’s downtime comes amid a rally in crypto costs and big brief liquidation occasions throughout Bitcoin, Ether, and different digital currencies.

On Wednesday, cryptocurrency alternate Bitmex informed customers of suspended buying and selling on the platform resulting from technical points. Bitmex assured customers that “all funds are secure” whatever the unscheduled buying and selling engine downtime.

Based on the replace, buying and selling halted on the platform round 14:51 UTC.

Crypto Sentiment Inexperienced Alongside Bitcoin Rally And BitMex Pause

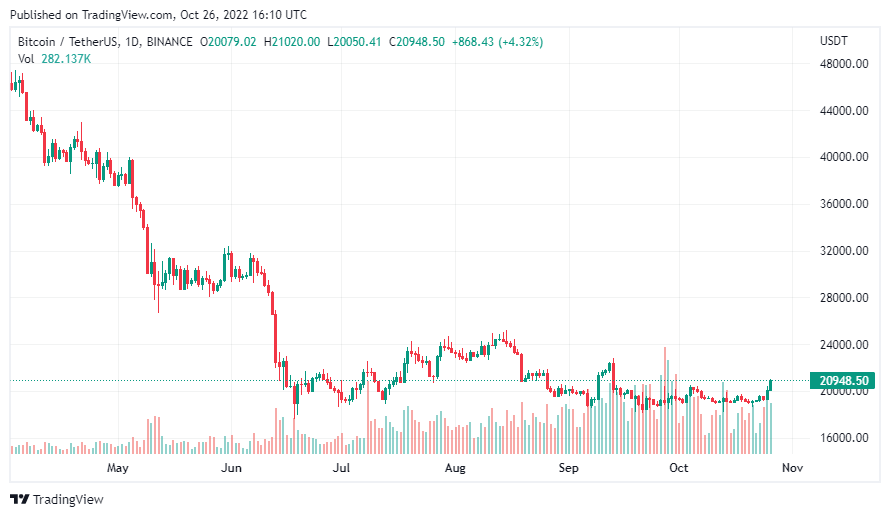

In the present day’s BitMex buying and selling engine downtime comes amid a rally within the crypto market. Bitcoin (BTC) broke above $21,000 per information from TradingView. Altcoin chief Ethereum recorded double-digit beneficial properties because the broader crypto market skilled aid.

Wednesday’s rally additionally preceded file brief liquidation occasions throughout main exchanges. Coinglass information reported over $1.4 billion in liquidations and 87% of the positions worn out have been brief merchants.

$700 million in liquidation occurred on FTX, setting a brand new file for the crypto alternate for the largest liquidation occasion in a single day.

Amid seemingly optimistic sentiment out there, crypto customers on Twitter famous that BitMex pausing its buying and selling engine would possibly maintain some significance. One consumer mentioned that the final time the alternate printed this alert, Bitcoin almost doubled in worth.

Nonetheless, pseudonymous BTC technical analyst Pentoshi surmised that right now’s pump may very well be one other bear market rally fueled by hopium that the feds would possibly ease off the fuel on their rate of interest hike technique.

Speculations broke out that the federal reserve may comply with the Financial institution of Canada and discover much less aggressive financial insurance policies as world governments battle rising inflation.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)