Fast take:

- The narrative of Bitcoin being a retailer of worth is gathering momentum

- Nations are diversifying their overseas foreign money reserves away from the US Greenback

- The conflict in Ukraine might speed up the de-dollarization of FX reserves as buyers, company treasures, and probably central banks look to Bitcoin as a retailer of worth

- In line with J.p. Morgan, the proportion of reserves allotted to USD property has declined by 5% since 2018

- Israel is the newest nation to diversify away from the USD by growing its allocation of the Chinese language Yaun

The regularly examined narrative of Bitcoin being a retailer of worth is as soon as once more gathering momentum as nations worldwide are diversifying their overseas foreign money reserves away from the greenback.

The potential of Bitcoin turning into enticing as a retailer of worth was explored by the Crypto Enterprise Advisor at Presight Capital, Patrick Hansen, who identified by way of Twitter that the conflict in Ukraine might speed up the development of counties allocating much less USD to their overseas foreign money reserves. He additionally added that ‘retail buyers, company treasuries, and more and more central banks are all searching for different shops of worth’ and hinted that Bitcoin matches the invoice of such an asset.

The de-dollarization is properly underway and up to date occasions in Ukraine will solely speed up this development.

Retail buyers, company treasuries, and more and more central banks are all searching for different shops of worth. #Bitcoin https://t.co/3nxgPQE8xQ

— Patrick Hansen (@paddi_hansen) April 23, 2022

FX Reserves Allotted to USD-Property have Fallen by 5% Since 2018

Mr. Hansen was responding to a different Tweet that elaborated on the shift by nations worldwide away from the US greenback as a reserve foreign money. The evaluation identified that in accordance with J.P Morgan, the proportion of overseas reserves allotted to USD property had declined by 5% since 2018. Moreover, after the COVID19 pandemic, the US greenback’s share of overseas reserves fell to an all-time low of lower than 59%.

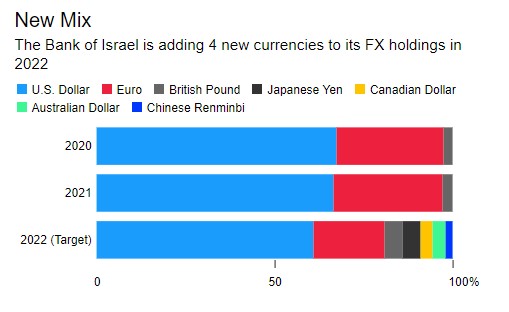

Israel Provides the Chinese language Yuan/Renminbi to its Reserves

One nation that has lowered its holdings of the USD in its reserves is Israel. In line with a report by Bloomberg, final yr, Israel’s Central Financial institution added the Chinese language Yuan/Renminbi alongside different three currencies to its reserves to the tune of $200 billion. Moreover, starting this yr,’ the foreign money combine will develop from the trio of the U.S. greenback, the euro and the British pound to incorporate the Canadian and Australian {dollars} in addition to the yen and the yuan, which is also referred to as the renminbi.’

Bloomberg visualized the brand new mixture of Israel’s Central Financial institution overseas foreign money reserve by means of the next chart.

![Why Ethereum [ETH] address outflows may be headed for DeFi](https://cryptonoiz.com/wp-content/uploads/2023/03/AMBCrypto_An_image_of_a_stylized_Ethereum_logo_with_arrows_poin_22f2aeff-c7bb-4c7d-aec7-547a37a35e82-1-1000x600-360x180.jpg)